Thanks to the folks that reports the "waiver" posts. Good to see awareness heightened and do continue the reports!

Credit Cards AmBank Credit Card V3, Free for life card, PPL access with T&C

Credit Cards AmBank Credit Card V3, Free for life card, PPL access with T&C

|

|

Sep 20 2018, 11:28 PM Sep 20 2018, 11:28 PM

Return to original view | Post

#1

|

|

Moderator

3,395 posts Joined: Dec 2007 From: 서울, South Korea |

Thanks to the folks that reports the "waiver" posts. Good to see awareness heightened and do continue the reports!

|

|

|

|

|

|

Jul 9 2024, 09:28 PM Jul 9 2024, 09:28 PM

Return to original view | Post

#2

|

|

Moderator

3,395 posts Joined: Dec 2007 From: 서울, South Korea |

Getting a credit card is all about matching your spending patterns to your reward preferences. Others may suggest this and that but only your own self truly understands how you wish to be rewarded from your spendings. More importantly there's no perfect credit card that will give you everything you want. watabakiu, francis226, and 3 others liked this post

|

|

|

Jul 10 2024, 07:40 AM Jul 10 2024, 07:40 AM

Return to original view | Post

#3

|

|

Moderator

3,395 posts Joined: Dec 2007 From: 서울, South Korea |

QUOTE(ericlaiys @ Jul 5 2024, 04:40 PM) anyone got the ambank enrich card and successful link with existing enrich account? someone from fb reported that his new card did not link. Upon successful application which should be around when one receive the SMS notification - cardholder Enrich account will be updated reflecting the reduced Enrich tier requirements. |

|

|

Jul 17 2024, 09:10 PM Jul 17 2024, 09:10 PM

Return to original view | Post

#4

|

|

Moderator

3,395 posts Joined: Dec 2007 From: 서울, South Korea |

QUOTE(zzzhhhzzz @ Jul 17 2024, 11:28 AM) Consider this ... if you applied directly, your application is handled directly by the bank staff. Means there's some level of (secured) document management applied. You are willing to trade off convenience vs security of your personal documents ? |

|

|

Jul 23 2024, 09:49 AM Jul 23 2024, 09:49 AM

Return to original view | IPv6 | Post

#5

|

|

Moderator

3,395 posts Joined: Dec 2007 From: 서울, South Korea |

QUOTE(tweakity @ Jul 23 2024, 09:25 AM) Still 50/50-ing Enrich card. Anyone verified that the 10% off using the specific link, is On-Top of any existing 10% or 5% off promo? There is a specific link which is under 'Co-Branded' card when you login to your Enrich account. In that page there is a booking button that you can click on. Book your flight in there.Like the current 5% off promo going on until 23rd This is not the only feature, but ya just trying to fill in the blanks in my mind Discount depends on the flight class. If you read the PDS carefully, it is up to 10% off. Sometimes the discount is marginal, sometimes it can be a full 10% off. Right now there's an on-going 5% off for Enrich members. Using that link, you will get up to an extra 5% off. This post has been edited by hye: Jul 23 2024, 09:53 AM |

|

|

Jul 23 2024, 10:36 AM Jul 23 2024, 10:36 AM

Return to original view | IPv6 | Post

#6

|

|

Moderator

3,395 posts Joined: Dec 2007 From: 서울, South Korea |

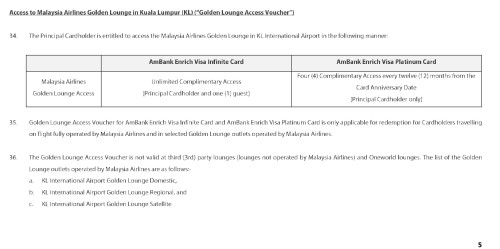

QUOTE(ZeneticX @ Jul 23 2024, 10:17 AM) Ambank Enrich VI - Main limitation is MAS and Enrich. No limitation when it comes to earning points, as in no specific categories or minimum spent (correct me if I'm wrong). Lounge access is golden lounge only so this can be a limitation depending on the airport you go. Can we use this card to access One World lounges? Access is only to MH lounge in KLIA. No access to One World lounges. To answer the last part - my opinion is that this depends on your spending pattern and how you wish to be rewarded. (If you want to accumulate Enrich points) If you have a total dislike for MH then this card is probably not for you as you can't redeem the points except for Enrich points.Alliance VI - points will never expire. However the earning is depends on specific categories. Some will earn will you higher points up to 8x eg: online spent and ewallets. Lounge access is typical public lounges To me it feels like a no brainer to go for Enrich VI? Unless you absolutely dislike / avoid MAS at all cost. If I want to get just one card now first, which would you recommend? Refer to Clause 34-46 for the AmBank Enrich VI MH lounge info. (Card TnC) This post has been edited by hye: Jul 23 2024, 11:27 AM ZeneticX liked this post

|

|

|

|

|

|

Jul 23 2024, 01:40 PM Jul 23 2024, 01:40 PM

Return to original view | IPv6 | Post

#7

|

|

Moderator

3,395 posts Joined: Dec 2007 From: 서울, South Korea |

QUOTE(ZeneticX @ Jul 23 2024, 11:38 AM) not according to the TnC. Putting this here in case anyone have the same question. So conclusion Enrich VI / VP lounge access is only limited to Golden Lounge in KLIA ONLY. You definitely gonna need another CC for lounges in other airports. And for clarity, "lounge in other airports" here refers to 3rd party lounge. Not MH lounge or OneWorld lounge.  Travellers who can attain Enrich Gold level (and above) would not care so much about the MH lounge access this card offers. And to the member who inquired whether this card product has any "traps" - that's why one has to read in depth the financial product you are signing up for. Banks don't hide their T&Cs and it is for us (the consumer) to read it up carefully. Don't cry wolf when you fail to understand what you sign up in the first place. This post has been edited by hye: Jul 23 2024, 01:49 PM |

|

|

Jul 23 2024, 05:04 PM Jul 23 2024, 05:04 PM

Return to original view | IPv6 | Post

#8

|

|

Moderator

3,395 posts Joined: Dec 2007 From: 서울, South Korea |

QUOTE(xin @ Jul 23 2024, 04:29 PM) It took me within one week to get everything in check. And approval took another week, i received an email followed by a sms informing that my application has been approved and can proceed to collect the CC in my preferred Ambank branch. Ambank branch then called the following day as well to inform CC arrived and can be collected anytime. Seems to be quite efficient and the Sales Executive assigned was very accomodating. Yes. Around 2 working days to obtain card application approval and 3 days for card preparations, mailing and receipt to your mailbox.Believe it Or Not - First time I'm seeing a bank has a SLA specific for credit card application. Which is 3 days + Whatever for card mailing/courier process. Whomever have free time can search for this SLA within the bank's website. This post has been edited by hye: Jul 23 2024, 05:06 PM |

|

|

Jul 23 2024, 06:04 PM Jul 23 2024, 06:04 PM

Return to original view | IPv6 | Post

#9

|

|

Moderator

3,395 posts Joined: Dec 2007 From: 서울, South Korea |

QUOTE(poooky @ Jul 23 2024, 06:00 PM) Is it worth it to use this card for overseas transactions? Per t&c, ambank charges 1% + visa 1.16% for a total of ~2% markup. Bear in mind the Enrich points accumulation and complimentary access to MH lounge which GX and TnG cards does not offer when making the comparison. Plus you are making comparisons between debit and credit cards which offer different payment protection.I'm considering using a cc vs tng/gx bank when overseas. Did you test this percentage yourself ? I tested via 1 sample transaction and what I see is that bank charge 1% on top of what Visa rate published in their website. To my knowledge Tng and GX will use Visa and Mastercard rate similar to what cc do. You may correct my understanding if I am in error. This post has been edited by hye: Jul 23 2024, 06:23 PM poooky liked this post

|

|

|

Jul 23 2024, 07:03 PM Jul 23 2024, 07:03 PM

Return to original view | IPv6 | Post

#10

|

|

Moderator

3,395 posts Joined: Dec 2007 From: 서울, South Korea |

@lilsunflower

Thanks for the great sharing of your experience. Will be a useful guide and info for the members who's going after the AmBank Enrich VI. |

|

|

Jul 29 2024, 11:06 PM Jul 29 2024, 11:06 PM

Return to original view | Post

#11

|

|

Moderator

3,395 posts Joined: Dec 2007 From: 서울, South Korea |

QUOTE(outsiders_86 @ Jul 29 2024, 10:41 PM) SMS notification of successful card application depends on what mobile number you put in the AmBank Enrich VI application. Ensure it is an active number that you normally able to receive SMS without any problems.(Hassle free) Linking of Enrich & AmBank Enrich VI - AmBank Enrich VI email must be the same as the one you use for Enrich account (as the primary element). This post has been edited by hye: Jul 30 2024, 10:36 AM |

|

|

Jul 31 2024, 06:16 PM Jul 31 2024, 06:16 PM

Return to original view | IPv6 | Post

#12

|

|

Moderator

3,395 posts Joined: Dec 2007 From: 서울, South Korea |

QUOTE(coolguy99 @ Jul 31 2024, 08:31 AM) Hi guys, may I ask how do you guys apply for the card? I am a NTB customer and dropped my information after clicking Apply from the website but did not receive any callback. I actually got a reply within 2 business days. No special treatment here but it's probably due being an early adopter when the card was launched.Probably now an avalanche of applications thus bank maybe struggle to handle the volume. |

|

|

Aug 28 2024, 04:29 PM Aug 28 2024, 04:29 PM

Return to original view | Post

#13

|

|

Moderator

3,395 posts Joined: Dec 2007 From: 서울, South Korea |

QUOTE(velo @ Aug 28 2024, 03:51 PM) May I know for lounge voucher redemption, this can only be done after having a valid MAS flight ticket? This is because even I can redeem GL voucher now, but it cost me 8000 Enrich points. I already can see my card under co-brand and also see the 30% Elite points reduction. You redeem the voucher when you are present at the lounge - you need to present your credit card, boarding pass and voucher. GL voucher redemption of 8000 points - any Enrich member can do so provided they have the 8K points to redeem, this is an existing feature as an Enrich member. This is independent of AmBank Enrich cc. |

|

|

|

|

|

Aug 28 2024, 06:03 PM Aug 28 2024, 06:03 PM

Return to original view | Post

#14

|

|

Moderator

3,395 posts Joined: Dec 2007 From: 서울, South Korea |

QUOTE(velo @ Aug 28 2024, 05:48 PM) Thanks for reply. But still don't quite get it. For sure I don't want to spend 8000 points to redeem the voucher. But what puzzle me is why can't I see "free" voucher redemption in my account now? You meant I only can see the "free" voucher when I present my credit card and boarding pass in front of the lounge? It can be quite messy right if many ppl doing it this way in front of the lounge and the staff will be quite busy entertaining everyone for the process of redeeming free voucher Have you checked your MH app for the voucher? (Hint: there's a how-to guide inside as well)The voucher would be there and you "activate" it when you intend to use it. |

|

|

Oct 18 2024, 02:50 PM Oct 18 2024, 02:50 PM

Return to original view | Post

#15

|

|

Moderator

3,395 posts Joined: Dec 2007 From: 서울, South Korea |

QUOTE(honsiong @ Oct 17 2024, 05:56 PM) Update to my card dispute of RM 2700+: For members knowledge, AmBank do provide SMS notifications. By default the threshold is set rather "high" (I can't remember the actual value) so members are encouraged to call in to the bank to set this SMS notifications to a lower value. They are rejecting the dispute because of no police report, which I was not allowed to make once I have left the city the crime happened in. FFS, AmBank could learn from other big banks like UOB and Maybank, send SMS and notifications as soon as a spend happens kan? The same goes for UOB and Maybank - if you don't make the attempt to change the SMS notifications settings, by default it is set at a "higher" value. I have to emphasize this as many members / bank customers assume that they will receive notifications for all of their spendings and not realising of this "default" setting. If I'm not mistaken for AmBank and MBB, customers need to call in and UOB, you need to fill in a form. Do confirm this with your respective card issuer on how to update the SMS notification threshold. This post has been edited by hye: Oct 18 2024, 02:55 PM |

|

|

Oct 21 2024, 09:04 PM Oct 21 2024, 09:04 PM

Return to original view | Post

#16

|

|

Moderator

3,395 posts Joined: Dec 2007 From: 서울, South Korea |

|

|

|

Nov 18 2024, 06:58 AM Nov 18 2024, 06:58 AM

Return to original view | Post

#17

|

|

Moderator

3,395 posts Joined: Dec 2007 From: 서울, South Korea |

QUOTE(mzms @ Nov 18 2024, 12:08 AM) That's good news. I booked hotel rooms through agoda and never got any notification or the page where we have to approve the transaction or enter a TAC code. It just went through. Imagine if the card was lost or details stolen, we won't ever know it was used for bookings until the transactions show up days later (pendings do not appear unlike Maybank) and only if we checked the transactions online or in the app. If you insist to receive TAC when using Agoda then you need to start looking for new travel services provider for your hotel bookings. Agoda system will not trigger a TAC irrespective of whatever credit card you use. Correction on your statement - you can know the moment your credit card is being used for any transactions. Make a point to sign up for SMS notifications, never assume that this is set up for you by default nor the default triggering amount is as per your expectations. (Alternatively, this notification may appear in your banking app.) If your credit card provider unable to provide such notification, then you should cut your ties with the credit card issuer without a second thought. I experienced where my credit card is compromised (details stolen by hackers) via a merchant who practices TAC. (Caused about 6,000 GBP of fraudulent transactions which I detected almost in real time via SMS alerts, immediately informed the bank and bank proceed to have the card blocked). Transactions were popping up in intervals of minutes and sometimes as fast as every 60 secs and this continued for 45 mins at around 3am in the morning. The merchant (who is based in SG but doing business in MY) does not want to admit responsibility not even a sorry and they continue to engage their vendor who is responsible for this mess. Therefore, if you see fraudulent transactions appearing on your card (e.g FB credits, etc) - have a thought about what ecommerce transactions that you made (what card you use, where it is being used, etc) in the past and try to make a note of their gateway providers. (e.g iPay88, GHL, Razer, senangPay, Stripe, Adyen, etc) Next search online on whether these gateways have been hacked recently (as far back as 6 months or even a year) and if you found them to have been hacked - you know not to use the merchant who continue to engage the services of these vendors. Better still, expose the irresponsible merchant online so that they take immediate action. Monitor your card that you used before for possible hacking and take immediate action when such happens. Critics may say there is a probability that your credit card provider have been hacked despite the super tight cybersecurity practices. Should this happen will see a bank wide card replacement exercise. Any members have seen this before with your bank? (Before anyone says it, I'm not saying that bank systems are 100% fool-proof.) Before jumping to conclusion that your bank was hacked, have a thought about where you used your card online first. So, receiving TAC does not equate to total credit card security. I'm not advocating no TAC, only correcting the understanding of the members here. Members - understand that what is important here is that your merchant engage a vendor (or self-implement) who knows well and practices good cybersecurity practices when handling credit card info, PID, tokenisation, etc. This post has been edited by hye: Nov 18 2024, 07:08 AM |

|

|

Nov 18 2024, 10:42 AM Nov 18 2024, 10:42 AM

Return to original view | Post

#18

|

|

Moderator

3,395 posts Joined: Dec 2007 From: 서울, South Korea |

|

|

|

Nov 18 2024, 12:23 PM Nov 18 2024, 12:23 PM

Return to original view | Post

#19

|

|

Moderator

3,395 posts Joined: Dec 2007 From: 서울, South Korea |

QUOTE(noobmaster_69 @ Nov 18 2024, 10:47 AM) I've mentioned this before - SST waivers (SST waivers do not exist in actuality) request discussions (or anything of such) is not allowed and this will be enforced strictly. Pay your SST or don't use a credit card.This post has been edited by hye: Nov 18 2024, 12:44 PM |

|

|

Nov 18 2024, 09:17 PM Nov 18 2024, 09:17 PM

Return to original view | Post

#20

|

|

Moderator

3,395 posts Joined: Dec 2007 From: 서울, South Korea |

QUOTE(mzms @ Nov 18 2024, 09:05 PM) I don't think you understand my comment at all. If your card is stolen, or your card details stolen and used for bookings, what control do you have over what the thief uses? Telling the card owner to "serious consider using a different platform" makes no sense whatsoever in this case. The info are not meant solely for you alone as it is for the benefit for everyone who reads the reply. Also, my account/card is set up where I am alerted for all purchases even the smallest RM1 or RM2 amounts and I do get those. But not when I make bookings with Agoda. If I am the one making the bookings, I don't mind, but what if it is someone else without my knowledge. So fraudulent charges can be done without me being aware or notified. You completely missed the point and went on a rant. Good for you that you have SMS and notifications setup and it is unfortunate Agoda transactions doesn't give you that reply. Shared my experience that I do receive SMS on Agoda transactions. If you think the reply is useless for you then so be it. Any other members who wish to help @mzms with his unsolved problem? (Please ensure you get your answer to meet @mzms expectations) This post has been edited by hye: Nov 18 2024, 09:20 PM |

| Change to: |  0.0250sec 0.0250sec

0.47 0.47

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 04:00 PM |