QUOTE(BooYa @ Jan 2 2019, 03:06 PM)

Economic recession? have you been to shopping mall, airport, restaurants, hotels recently?Auction properties

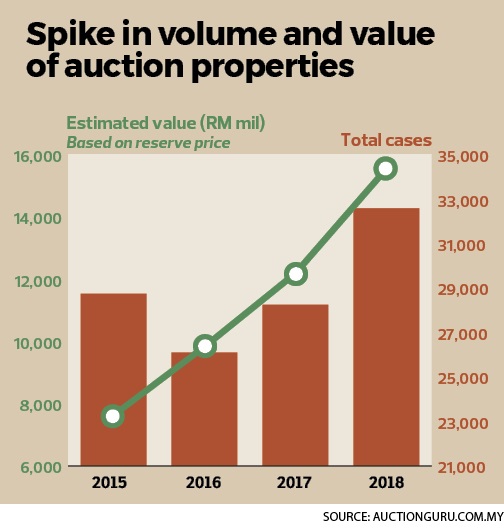

Auction properties

|

|

Jan 2 2019, 03:13 PM Jan 2 2019, 03:13 PM

Return to original view | IPv6 | Post

#61

|

All Stars

21,456 posts Joined: Jul 2012 |

|

|

|

|

|

|

Jan 3 2019, 12:46 PM Jan 3 2019, 12:46 PM

Return to original view | IPv6 | Post

#62

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(puchongite @ Jan 3 2019, 12:11 PM) https://themalaysianreserve.com/2019/01/03/...il-price-slump/https://themalaysianreserve.com/2019/01/03/...ver-6-year-low/ |

|

|

Jan 4 2019, 10:36 PM Jan 4 2019, 10:36 PM

Return to original view | Post

#63

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(alenac @ Jan 4 2019, 08:01 PM) More properties coming into main stream auction AMMB disposing of RM544 mill bad loans The last time banks offloaded npl from balance sheet to spv was during 1997 afc. guess npl is rising.http://ipaper.thesundaily.my/epaper/viewer...tpuid=3#page/12 |

|

|

Jan 13 2019, 01:58 PM Jan 13 2019, 01:58 PM

Return to original view | Post

#64

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(noiseemunkee @ Jan 13 2019, 01:47 PM) any trend noticed among the owner and projects that kena auctioned? are the owner overstretched in borrowing or the places just cannot rent out and cannot resell. Believe the trend was casted when dibs was available, many hoped to flip upon vp. What is happening at auction is basically a fallout from 2011-2014 property bull run.This post has been edited by icemanfx: Jan 13 2019, 02:14 PM |

|

|

Jan 14 2019, 12:11 AM Jan 14 2019, 12:11 AM

Return to original view | Post

#65

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(BEANCOUNTER @ Jan 13 2019, 10:49 PM) I prefer to look at my subsale properties. ManutdGiggs2014 15 already on the down trend....no longer bbb....from subsale buyers.. The peak of bull run was btw 2010 to 2012 when we talked abt subsale. Those bought off plan in 2012 will be doing it tough when vped. |

|

|

Jan 15 2019, 03:09 PM Jan 15 2019, 03:09 PM

Return to original view | IPv6 | Post

#66

|

All Stars

21,456 posts Joined: Jul 2012 |

Some 180 property developers have pledged to slash the prices of their unsold homes by at least 10% as the real estate sector struggles to clear RM22 billion worth of inventories amid rising prices and tightened financing availability.

The government will host the developers at a mega home sales expo “Home Ownership Campaign” in March, two decades after a similar expo in 1998. Housing and Local Government Minister Zuraida Kamaruddin said the campaign would be held on March 1-3 at the Kuala Lumpur (KL) Convention Centre. https://themalaysianreserve.com/2019/01/11/...alleviate-glut/ One may not need to go to auction for cheaper price property. does it mean property will devalue by >10%? those buyers who are not in hurry could wait to shop in march. This post has been edited by icemanfx: Jan 15 2019, 03:15 PM |

|

|

|

|

|

Jan 17 2019, 12:36 AM Jan 17 2019, 12:36 AM

Return to original view | Post

#67

|

All Stars

21,456 posts Joined: Jul 2012 |

|

|

|

Jan 19 2019, 05:28 PM Jan 19 2019, 05:28 PM

Return to original view | Post

#68

|

All Stars

21,456 posts Joined: Jul 2012 |

|

|

|

Jan 19 2019, 06:05 PM Jan 19 2019, 06:05 PM

Return to original view | Post

#69

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(Sand Dust @ Jan 19 2019, 05:59 PM) Dont see how the country can afford interest hike esp current poor economic situation Unless bank subsidize borrower or liquidity tightening is temporary, loan interest rate has to be higher than deposit rate.Esp US just plan to hike 2 times this year. So my bet this year wont be any hike. This post has been edited by icemanfx: Jan 19 2019, 06:05 PM |

|

|

Jan 25 2019, 06:14 PM Jan 25 2019, 06:14 PM

Return to original view | Post

#70

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(New Klang @ Jan 25 2019, 06:00 PM) Those have money are likely to buy from auction than subsale or developer.Property auction is probably the closest to stocks, gold, btc exchange, where price is transparent. This post has been edited by icemanfx: Jan 25 2019, 06:17 PM |

|

|

Jan 27 2019, 01:06 PM Jan 27 2019, 01:06 PM

Return to original view | Post

#71

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(z21j @ Jan 27 2019, 01:00 PM) Even if you won the auction bid, you would still have to pay for legal, stamp duty etc. I see some properties are with the reserved price even higher than the open resale market. And when buy from resale, agent would at least help follow up. Whats actually make the people so enthu in auction properties.... Auction is only worth while if significantly cheaper than market price. Hence, many foreclosure went through a few rounds of price reduction in reserved price before it is sold. |

|

|

Jan 28 2019, 09:23 AM Jan 28 2019, 09:23 AM

Return to original view | Post

#72

|

All Stars

21,456 posts Joined: Jul 2012 |

|

|

|

Feb 21 2019, 11:09 AM Feb 21 2019, 11:09 AM

Return to original view | Post

#73

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(BEANCOUNTER @ Feb 21 2019, 08:56 AM) I read it once and didnt quick understand the bahasa. Did the bidder cut api dan air before or after he/she got the court order,?? Can cut water n electricity meh? Its deemed to be uneithical i thought. QUOTE(Harry_Bobinski @ Feb 21 2019, 08:59 AM) What about tresspasser? Not unethical or illegal to tresspass? |

|

|

|

|

|

Feb 23 2019, 10:32 AM Feb 23 2019, 10:32 AM

Return to original view | Post

#74

|

All Stars

21,456 posts Joined: Jul 2012 |

https://www.edgeprop.my/content/1480406/mor...der-hammer-2018 Number of foreclosure in this year is likely higher than 2018. Number of foreclosure is as many as number of developers overhang units. given most investors financial is weaker than developers, mean many are in financial distressed. This post has been edited by icemanfx: Feb 23 2019, 10:38 AM |

|

|

Feb 23 2019, 11:19 AM Feb 23 2019, 11:19 AM

Return to original view | Post

#75

|

All Stars

21,456 posts Joined: Jul 2012 |

|

|

|

Mar 4 2019, 05:07 PM Mar 4 2019, 05:07 PM

Return to original view | Post

#76

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(nexona88 @ Mar 4 2019, 04:45 PM) huhuhuh.. Not unexpected, after this batch of eager buyers are exhausted, price will tumble to new low.it's confirmed my latest theory.... suddenly there's demand for Auction Properties & the winning price would be way higher than current reserved & previous round reserved pricing |

|

|

Mar 4 2019, 06:48 PM Mar 4 2019, 06:48 PM

Return to original view | Post

#77

|

All Stars

21,456 posts Joined: Jul 2012 |

|

|

|

Mar 11 2019, 04:53 PM Mar 11 2019, 04:53 PM

Return to original view | Post

#78

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(Bjorn1688 @ Mar 11 2019, 12:25 PM) Not sure of his political affiliations but this is one of the casualties of crude oil falling. He was the owner of this company called Black Gold Ventures, had several projects that did not take off, also had the contract for a waste to energy incinerator project. Doubt he was into loan compression but not surprised he bought properties like there was no tomorrow. QUOTE(Bjorn1688 @ Mar 11 2019, 02:39 PM) Many of these venture are only financially feasible when oil price is at stratosphere level and many of these were vehicle to scam gomen funding. |

|

|

Mar 13 2019, 11:07 AM Mar 13 2019, 11:07 AM

Return to original view | Post

#79

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(tometoto @ Mar 12 2019, 10:49 PM) During bull run, flippers advocated they were rewarded for risks they took. Similarly, they reap the consequences when the tide turned.Conventionally, his friends and family are likely similarly committed. This post has been edited by icemanfx: Mar 13 2019, 11:14 AM |

|

|

Mar 13 2019, 01:17 PM Mar 13 2019, 01:17 PM

Return to original view | Post

#80

|

All Stars

21,456 posts Joined: Jul 2012 |

Double posted.

This post has been edited by icemanfx: Mar 13 2019, 01:26 PM |

| Change to: |  0.0184sec 0.0184sec

0.54 0.54

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 11th December 2025 - 10:09 AM |