QUOTE(cherroy @ Jul 25 2018, 11:13 AM)

My view,

If 1M is not enough for the education cost, then might as well drop the idea.

Kids need to learn how to gather education fund themselves, it is process of growing up.

If the kid indeed brilliant in study, there are various scholarship and channels to fund the education nowadays, may not need as much as that.

I am not a fan of "using money to push the kid education" theory.

In fact, it may actually spoil the kid, especially if the kid is just ordinary or lesser than ordinary.

Nowadays, getting a ordinary degree is no longer a career path guaranteed, which in return may "trap" themselves in career path.

In fact, nowadays, many non-degree holder are thriving better than ordinary degree holders.

Kid need to go along their interest and exhibit their own strength and constant learning.

Industries are changing fast nowadays, now we are also talking about financial sector total revamp, HK already comes out with virtual banking, whereby the bank has no physical branch to serve customer anymore, but only through online channel. So previous ordinary banker also need to know how online banking works nowadays.

Those thrive or success in their career, generally are not because of their degree, but constantly learning and improve themselves instead of due to previously throwing money at ordinary education.

Just my personal opinion.

Lets address this.

1. If your kid manages to get accepted into Harvard, but were unable to secure any scholarship. Would you tell them, sorry life sucks settled with UM instead? Perhaps some might, but I'm of the opinion i shall give her the chance.

2. You are right, an ordinary degree is no longer a guaranteed career path. But without a degree, statistically is even worse, do you agree?

3. Non degree holder is thriving better then ordinary degree holder. Statistic disagree with you on this. Sure we all heard of the rags to riches story, "mr XYZ who managed to be a millionaire with just his SPM". What are the percentaged of these people making it? Did you hear of the other 99% which is currently in the B40 range cause they only have a SPM?

4. Industry is fast changing etc etc, sure everything is fast changing. Are you trying to say that those without a degree will adapt better then those with higher education? If there is any relation, i would say uneducated ones are the ones being left behind.

Infact you see fresh grads in LYN complaining that they are getting RM3k a month as starting salary, do you want your children to go thru this? Cause I know that if you have a decent education (i.e. ivy league uni) you start off at a much higher level and would be better positioned to have a fast track thru your career. Ofcourse there is no "guarantees" in life, but in general those who are better equiped with the right tools does a better job than those that starts with nothing.

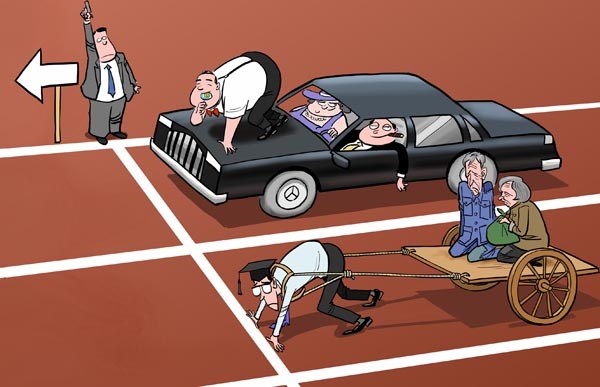

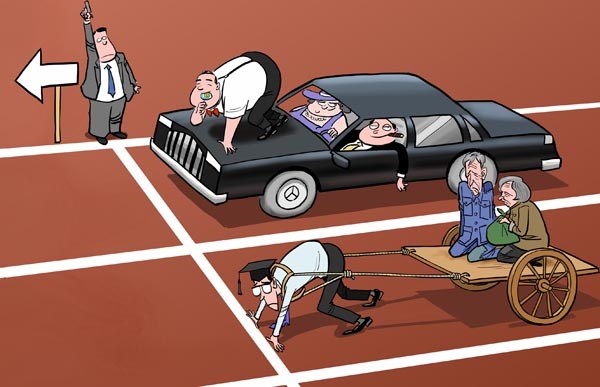

Let me leave you with this. It might not be right, or morally acceptable, but today's capitalistic world is harsh

Jul 24 2018, 12:16 PM

Jul 24 2018, 12:16 PM

Quote

Quote

0.0276sec

0.0276sec

0.76

0.76

7 queries

7 queries

GZIP Disabled

GZIP Disabled