What are Unit Trusts?

i) A form of collective investment that allows investor with similar investment objectives to pool their savings, which then invested in a portfolio of securities or other assets managed by investment professionals.

ii) Investors in Unit Trusts do not purchase the securities in the portfolio directly and the ownership of the portfolio is divided into units of entitlement and each investor is known as a "unit holder"

iii) As evidence of their stake in the Unit Trusts, each investor receives a confirmation of entitlement either in the form of a statement or unit certificate.

iv) The return on investment for unitholder in Unit Trusts is usually a combination of a regular income payment (distribution) and capital appreciation, derived from the pool of investment held within that Unit Trusts.

_____________________________________________________________________

Who should invest in Unit Trusts?

I) For investor who is unable or unwilling to research and analyse investment markets on his own, Unit Trusts are an ideal tool of investing.

II) Investor who have relatively small amounts to invest and neither have the time nor the inclination to hold portfolios of direct investments in shares or bond.

III) Investors who want good returns on their savings, Unit Trusts provide an ideal way for them to gain exposure to investment that, in the long run, can produce returns superior to those from traditional saving accounts and fixed deposits. ( Bare in mind that 3.7% from FD can barely cover the actual inflation rate)

_____________________________________________________________________

How to invest in Unit Trust

1) Lump Sum Purchase

- An investor can invest his savings in the Unit Trusts after he or she has completed an application form from a prospectus. With a lump sum purchase, there is no further commitment to add to the initial investment.

2) Reinvestment of Income/Distribution

-By reinvesting distributions from Unit Trust, an investor can acquire, on a regular basis, small numbers of additional units that, over time, can add significantly to total returns from investing in Unit Trusts.

3) Regular Saving

- Investor may invest in Unit Trusts by making regular contribution (such as a monthly Standing Instruction to purchase additional unit which will be deducted from your saving account) to purchase more unit. The contributions are not contractual and can be stopped at any time without penalty.

-This is a disciplined, useful and flexible way for investor to accumulate capital for a future need.

4) Borrowing to invest in Unit Trusts

- An investor can obtain loan from a financial institution for the purpose of investing in Unit Trusts.

- As long as the rate of return from investing in Unit Trusts exceed the borrowing costs, the investor will benefit from the additional profit arise from the investment. This is known as LEVERAGING (or GEARING) an investment in Unit Trusts.

- Most banks and finance companies in Malaysia offer borrowing facilities to investor who wish to leverage their investment in Unit Trusts. Loans are generally for periods of up to 10 years at interest rates generally higher than personal finance and housing loans.

- The maximum loan-to-valuation ratio is 67%. Meaning that an investor who wishes to invest RM 100,000 in Unit Trusts could be able to borrow up to RM 67,000.

- However, this method may involve certain risk such as volatile interest rate and a possibly margin call from the bank if the value of investment falls below a certain level.

_____________________________________________________________________

Which type of Unit Trusts is suitable for you?

A) Age 21 ~ 30 Years

- At this early stage of life, an investor may be single or newly married. His or her income level may be sufficient to meet living expenses. There may be no significant financial respondsibilities.

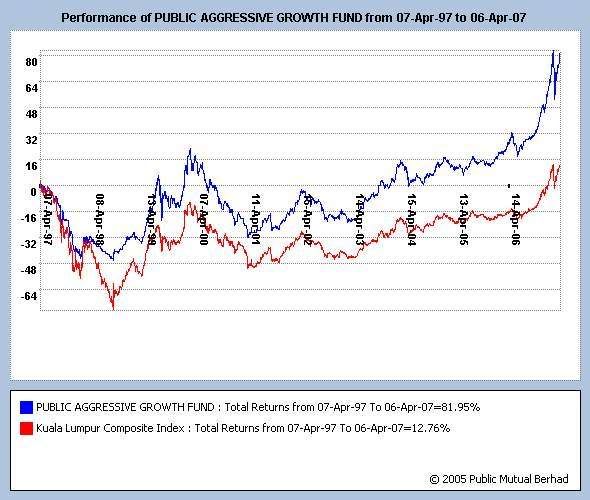

- Young investor in this group can perhaps begin to build a small nest egg by investing into growth-oriented Unit Trusts with Aggresive and Specialised investment objective. (such as Public Small-Cap Fund, Public Equity Fund)

B) Age 31 ~ 44 Years

- Commonly, investor at their 30's & 40's may be at the peak of their carreer life and accompany with greater financial responsibilities such as children's education needs and house mortgage.

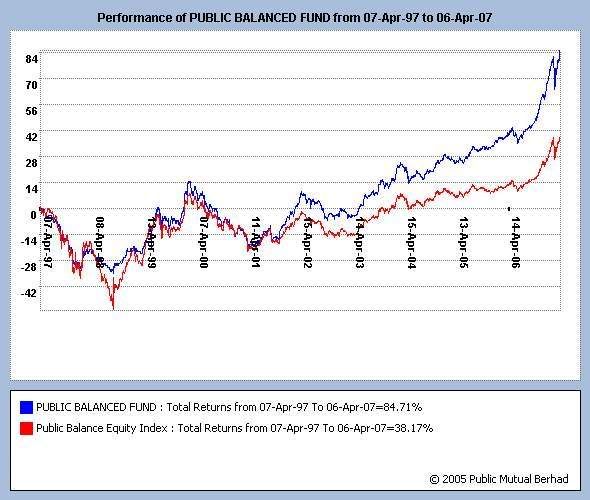

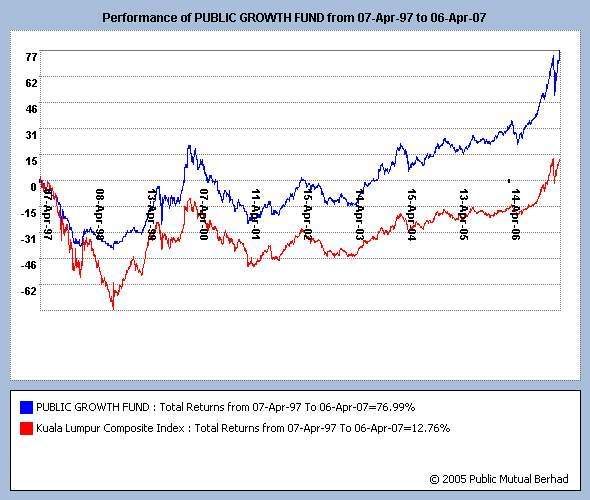

- Depending on the level of financial commitments, there may now be a greater opportunity to save and invest. Investor at this age can consider investing for long-term capital growth using Growth or Balanced Unit Trusts.

- Also, their EPF balances may now be sufficient to be transferred to Unit Trusts that meet these objective.

C) Age 45 ~ 60 Years

- An investor in this age group may now be more financially secure and have a high savings capacity to invest for retirement.

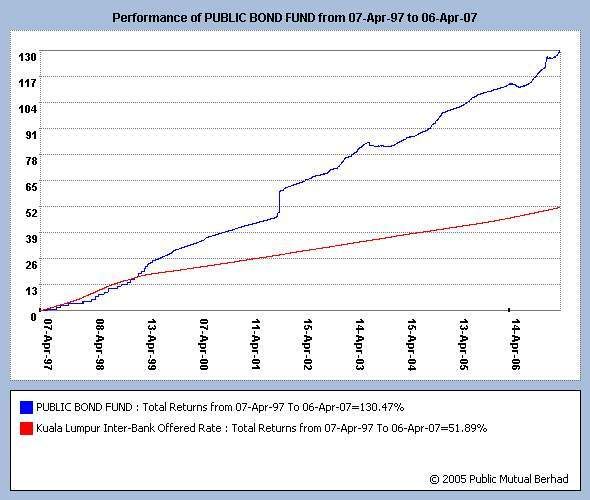

- Perhaps more conservative Unit Trusts should be considered, such as Bond Fund as well as Balanced Fund.

This post has been edited by deadalus: Jun 25 2007, 12:44 PM

Understanding Unit Trusts (Update 25/6/07 Post#5), Risk taker? Orthodox? All invited.

Apr 5 2007, 09:36 PM, updated 19y ago

Apr 5 2007, 09:36 PM, updated 19y ago

Quote

Quote

0.0224sec

0.0224sec

0.39

0.39

6 queries

6 queries

GZIP Disabled

GZIP Disabled