QUOTE(waiwai79 @ May 21 2020, 07:37 PM)

I always mention can't compare subsale and new house...

500k subsale need 100k cash.... Is for different categories buyers

Not really, depends how you are looking at it. The new units basically dump all the cost into the unit price, hence it is inflated then you get the "fake 10%" discount so to speak. You are still paying for every single sen of it, just that you don't see the bill now.

Sub-sale prices are sold well below market/bank value. If you are buying on mark up concept, its the same thing all over. Whatever you spend for the legal fee, you get it back once final disbursement is done. Same concept, different method. Smart buyers take advantage of this and reap the real value out of sub sale units, as some desperate sellers (a lot of them now) are willing to knock off even more just to get rid of their unit.

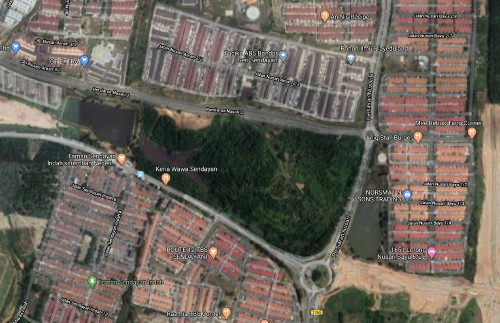

FYI, a subsale 2 storey unit in BSS is ranging about 380-450k. Your bank value is starting from 500-600k upwards. Do the math. A new unit on the other hand is being sold at 600k+ before discount, the standard discount is about 10-15% in BSS.

If the discussion is about getting a brand new unit, well half of the sub-sale are technically new unoccupied units. And you dont even need to service the progressive interest during construction phase. That itself can be almost 10k for a 500k unit.

Why sub-sale is said to be the not so preferred purchasing method? Its because you don't see aggressive marketing at this end. Sales Agents promoting new projects are so creative to paint a different story to buyers.

And, for the part which you mention 500k must come up with 100k. Well, more homework is needed then. You don't sign an S&P for 500k, you sign 550k and dont pay any downpayment (besides the earnest deposit). If unit is still being sold as 500k with a market value of 500k, then you probably didn't bargain well. Sub-sale dont work this way.

This post has been edited by kimchi rider: May 24 2020, 09:50 AM

Mar 26 2020, 03:37 PM

Mar 26 2020, 03:37 PM

Quote

Quote

0.0844sec

0.0844sec

0.76

0.76

7 queries

7 queries

GZIP Disabled

GZIP Disabled