Outline ·

[ Standard ] ·

Linear+

Credit Cards Credit Card v20, Post/Ask general questions here, Please read post 1-3 before posting, tq

|

Duckies

|

Jul 13 2017, 12:08 PM Jul 13 2017, 12:08 PM

|

|

Previously got rejected for credit card application due to PTPTN tunggakan. Just settled it this early of the month. Just went and check the CCRIS report it's still not showing 0 yet so I think should be next month only can see it.

Should I wait for next month only go and apply credit card? Or as long as I settle the tunggakan then should be all right to go and apply?

|

|

|

|

|

|

Duckies

|

Jul 13 2017, 03:01 PM Jul 13 2017, 03:01 PM

|

|

QUOTE(fruitie @ Jul 13 2017, 01:25 PM) Credit card still refers to CCRIS. I settled my tunggakan in October 2016 and until April 2017, my applications were still rejected. Just tried luck again this month and see how it will fare. My CCRIS already zerolized since I cleared tunggakan in October. Just saying. Eh do update me ya if you manage to get the credit card. |

|

|

|

|

|

Duckies

|

Aug 1 2017, 09:41 AM Aug 1 2017, 09:41 AM

|

|

fruitie, how's your recent card application? You mentioned that you just cleared your PTPTN right? Got the card already?

|

|

|

|

|

|

Duckies

|

Aug 1 2017, 10:18 AM Aug 1 2017, 10:18 AM

|

|

QUOTE(fruitie @ Aug 1 2017, 10:16 AM) I applied both SCB and Citibank, both approved recently.  Cleared tertunggak in Oct and still rejected in April but approved in July, however for different cards and banks. I applied PBB in April by the way.  Applied in April but July only approved? That's 3 month eh  I plan to apply PBB card later...dunno will get rejected or not since I cleared my tertunggak last month only. |

|

|

|

|

|

Duckies

|

Aug 8 2017, 09:37 AM Aug 8 2017, 09:37 AM

|

|

Ohh, I just called to check my PBB credit card application status. It says that it has been approved. Finally got to get new credit cards after clearing my PTPTN tunggakan.

|

|

|

|

|

|

Duckies

|

Sep 16 2017, 09:58 AM Sep 16 2017, 09:58 AM

|

|

QUOTE(Sedih @ Sep 16 2017, 09:22 AM) How long do you wait after clear? 1 week. |

|

|

|

|

|

Duckies

|

Dec 20 2018, 11:56 AM Dec 20 2018, 11:56 AM

|

|

Which is the best credit card we can use to pay for AIA insurance? Can it be monthly or needs to be one shot? Pay via online or counter?

|

|

|

|

|

|

Duckies

|

Feb 24 2020, 06:51 PM Feb 24 2020, 06:51 PM

|

|

Any good sign up offer/gift for credit card? Was eye-ing on HSBC credit card.

|

|

|

|

|

|

Duckies

|

Sep 1 2020, 10:30 PM Sep 1 2020, 10:30 PM

|

|

Any good sign up campaign for credit card?

|

|

|

|

|

|

Duckies

|

Dec 22 2020, 11:37 PM Dec 22 2020, 11:37 PM

|

|

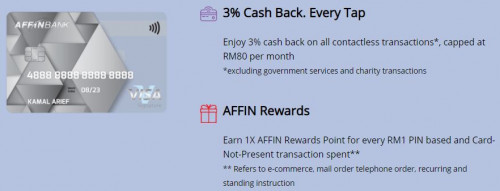

Does Affin bank Visa Signature get cashback for insurance payment?

This post has been edited by Duckies: Dec 22 2020, 11:38 PM

|

|

|

|

|

|

Duckies

|

Dec 23 2020, 09:17 AM Dec 23 2020, 09:17 AM

|

|

QUOTE(GrumpyNooby @ Dec 23 2020, 06:41 AM) If you can wave it at the counter, you'll get cash back. QUOTE(ClarenceT @ Dec 23 2020, 07:49 AM) Must be less than RM250 per wave transaction Wave at counter? What about if I pay online? |

|

|

|

|

|

Duckies

|

Dec 23 2020, 10:59 AM Dec 23 2020, 10:59 AM

|

|

QUOTE(GrumpyNooby @ Dec 23 2020, 09:20 AM) So.. Transactionless means online also can right... Also exclusion doest not have insurance.. So I guess it's all right...? |

|

|

|

|

|

Duckies

|

Dec 23 2020, 11:03 AM Dec 23 2020, 11:03 AM

|

|

QUOTE(ClarenceT @ Dec 23 2020, 11:01 AM) Ah okay.. In this case what is the best cashback card for online insurance payment? PBB Quantum? |

|

|

|

|

|

Duckies

|

Dec 26 2020, 02:38 PM Dec 26 2020, 02:38 PM

|

|

QUOTE(ClarenceT @ Dec 23 2020, 11:16 AM) Affin Duo Visa (Online / Direct Debit) Public Quantum Mastercard (Online), Visa Signature (Online), Quantum Visa (Contactless) Maybank FC Barcelona VS (PIN / Direct Debit / Online) Standard Chartered Just-One Platinum (Debit Debit / Online) RHB VS (Online) T&C apply. Read the cashback schemes of each CC. Thanks for the suggestions. Any good recommendations for misc? I used to have Maybank Barcelona Signature that gives 2% for everything but they revised it to 1% =( |

|

|

|

|

|

Duckies

|

Jan 8 2021, 05:48 PM Jan 8 2021, 05:48 PM

|

|

QUOTE(cybpsych @ Jan 2 2021, 04:26 PM) Hi, does these campaigns stack together? Example I applied 1 SC credit card so am I eligible for both 388 cashback and 500 cashback? |

|

|

|

|

|

Duckies

|

Jan 8 2021, 05:59 PM Jan 8 2021, 05:59 PM

|

|

QUOTE(cybpsych @ Jan 8 2021, 05:51 PM) read the Eligibility section I read through and didn't get the answer...or maybe my understanding skill is low...  |

|

|

|

|

|

Duckies

|

Jan 8 2021, 06:38 PM Jan 8 2021, 06:38 PM

|

|

QUOTE(cybpsych @ Jan 8 2021, 06:18 PM) read again the whole Eligibility section New to Product (“NTP”) Existing to Product (“ETP”) "New Customers" Yea but if I apply a new card I'm consider as new to product for both campaign right..? |

|

|

|

|

|

Duckies

|

Apr 6 2021, 12:57 AM Apr 6 2021, 12:57 AM

|

|

Hi guys I have 2 questions here.

1. Is it possible to cancel the monthly installment via credit card and do 1 shot payment to clear it off?

2. Do I still get Maybank AMEX cashback for monthly installment?

|

|

|

|

|

|

Duckies

|

Apr 30 2022, 12:36 AM Apr 30 2022, 12:36 AM

|

|

Any credit card recommendations for insurance payment and TNG reload? I currently own PBB Quantum Mastercard and Visa, Visa Signature, and Islamic Platinum. Perhaps Affin Duo but the application is damn slow... I applied last month and til now I haven't got it.

|

|

|

|

|

|

Duckies

|

Apr 30 2022, 09:35 AM Apr 30 2022, 09:35 AM

|

|

QUOTE(LostAndFound @ Apr 30 2022, 07:01 AM) The PBB Quantum Master and Visa Signature do not give any benefit for TNG reload (according to TNC), can check their threads for more details. Only Islamic Platinum does. Affin Duo is a reliable one. Other than that can consider HSBC Amanah (they still have FCFS promo for RM15 cashback on TNG reload, but damn competitive at midnight on first day of month). Also can consider UOB YOLO (min spend RM600, 5% cashback but ewallet capped at RM15 so you need RM300 'other spend' to get 5%). Anything for insurance payment? |

|

|

|

|

Jul 13 2017, 12:08 PM

Jul 13 2017, 12:08 PM

Quote

Quote

0.0302sec

0.0302sec

0.44

0.44

7 queries

7 queries

GZIP Disabled

GZIP Disabled