hi guys, anyone took HLB's 12m 0% balance transfer promo before?

Wanna ask, is the monthly installment/repayment really 5% of outstanding balance only?

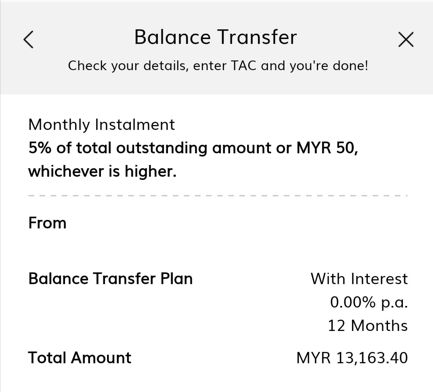

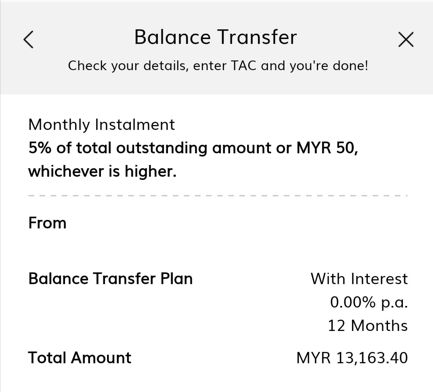

For example like this:

BT amount = RM13,163.40

Initially i thought the installment would be RM13,163.40 / 12 = RM1096.95/month for 12 months

But when i get my CC statement, the min payment shown as 5% like in above screenshot.

so 1st repayment = 5% of it = RM658.17 instead of the RM1096.95 that i expected

I tried finding anywhere else in the statement for the payment amount and nada, it just shows my outstanding balance and min payment = 658.17

not like CC statement where it have 1) outstanding amount 2) amount to pay 3) min payment req

I scared if i just pay the min amount which is the 5% later will kena interest/charges..

EDIT:

also, yes im aware, if pay only the 5% amount every month, at the end of tenure at 12th month will still have a lot outstanding balance that need to fully settle at one go.

Which i guess is where HLB try to trap people la. But for me is okay cause my financial discipline is tight.

So if can really pay just 5% instead of the BT amount/12months then i will go for it. The extra money just park it somewhere and keep. then at final month need take out and pay off all the remainder balance

I kena for UOB forgot to keep track of the month. 2 months interest kena.

1st month i thought forgot payment so late interest. 2nd momth only realized kena con

Feb 14 2023, 03:43 PM

Feb 14 2023, 03:43 PM

Quote

Quote

0.0310sec

0.0310sec

0.52

0.52

7 queries

7 queries

GZIP Disabled

GZIP Disabled