QUOTE(hustlerism @ Jun 6 2024, 01:32 AM)

should probably do in the reverse wayapply BT and resulting in credit balance in CC, then apply advance

NOTE: I have not tried if it is workable though

Credit Cards Credit Card v20, Post/Ask general questions here, Please read post 1-3 before posting, tq

|

|

Jun 6 2024, 11:34 AM Jun 6 2024, 11:34 AM

Return to original view | IPv6 | Post

#21

|

Senior Member

1,141 posts Joined: Oct 2018 |

QUOTE(hustlerism @ Jun 6 2024, 01:32 AM) should probably do in the reverse wayapply BT and resulting in credit balance in CC, then apply advance NOTE: I have not tried if it is workable though |

|

|

|

|

|

Jun 6 2024, 02:20 PM Jun 6 2024, 02:20 PM

Return to original view | IPv6 | Post

#22

|

Senior Member

1,141 posts Joined: Oct 2018 |

QUOTE(WaCKy-Angel @ Jun 6 2024, 12:17 PM) Dont think it works that day, although u can try ask for refund to bank account. not sure y u need to ask for refundThe BT amount to the bank is just like "cash deposit/payment" they wont know it is actually BT. I had similar case before....i bought from Lazada and already paid the statement. Later Lazada issued refund and i got -ve amount so i called and ask for transfer to savings account. Took about 1 week though, and bank may not allow if frequently do such request. when your cc a/c received BT ('cash deposit'payment'), your available credit limit increases too then could get higher Ezycash amount due to the increased limit |

|

|

Jul 6 2024, 05:10 PM Jul 6 2024, 05:10 PM

Return to original view | IPv6 | Post

#23

|

Senior Member

1,141 posts Joined: Oct 2018 |

QUOTE(jasmineh2y @ Jul 6 2024, 03:58 PM) 3. Card required for: Cashback for Online and Retail transactions (Dining, Shopping, Auto Bill), Free LCCT Lounge Access. not sure y u listed the card features as we are aware of those4. Existing credit cards (if any): Affin Duo cards - 3% for auto-billing and online txn Affin Sign Visa - 3% for pay wave retail spend MBB Barcelona - 1% for all spend except gov 6. Others: Monthly Card expenses around RM4-5k. whereas left out the crucial information of estimated spending in respective categories e.g. assuming that biggest spend insurance around RM 1k, remains RM 3-4k other spendings, how would HSBC live+ be attractive? |

|

|

Jul 8 2024, 10:56 AM Jul 8 2024, 10:56 AM

Return to original view | IPv6 | Post

#24

|

Senior Member

1,141 posts Joined: Oct 2018 |

QUOTE(jasmineh2y @ Jul 6 2024, 06:52 PM) After detail it, my big spend on online txn. could probably still keep affin duo forOnline Txn 2000 Other Retail 1000 Auto Bill 300 Petrol 200 Dining 1000 Insurance 800 wallet top up 1000 Online Txn , Auto Bill and Insurance might consider alliance visa signature for the rest need to ensure that the statement balance of both cards are RM 3,000 or above though jasmineh2y liked this post

|

|

|

Aug 15 2024, 09:29 AM Aug 15 2024, 09:29 AM

Return to original view | IPv6 | Post

#25

|

Senior Member

1,141 posts Joined: Oct 2018 |

QUOTE(hottemper @ Aug 14 2024, 10:10 PM) pay off every transaction instead of end of month total bill, will this help build credit score? Or i have to pay the statement bill in one shot after statement date to build credit score? i believe the credit system keeps track of whether you have no late payment "0" or late by 1 month "1" etc instead of how quickly you pay off debthowever, paying off before the records updated to the credit system would result in lower outstanding amount, which may keep credit utilisation rate low still, high credit limit would affect your debt service ratio |

|

|

Sep 11 2024, 02:41 AM Sep 11 2024, 02:41 AM

Return to original view | IPv6 | Post

#26

|

Senior Member

1,141 posts Joined: Oct 2018 |

QUOTE(perfect10 @ Sep 10 2024, 10:16 PM) i have the issue of if there is money lying in saving it might be spent off and then realizing not enough to settle off monthly repayment later. Yes most of them are 0% interest but they all have upfront interest which the interest has already been paid. do you have more than one savings account? just park all BT repayment in one account, schedule transfer & u r good |

|

|

|

|

|

Oct 20 2024, 03:32 AM Oct 20 2024, 03:32 AM

Return to original view | IPv6 | Post

#27

|

Senior Member

1,141 posts Joined: Oct 2018 |

QUOTE(watabakiu @ Oct 19 2024, 11:01 PM)  I need further help on this. So let's say on a 10k outstanding balance.... Islamic CC: Month 1 | 10k purchases = 10k Month 2 | No purchases and no payments made = 10k outstanding x 1.5% interest = 10,150 Month 3 | 10,150 still? 1. if u fail to pay, the management fee (interest) will be charged from the date of transaction instead of statement date so, if u spend on the 1st of month 1, would have incurred RM 150 in month 1 outstanding on end of month 1 = RM 10,150 2. compounding charges refer to 'interest on interest', meaning that the RM 150 interest you incurred in month 1 will not be charged interest in month 2 management fee for month 2 remains the same = RM 10,000 x 1.5% (if conventional compounding --> RM 10,150 x 1.5% = RM 152.25) month 2 outstanding: islamic = RM 10,300; conventional = RM 10,302.25 |

|

|

Nov 16 2024, 07:25 PM Nov 16 2024, 07:25 PM

Return to original view | IPv6 | Post

#28

|

Senior Member

1,141 posts Joined: Oct 2018 |

QUOTE(kyleen @ Nov 16 2024, 07:56 AM) while i m using UOB One and agree with the benefitsbut do the math first maybe... RM 60 x 12 - RM 98 - RM 25 = RM 597 RM 597 / RM 6,000 = 9.95% lower but probably still the highest in the market |

|

|

Nov 16 2024, 11:30 PM Nov 16 2024, 11:30 PM

Return to original view | IPv6 | Post

#29

|

Senior Member

1,141 posts Joined: Oct 2018 |

|

|

|

Dec 18 2024, 10:28 AM Dec 18 2024, 10:28 AM

Return to original view | IPv6 | Post

#30

|

Senior Member

1,141 posts Joined: Oct 2018 |

QUOTE(wklim090 @ Dec 17 2024, 11:50 PM) 2. Then apply to add one credit card on same bank, but on Islamic side (*I had one credit card on Islamic side too) this should not be a problem as you already have approved credit limit on both conventional and islamic account, there's exception but i can't remember which bank/card |

|

|

Jan 17 2025, 07:27 PM Jan 17 2025, 07:27 PM

Return to original view | IPv6 | Post

#31

|

Senior Member

1,141 posts Joined: Oct 2018 |

QUOTE(synical @ Jan 17 2025, 05:03 PM) Been thinking of cancelling the last Stan Chart and HSBC Amanah cards I got, but the CL I got for both are crazy high (30K and 20K). Otherwise I have no real use for them... Should I hang on to them, or should I cut them loose and apply for other cards? I have other cards, but the highest CL I have is like 10K (combined, Affin Duo).. otherwise, i would pick card benefits (cashback/point/miles) over credit limit chronologically, my credit limit was MBB (1) --> UOB (5) --> PBB (3) --> Affin (4) --> OCBC (2), 1 being lowest; 5 being highest |

|

|

Feb 20 2025, 12:15 PM Feb 20 2025, 12:15 PM

Return to original view | IPv6 | Post

#32

|

Senior Member

1,141 posts Joined: Oct 2018 |

QUOTE(nexus2238 @ Feb 20 2025, 11:58 AM) Think from the perspective of insurance company. not exactly, the premium is based on 'outstanding credit card statement balance'Credit shield basically will pay out if principal card holder die / pd. There is no age profiling, health profiling, risk profiling that normally available to insurance company like in life / medical insurance. Of course premium of credit shield will be expensive. therefore, u could pay all outstanding balance prior to the statement date which will result in Nil premium cost and yet be covered under the scheme not attractive for me since spending within my means secondly, i prefer 20-day interest free period aurora97 liked this post

|

|

|

May 28 2025, 05:16 PM May 28 2025, 05:16 PM

Return to original view | Post

#33

|

Senior Member

1,141 posts Joined: Oct 2018 |

QUOTE(terriblyrawtea @ May 28 2025, 04:56 PM) is it possible to setup my CC to deduct from my savings account to pay statement balance by due date? i tried checking and i dont see such options for Maybank and SCB possible for MBB |

|

|

|

|

|

Jun 6 2025, 09:45 AM Jun 6 2025, 09:45 AM

Return to original view | Post

#34

|

Senior Member

1,141 posts Joined: Oct 2018 |

QUOTE(verbatin @ Jun 5 2025, 10:35 PM) i am a Singaporean. i have rental income and dividend income in Malaysia. but i do not have salary in Malaysia. possible to support rental income with form B/BEi check from Chat GPT and it say i can apply for a credit card by placing a 10k FD to get a unsecured credit card. some bank like standard chart, Maybank may offer this option. is this true? if yes, which malaysia bank give good rebates (cash rebates) without much criteria previous post suggested that some banks are willing to accept SG salary but you have to find out yourself FD pledging is possible but by definition that would be credit card secured by FD cash rebate depends on your spending category and amount QUOTE(Patent @ Jun 6 2025, 06:04 AM) the bank you applied for has more effect than your income bracket |

|

|

Jun 7 2025, 12:32 PM Jun 7 2025, 12:32 PM

Return to original view | Post

#35

|

Senior Member

1,141 posts Joined: Oct 2018 |

QUOTE(Patent @ Jun 6 2025, 07:26 PM) Which bank do you think would have more leeway requirement in giving such high credit limit? local bank i think Affin appears to be granting more limit that Public; Maybank would probably grant the lowestTbh, the reason I'm asking because apparently you can buy big bikes with EPP. So wouldn't be it a good deal to pay with 0% installment UOB granted about 6x of my salary about 6 years ago, unfortunately, they do not issue islamic cc here for EPP, u might need to check the banking partner as some may offer up to 36 months interest-free |

|

|

Jun 25 2025, 09:50 AM Jun 25 2025, 09:50 AM

Return to original view | Post

#36

|

Senior Member

1,141 posts Joined: Oct 2018 |

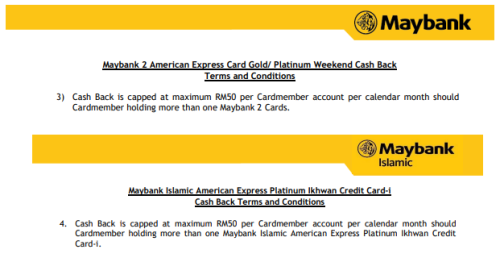

QUOTE(Fantasia @ Jun 24 2025, 05:45 PM) She said 1 way to work around it is to appeal my application through emailing them to reduce the credit limit given to my Ikhwan Amex and use the remaining credit limit on my 2 Platinum cards. I find it interesting as I always though Islamic and conventional division are separate entities so each will have its own credit limit. I also did not expect to exhaust my credit limit with a single card cause my UOB One has more than twice the credit limit. Besides, how high is my chance will my appeal (reducing credit limit on Ikhwan) be if my nett income is just slightly higher than the minimum income for 2 Platinum cards? i also find it interesting that the customer service had provided a suggested solution to your enquiry and yet u r here since they had informed u regarding the reason of rejection and proposed solution, might as well give it a try every bank has its own assessment criteria i agree that the credit limit granted from UOB is way too high |

|

|

Sep 4 2025, 06:38 PM Sep 4 2025, 06:38 PM

Return to original view | Post

#37

|

Senior Member

1,141 posts Joined: Oct 2018 |

QUOTE(AlexisStarZ @ Aug 29 2025, 11:55 PM) I use spaylater then during weekend will paid using amex, pain 1k then easily can get RM 50 cashback not what's written in the t&cAs for islamic amex, I though amex cashback is share between each other? correct me if I am wrong on this  then again, they didn't charge you sst on inactivated card so the t&c could be wrong too |

| Change to: |  0.1528sec 0.1528sec

0.86 0.86

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 11th December 2025 - 11:02 PM |