QUOTE(Boon3 @ Jul 21 2020, 07:22 PM)

paper trading also need tips meh?

Aiyooooooo macam mana ni?

Right now, there are so many things you can paper trade ma...

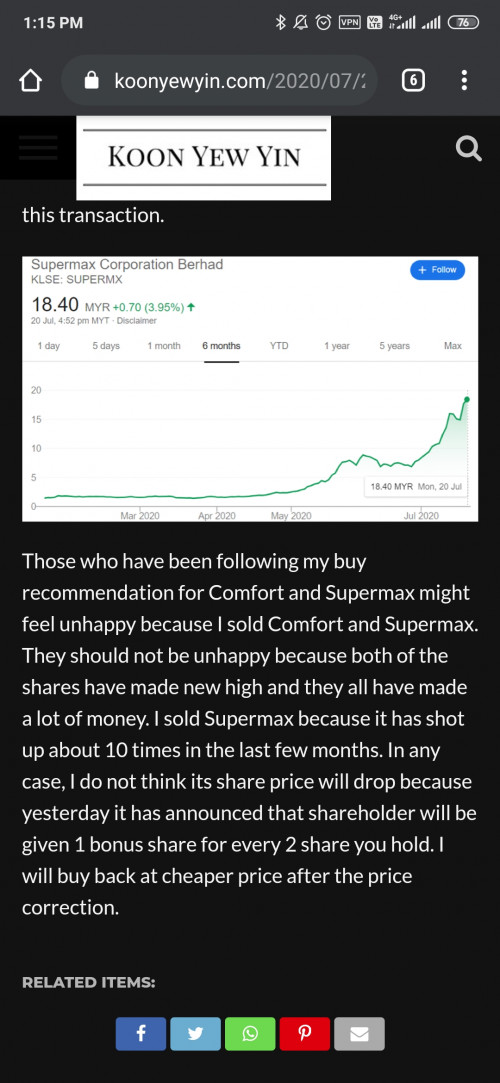

So I spit mouth water on that lowlife on Superman. So why don't you paper trade Superman then?

See if you can find an entry and of course you need to know where is your exit points...

Paper trade lo...

See this is not a simply challenge ma...

For me, without him...

I suspect the stock will lack one leg...

Missing one leg... err... supports not as good hor...

Missing one leg... which other leg will occasionally kick the stock up?

Or you can think about other stuff too....................

Then the simple question...

beside rubber glove stocks, which other area/stock/sector is actually doing pretty good?

....

I should have rephrased. How to be better?

This is what I do with my paper trade.

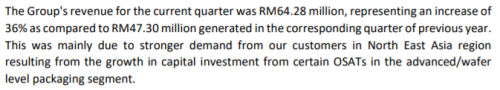

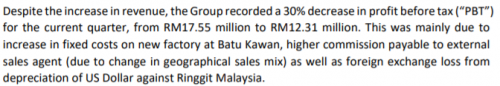

1. Identify trending sector.

2. Take out around 5 best companies in the sector.

3. Read their AR and QR (I'll admit, figures are skimped, percentages are emphasized on growth, that's what I do la, really bad with numbers)

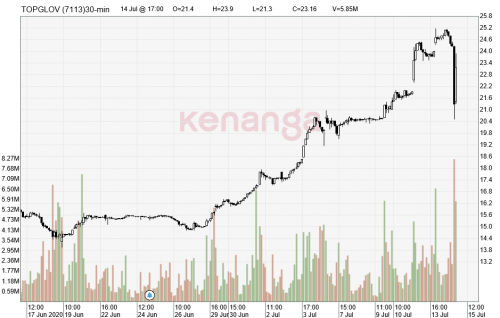

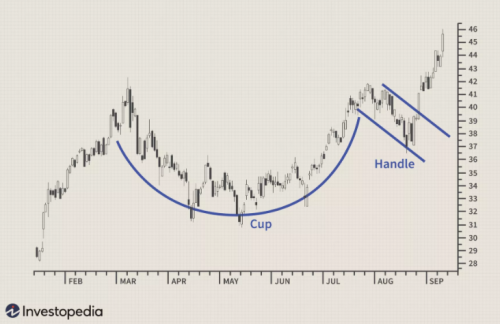

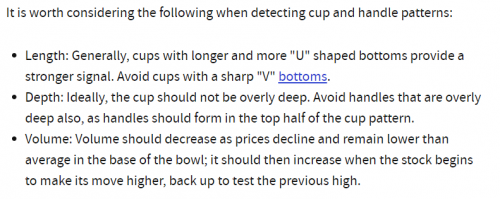

4. Look at their charts, trends, candles, and strengths. (supports and resistances with high volume in the past)

5. Identify entry and exit points. (like to buy after a retracement, never good with chasing; use ATR1.5 for cut loss, or roughly 7%, if the stocks I bought touch my CL point, that means I'm wrong)

6. Never goes all in. (buy in batches, average up, not down)

7. Wait.

**Did anticipate the possible formation of the chart. Since we don't do short here, we can only go long. Like you said, another leg, another retracement, etc.

The paper trading for 2020 is a success. But it's a bull market. So, I guess I just kinda like, went along with the flow. Since the market is unpredictable, it is never my own ability to even begin with, I just go along and trade according to my setups.

But again, how to be better? After these few years, when I am right, I am. When I am wrong, I just CL. Although winning rate is better than my losing ones, still, I started with diversification, long term buy & hold beats trading, dollar-cost averaging, humans can't beat passive investment, yada yada...

Macam mana ni? Aiyooooooooo

This post has been edited by billy_overheat: Jul 22 2020, 08:58 AM

Jul 14 2020, 07:50 PM

Jul 14 2020, 07:50 PM

Quote

Quote

0.2024sec

0.2024sec

0.52

0.52

7 queries

7 queries

GZIP Disabled

GZIP Disabled