Outline ·

[ Standard ] ·

Linear+

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

citymetro

|

Apr 29 2019, 12:46 PM Apr 29 2019, 12:46 PM

|

Getting Started

|

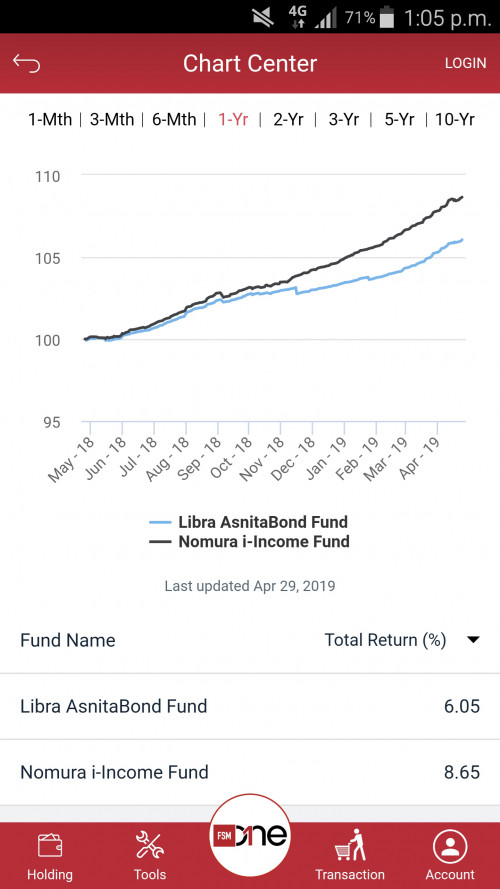

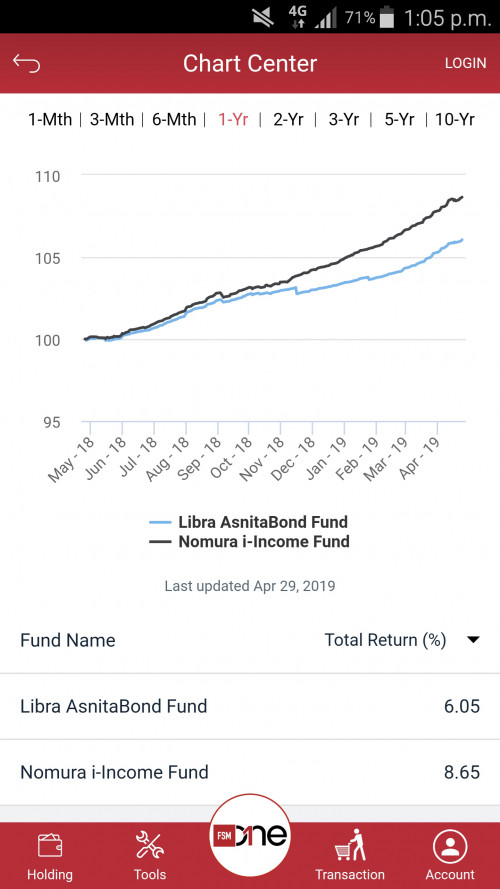

Hello sifus, I already have Asnita, does it make sense to also get Nomura Income or let go of Asnita and get Nomura? Any input is much appreciated.

This post has been edited by citymetro: Apr 29 2019, 12:47 PM

|

|

|

|

|

|

citymetro

|

Apr 29 2019, 12:59 PM Apr 29 2019, 12:59 PM

|

Getting Started

|

QUOTE(MUM @ Apr 29 2019, 12:54 PM) yes, if one has the initial investment value of the Nomura and ALSO if one can trust that Nomura performance can sustain and it volatility is suitably low as compared to Anista for the investment period Thank you. Asnita has given me +10.50 so far. I do think that adding Nomura to my port will be a decent move. Just unsure if I should move totally to Nomura or add Nomura. |

|

|

|

|

|

citymetro

|

Apr 29 2019, 01:14 PM Apr 29 2019, 01:14 PM

|

Getting Started

|

QUOTE(Avangelice @ Apr 29 2019, 01:06 PM)  Here u go Yes, I've done the comparison and saw Nomura's prospect as compared to Asnita. That is why I am thinking of switching or adding. Btw, I read about Nomura Holdings troubles in Bloomberg. Should I be concern? Will that affect Nomura Asset Management? |

|

|

|

|

|

citymetro

|

Apr 29 2019, 01:17 PM Apr 29 2019, 01:17 PM

|

Getting Started

|

QUOTE(MUM @ Apr 29 2019, 01:06 PM) why not try change them to ASNB FP funds? if the age allows....try self contribution in EPF....(max 60k pa) Self employed so contribution to own EPF is negligible. Ha.. ASNB FP is just a pain to obtain. I don't have the time to captcha spam. |

|

|

|

|

|

citymetro

|

Apr 29 2019, 05:33 PM Apr 29 2019, 05:33 PM

|

Getting Started

|

Thank you for all the helpful insights. I am glad to see level and clear headed replies here instead of the usual fear mongering I have seen elsewhere.

|

|

|

|

|

|

citymetro

|

May 13 2019, 03:55 PM May 13 2019, 03:55 PM

|

Getting Started

|

QUOTE(David83 @ May 13 2019, 02:31 PM) Mine is at -7.41%. I have seen it sliding from -4.14% in just a week or two. Hit brick wall lah.... |

|

|

|

|

|

citymetro

|

Aug 4 2020, 02:10 PM Aug 4 2020, 02:10 PM

|

Getting Started

|

Anyone holding RHB Gold And General Fund? A good time to go in? Kindly enlighten me..much appreciated.

|

|

|

|

|

|

citymetro

|

Aug 8 2020, 11:41 AM Aug 8 2020, 11:41 AM

|

Getting Started

|

Sifu sifu ... I have been holding on to KGF for over 5 years and have been through thick and thin with it. Now, I see that KGOF seems to be waking up and really working hard..so I jump ship?

|

|

|

|

|

|

citymetro

|

Aug 8 2020, 11:47 AM Aug 8 2020, 11:47 AM

|

Getting Started

|

QUOTE(MUM @ Aug 8 2020, 11:43 AM) How many % of kgf is allocated in Yr port? 12.31% |

|

|

|

|

|

citymetro

|

Aug 8 2020, 12:16 PM Aug 8 2020, 12:16 PM

|

Getting Started

|

QUOTE(MUM @ Aug 8 2020, 11:54 AM) With that %, I think just switch all to KGOF,... But do check the valuation of msia small cap mkt. As I think small cap funds had been up alot for sometime already.... If not in a hurry to switch, can switch to a FI fund n wait for some small cap mkt pullback to enter? Just my thought only... Not in a real hurry to switch but knowing that FI fund is doing better than KGF really makes me go what?! Also investor sentiment aside, I think I will need to let go of KGF eventually, twas my first UT.  |

|

|

|

|

|

citymetro

|

Aug 10 2020, 03:06 PM Aug 10 2020, 03:06 PM

|

Getting Started

|

QUOTE(WhitE LighteR @ Aug 10 2020, 03:00 PM) i think most good funds are at all time high now relative to each other. this is not a good criteria as a consideration. Sharing the same sentiments. My Asnita is also riding high but I am still topping up. |

|

|

|

|

|

citymetro

|

Aug 12 2020, 01:06 PM Aug 12 2020, 01:06 PM

|

Getting Started

|

QUOTE(whirlwind @ Aug 12 2020, 12:40 PM) I’m currently planning to change/fine tune my funds. Do comment since I’m still new in UT 30% principal islamic lifetime enhanced sukuk fund - switch 15% to principal global titans fund 15% principal greater china equity fund 15% affin hwang aiiman balanced fund - redeem and distribute to my other funds 15% eastspring investments small-cap fund 15% precious metals securities - switch all to Ambond (lost my balls, hahaha, too scary but will consider to switch back)Was this decision to switch based on the falling gold price?  I am still holding to RHB Gold and General Fund and I am sitting tight ... very ucomfortably tight..  |

|

|

|

|

|

citymetro

|

Aug 12 2020, 04:37 PM Aug 12 2020, 04:37 PM

|

Getting Started

|

QUOTE(whirlwind @ Aug 12 2020, 01:28 PM) Yup, predicting that it will continue to slide down. Invested at first because there’s many speculation gold might even reach 3k Gold counters went back up ...  |

|

|

|

|

|

citymetro

|

Aug 17 2020, 10:42 AM Aug 17 2020, 10:42 AM

|

Getting Started

|

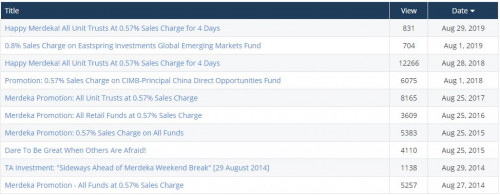

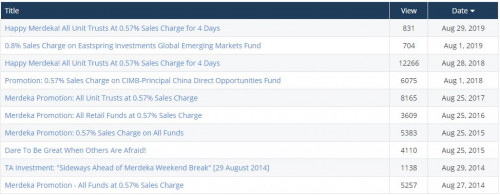

QUOTE(GrumpyNooby @ Aug 17 2020, 10:20 AM) Since 2014, it is always there:  Anticipating the sale to start later in the week. Need to lumpsum to take advantage of it. |

|

|

|

|

|

citymetro

|

Aug 17 2020, 10:54 AM Aug 17 2020, 10:54 AM

|

Getting Started

|

QUOTE(GrumpyNooby @ Aug 17 2020, 10:49 AM)  Dining vouchers only. If cash that can be invested then more attractive. |

|

|

|

|

|

citymetro

|

Aug 17 2020, 05:38 PM Aug 17 2020, 05:38 PM

|

Getting Started

|

QUOTE(hs_clover @ Aug 17 2020, 04:41 PM) anyone top up precious metal? Dont have this in my port but planning to top up RHB Gold during Merdeka Sales. This post has been edited by citymetro: Aug 17 2020, 05:38 PM |

|

|

|

|

|

citymetro

|

Aug 18 2020, 04:32 PM Aug 18 2020, 04:32 PM

|

Getting Started

|

QUOTE(GrumpyNooby @ Aug 18 2020, 03:28 PM) It used to be a star fund. The star is shining back! ROI to date is back to double digit. Yup, double digits and going strong.  Took a nosedive in March but it bounced back nicely. They have an 8.52% stake in Tencent and was worried something might trigger a fall but still holding on solidly. |

|

|

|

|

|

citymetro

|

Aug 18 2020, 05:39 PM Aug 18 2020, 05:39 PM

|

Getting Started

|

QUOTE(whirlwind @ Aug 18 2020, 05:35 PM) Gold price went up over 2k already Already switched my Precious Metal Securities. If I’ve hold on to it, I wouldn’t have incurred some losses 🙁 How long have you been holding? For me, investment in commodities is always for the long run. |

|

|

|

|

|

citymetro

|

Aug 18 2020, 05:55 PM Aug 18 2020, 05:55 PM

|

Getting Started

|

QUOTE(whirlwind @ Aug 18 2020, 05:50 PM) I guess around 5% I’m actually using my epf platform to invest. GoldETF would have been more suitable for you if you are looking to profit from Gold in the short term. |

|

|

|

|

|

citymetro

|

Aug 19 2020, 10:31 AM Aug 19 2020, 10:31 AM

|

Getting Started

|

QUOTE(WhitE LighteR @ Aug 19 2020, 08:47 AM) Add on some into Precious Metal today. I am still waiting for Merdeka sales to top up...  Btw, I am glad I switched out KGF and replaced with KGOF. Doing solidly better...  |

|

|

|

|

Apr 29 2019, 12:46 PM

Apr 29 2019, 12:46 PM

Quote

Quote

0.0709sec

0.0709sec

0.30

0.30

7 queries

7 queries

GZIP Disabled

GZIP Disabled