QUOTE(pisces88 @ Aug 19 2020, 01:09 PM)

Not attractive a prize enough to give up sales charge sales lah ... FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Aug 19 2020, 01:42 PM Aug 19 2020, 01:42 PM

Return to original view | IPv6 | Post

#21

|

Junior Member

152 posts Joined: Apr 2017 |

|

|

|

|

|

|

Aug 20 2020, 09:23 AM Aug 20 2020, 09:23 AM

Return to original view | Post

#22

|

Junior Member

152 posts Joined: Apr 2017 |

QUOTE(yklooi @ Aug 20 2020, 01:02 AM) was back reading an article on KGF...... She was a darling during her heydays for sure. But I had to let her go. Her cousin seems more exciting now. Hehe..was a darling of many during those time.... i was one of those that were enticed by her returns..... will her magic power ever come back? |

|

|

Aug 20 2020, 09:47 AM Aug 20 2020, 09:47 AM

Return to original view | Post

#23

|

Junior Member

152 posts Joined: Apr 2017 |

|

|

|

Aug 21 2020, 01:45 PM Aug 21 2020, 01:45 PM

Return to original view | IPv6 | Post

#24

|

Junior Member

152 posts Joined: Apr 2017 |

Not much choice in Tech funds through FSM. Anyone knows if the other platform have more choices?

|

|

|

Aug 21 2020, 01:54 PM Aug 21 2020, 01:54 PM

Return to original view | IPv6 | Post

#25

|

Junior Member

152 posts Joined: Apr 2017 |

QUOTE(yklooi @ Aug 21 2020, 01:51 PM) Thanks! I filtered through FSM and found the same few funds. TA Global Tech seems to be a fav here but looking at its benchmark, doesn't look too appetizing. Any input? ETA : Wouldn't touch PM with a ten foot pole! This post has been edited by citymetro: Aug 21 2020, 01:55 PM |

|

|

Aug 21 2020, 02:12 PM Aug 21 2020, 02:12 PM

Return to original view | IPv6 | Post

#26

|

Junior Member

152 posts Joined: Apr 2017 |

QUOTE(yklooi @ Aug 21 2020, 01:57 PM) i usually don't look at the benchmark... I guess most investors will look at what you are looking at, which is *can I expect to get XX% pa in X year/s*, myself included.i just looked at "can i expect to get XX% pa in this coming 1 year?" are you looking at "can the fund meet it stated benchmark in the coming 1 year? (what is the benchmark value in terms of returns?) But I also like to look at if the fund can make me X% pa more and that is when comparing the fund's performance to its benchmark comes in. |

|

|

|

|

|

Aug 21 2020, 03:06 PM Aug 21 2020, 03:06 PM

Return to original view | IPv6 | Post

#27

|

Junior Member

152 posts Joined: Apr 2017 |

QUOTE(yklooi @ Aug 21 2020, 02:21 PM) for me...I also like to look at if the fund can make me X% pa more and that is when comparing the fund's performance to its |

|

|

Aug 25 2020, 02:34 PM Aug 25 2020, 02:34 PM

Return to original view | IPv6 | Post

#28

|

Junior Member

152 posts Joined: Apr 2017 |

QUOTE(joeaverage @ Aug 25 2020, 12:22 PM) I have a referral token of 1% and want to use it for inter switching. Is this possible? Where do i utilise it? I tried but it also shows the normal fee only... Merdeka promotion will start after their current promo ends, hopefully. I am sitting and waiting here... also, no merdeka promotion this year or usually its last min? i thought usually by august it would be out... |

|

|

Aug 27 2020, 04:01 PM Aug 27 2020, 04:01 PM

Return to original view | IPv6 | Post

#29

|

Junior Member

152 posts Joined: Apr 2017 |

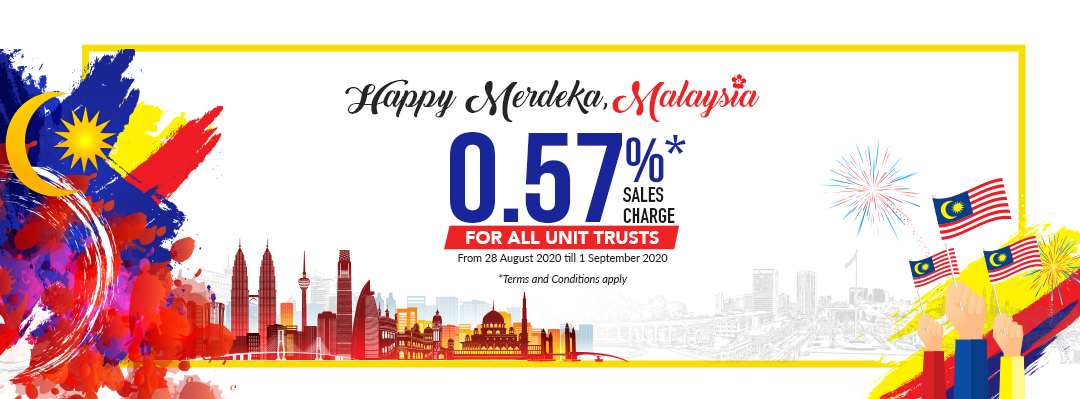

Happy Merdeka Day, Malaysia! Enjoy 0.57% sales charge on ALL Unit Trust Funds! Terms & Conditions: This promotion is valid from 28 August 2020 till 1 September 2020. All cash payments (cheque, internet payments, RHB cash management fund 2 or cash account) must reach us by 3pm on 4 September 2020. Regular Savings Plan (RSP) sales charge will be adjusted (where applicable) to reflect promotional sales charge during the promotion period. This promotion does not apply to transactions involving Intra Switch Buy (same fund house). Account holders under the FSMOne Rewards Program will be given either the promotional sales charge or the FSMOne Rewards Program discount, whichever is lower. This promotional sales charge is applicable to ALL Unit Trusts listed on FSMOne Platform. For further enquiries, please call us at (03) 2149 0567 (KL) or drop us an email at investhelp.my@fundsupermart.com. ------------------------- It's Here!! WhitE LighteR, ericlaiys, and 1 other liked this post

|

|

|

Aug 27 2020, 06:17 PM Aug 27 2020, 06:17 PM

Return to original view | Post

#30

|

Junior Member

152 posts Joined: Apr 2017 |

QUOTE(GrumpyNooby @ Aug 27 2020, 04:19 PM) RHB Gold and General Fund has been red for a week now so I have been waiting for this sale to go in more. Other funds though, as you mentioned, really all time high. I DCA a few so can't really say much else. |

|

|

Sep 3 2020, 01:45 PM Sep 3 2020, 01:45 PM

Return to original view | IPv6 | Post

#31

|

Junior Member

152 posts Joined: Apr 2017 |

QUOTE(lee82gx @ Sep 3 2020, 01:38 PM) Any of you still holding on the KGF, Eastspring Investment Small Cap, Principal Asia Pacific Dynamic Income Fund? Switched KGF to KGOF but still holding on to Eastspring Investment Small Cap and Principal Asia Pacific Dynamic Income Fund.You know the oldies, but not so goldy anymore recently? They are both still looking good to me ... steady ... so why the not so goldy anymore statement ya? I still have Asnita and Nomura as well, haha .... |

|

|

Sep 3 2020, 01:48 PM Sep 3 2020, 01:48 PM

Return to original view | IPv6 | Post

#32

|

Junior Member

152 posts Joined: Apr 2017 |

|

|

|

Sep 3 2020, 01:50 PM Sep 3 2020, 01:50 PM

Return to original view | IPv6 | Post

#33

|

Junior Member

152 posts Joined: Apr 2017 |

QUOTE(GrumpyNooby @ Sep 3 2020, 01:47 PM) Portfolio diversification taking a backseat while I am trying to gain some from KGOF speedy movement. Will eventually move after the speed subsides?Since the switch a few weeks ago, ROI is at 4.7%. |

|

|

|

|

|

Sep 3 2020, 02:00 PM Sep 3 2020, 02:00 PM

Return to original view | IPv6 | Post

#34

|

Junior Member

152 posts Joined: Apr 2017 |

QUOTE(GrumpyNooby @ Sep 3 2020, 01:51 PM) Recent months gain I believe that the fund manager switched region concentration to Greater China. Top 10 HoldingsIt has 29% in HK, 9.5% in Taiwan and 4% in China Alibaba Group Holding Ltd Cayman Islands 9.12 Tencent Hldg Ltd HK, China 8.66 Reliance Industries Ltd India 6.47 Taiwan Semiconducter Manuf Taiwan 5.85 Samsung Electronics Co. Ltd South Korea 5.23 LG Chem Ltd South Korea 5.06 BHP Group Ltd Australia 3.16 Techtronic Industries Co HK, China 2.69 Hong Kong Exchanges & Clearing HK, China 2.61 China Resources Land Ltd HK, China 2.35 Quite happy with the holdings allocations here, so I will keep holding unless US China starts going batsheep with each other causing the Asian market to react violently. |

|

|

Sep 3 2020, 02:24 PM Sep 3 2020, 02:24 PM

Return to original view | IPv6 | Post

#35

|

Junior Member

152 posts Joined: Apr 2017 |

QUOTE(GrumpyNooby @ Sep 3 2020, 02:07 PM) If you follow Principal funds properly, actually Principal has changed Principal Asia Pacific Dynamic Income Fund mandate to become less aggressive by introducing Principal Asia Pacific Dynamic Growth Fund. Comparing both funds, Principal Asia Pacific Dynamic Growth fund has a higher volatility so you're correct that Principal Asia Pacific Dynamic Income Fund is a more steady dividend income fund.Therefore, you may want to lower the expecation for Principal Asia Pacific Dynamic Income Fund as it has now becomes like a dividend fund instead of growth fund whereby it pays out distribution almost every quarter. Correct me if I'm wrong. Btw, are more China focused funds aiming for growth? |

|

|

Sep 18 2020, 11:25 AM Sep 18 2020, 11:25 AM

Return to original view | IPv6 | Post

#36

|

Junior Member

152 posts Joined: Apr 2017 |

Sifu sifu, may I know the purpose of opening additional accounts in FSM?

|

|

|

Sep 18 2020, 12:33 PM Sep 18 2020, 12:33 PM

Return to original view | IPv6 | Post

#37

|

Junior Member

152 posts Joined: Apr 2017 |

QUOTE(MUM @ Sep 18 2020, 11:33 AM) just a quick one i can think of, maybe maybe this?, New Account Benefit 2.1 How to be entitled for new account benefit? All new account holder will be entitled for new account benefit. Existing account holders who open additional accounts with us will also be eligible. 2.2 What benefit is associated with the new account? As a new account holder, you get to enjoy 1.00% maximum sales charge for all your transactions for the next 30 calendar days upon account activation. Normal FSMOne sales charge is 1.75%. https://www.fundsupermart.com.my/fsmone/fun...Account-Benefit |

|

|

Sep 30 2020, 03:44 PM Sep 30 2020, 03:44 PM

Return to original view | IPv6 | Post

#38

|

Junior Member

152 posts Joined: Apr 2017 |

|

|

|

Oct 6 2020, 01:56 PM Oct 6 2020, 01:56 PM

Return to original view | IPv6 | Post

#39

|

Junior Member

152 posts Joined: Apr 2017 |

Finally my Kenanga Growth Opportunities Fund has turned green.....

But for how long leh? |

|

|

Dec 3 2020, 02:14 PM Dec 3 2020, 02:14 PM

Return to original view | IPv6 | Post

#40

|

Junior Member

152 posts Joined: Apr 2017 |

QUOTE(whirlwind @ Dec 3 2020, 01:25 PM) It's like a roller coaster ride...gold fund was my highest gainer yesterday +3.4134 Still, this port remains in the red. I am in it for the long term but sometimes the head and the heart aren't on the same page. WhitE LighteR liked this post

|

| Change to: |  0.0577sec 0.0577sec

0.55 0.55

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 11th December 2025 - 02:01 AM |