QUOTE(yklooi @ Oct 21 2017, 08:06 PM)

someone did make a discussion regarding shifting of some % of profit or "over limits" whenever they feel it is "hot"

something sort of this....if I am not mistaken

if port has RM10 000

if M'sia is allocated 10% in the port = RM1000

is M'sia mkts made 20% rise = RM 200 + RM 1000 = RM1200

this 20% rise or RM200 is abt 2% of the port value

if keep this RM200 in the same fund......

every 10% continue rise or eventual fall of 10% of NAV will just affect 200 x 10% = RM 20

which will just affect 0.2% of the port value....

so the argument is that is it effective to just move the profit or over limits?

for if one really feels "hots",....shouldn't he move it out completely?

Yes, fund-houses when they compare re-balancing strategies they like to talk about period based vs. percentage based re-balancing. Vanguard for instance has many writings discussing portfolio re-balancing strategies.

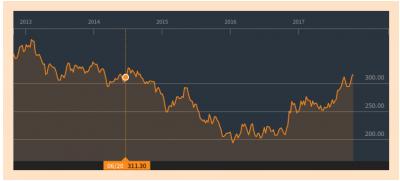

I like period based re-balancing, because I am rather 'lazy' and do not like to check my portfolio too often. When a bull charge has started, it will run with momentum for an extended period of time (otherwise it is not called a bull charge); and as Gary Shilling like to say: people react slowly to macro changes so when investors generally thing the market is in bull, they would keep investing for a rather extended period of time. So I would let a bullish part of my portfolio to run for 3 months, if the earning is good enough to justify a re-balancing, I would do. Otherwise, I let it run for another 3 months without doing anything now.

That's what I do, I am not saying percentage based re-balancing is bad. In fact, I do think it is a good strategy, even could be better than what I am doing.

Oct 21 2017, 12:17 AM

Oct 21 2017, 12:17 AM

Quote

Quote

0.6305sec

0.6305sec

0.34

0.34

7 queries

7 queries

GZIP Disabled

GZIP Disabled