Hi. What is vietnam fund listed as? I dont see any fundmanagers list in FSM

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Oct 31 2020, 07:41 PM Oct 31 2020, 07:41 PM

Return to original view | Post

#81

|

Junior Member

867 posts Joined: Feb 2017 |

Hi. What is vietnam fund listed as? I dont see any fundmanagers list in FSM

|

|

|

|

|

|

Nov 3 2020, 11:10 PM Nov 3 2020, 11:10 PM

Return to original view | Post

#82

|

Junior Member

867 posts Joined: Feb 2017 |

doesn US election will affect the local small cap fund too? Mind isn't moving alot, some dropped.

|

|

|

Nov 20 2020, 01:08 PM Nov 20 2020, 01:08 PM

Return to original view | IPv6 | Post

#83

|

Junior Member

867 posts Joined: Feb 2017 |

any health care fund managers? US region.

|

|

|

Nov 20 2020, 06:46 PM Nov 20 2020, 06:46 PM

Return to original view | IPv6 | Post

#84

|

Junior Member

867 posts Joined: Feb 2017 |

QUOTE(ironman16 @ Nov 20 2020, 03:56 PM) US region susah sikit la ya UT i mean. lol thanks alot!Global region easy.....United Global Healthcare Fund - Class A - MYR Acc (almost 70% US) https://www.fsmone.com.my/admin/buy/factshe...etMYUGHFMYR.pdf *** sorry, u mahu cari fund managers????? ingat mahu cari UT ..... |

|

|

Feb 24 2021, 06:22 PM Feb 24 2021, 06:22 PM

Return to original view | Post

#85

|

Junior Member

867 posts Joined: Feb 2017 |

Guys, I invested the Principal Asia Pacific Dynamic Income Fund - MYR.

At date I am having 18% return. Today I just say the SUPPLEMENTAL PROSPECTUS info in their announcement. Should I be worry? I read through all, not fully understand. |

|

|

Mar 1 2021, 06:19 PM Mar 1 2021, 06:19 PM

Return to original view | Post

#86

|

Junior Member

867 posts Joined: Feb 2017 |

whole china market down.

Buy more or hold? |

|

|

|

|

|

Mar 3 2021, 04:41 PM Mar 3 2021, 04:41 PM

Return to original view | Post

#87

|

Junior Member

867 posts Joined: Feb 2017 |

QUOTE(real55555 @ Mar 3 2021, 03:11 PM) Moving forward I think more and more people will go into platform like FSM instead of going through agents. But I can foresee some people will still need agent: sadly, many unscrupulous agents today especially the younger ones are tarnishing this career type, making everyone hate agents. and those honest agents face challenges to find customers. Remember when public Mutual came in big? 1. Those not tech savy like the uncle aunties now 2. Those have no financial knowledge to analyse, thus agent is like their saviour, giving them advice on which to invest etc This is why I stop using the agent when I found FSM or StashAway. So easy to switch funds, change strategy without contacting agents. The same goes for the insurance agent, simply sell an insurance plans without helping to access the buyer's profile, income, making consumer hate them when they burned their money. all just want big sales and fast money. Property agent will be the next, hoping to see a start-up introducing owner to buyer direct nego without the middle property agents. Still remember one property agent I had, took the ernest depo and never pick up my phone after. what I am trying to say is, consumers will be getting smarter looking for way to move into direct buying. FSM is like a library for meto study about every fund's info, types of funds, and options for me to choose to invest, which I don't think today's agent can do, they won't even bother to teach you. |

|

|

Mar 3 2021, 04:43 PM Mar 3 2021, 04:43 PM

Return to original view | Post

#88

|

Junior Member

867 posts Joined: Feb 2017 |

QUOTE(eenong89 @ Mar 3 2021, 03:13 PM) I believe there are some sort profit sharing agreement between those fund house and FSMone... that is why their sales charge are low~~~ of course they do, is like a marketplace platform like lazada and shopee. easy to access to many types of fund. Fund companies just need to list it, and FSM only take a small cut, to maintain their website and human resource for updating all information."I might not know what am I talking about" |

|

|

Mar 17 2021, 08:02 PM Mar 17 2021, 08:02 PM

Return to original view | Post

#89

|

Junior Member

867 posts Joined: Feb 2017 |

|

|

|

Mar 26 2021, 06:02 PM Mar 26 2021, 06:02 PM

Return to original view | Post

#90

|

Junior Member

867 posts Joined: Feb 2017 |

QUOTE(ganesh1696 @ Mar 26 2021, 10:44 AM) My updated portfolio following the "dip". last year i did well, roughly 18% return, my target was 9%Affin global disruptive innovation fund = 29.6% Affin Next gen tech fund = 12.1% Am china a shares myr hedged = 20% Interpac dana safi = 12.3% Principal greater china equity fund= 1% Rhb shariah china focus fund = 8.5% United malaysia fund= 16.5% Only interpac and United fund, is in green. Others are bleeding "unstoppable" . Almost every week I've top up my USA and CHINA funds to minimize my losses which drag me to "five digit" losses. But price fall is continuing with no sign of rebound. Almost losing hope with both regions' portfolio. But am still holding. Thinking of use ( i sinar) funds to top up and find some better opportunities. So much confused. How about your portfolio friends? now dip to 11%. i have no regret and not going to sell. afterall, the fund managers have responsibility to check and balance, and should be exploring more This is UT, play like stock market, we die, play with fear cannot do good. as long as fundamental history is in the up range, i don't think it will dip forever. most funds i have are able 1 year to 2 years, my target is 10 years. |

|

|

May 12 2021, 04:03 PM May 12 2021, 04:03 PM

Return to original view | Post

#91

|

Junior Member

867 posts Joined: Feb 2017 |

why all red color today

|

|

|

May 17 2021, 08:52 PM May 17 2021, 08:52 PM

Return to original view | Post

#92

|

Junior Member

867 posts Joined: Feb 2017 |

All red color. 🤣

|

|

|

Aug 19 2021, 02:56 PM Aug 19 2021, 02:56 PM

Return to original view | Post

#93

|

Junior Member

867 posts Joined: Feb 2017 |

daidragon12 liked this post

|

|

|

|

|

|

Aug 23 2021, 03:27 PM Aug 23 2021, 03:27 PM

Return to original view | Post

#94

|

Junior Member

867 posts Joined: Feb 2017 |

How many of you topping up China region?

Just want to feel the omph and kick to place more order. |

|

|

Aug 25 2021, 02:53 PM Aug 25 2021, 02:53 PM

Return to original view | Post

#95

|

Junior Member

867 posts Joined: Feb 2017 |

China rebound?

https://www.barrons.com/articles/alibaba-ch...cks-51629805966 Alibaba and Other Chinese Tech Stocks Are Rallying. Cathie Wood Is Back in the Game. Chinese tech stocks rallied early on Tuesday, as Alibaba, JD.com, and Tencent all made impressive gains and Cathie Wood’s ARK got back in the game. The sector, which has been under pressure recently due to a wide-ranging regulatory crackdown in China, enjoyed a sharp rebound as the regulatory outlook became clearer and investors looked for buying opportunities. One such investor was seemingly Cathie Wood, whose ARK Invest snapped up 164,889 of JD.com’s American depository receipts (ADRs). The company’s Hong Kong-listed shares soared 15% on Tuesday after second-quarter earnings beat expectations. The ADRs were close to 8% up in premarket trading. ARK’s largest fund, ARK Innovation, dumped almost all its Chinese stocks at the end of July as Beijing’s regulatory crackdown intensified. JD.com wasn’t the only name surging early on Tuesday, Alibaba stock was 5% higher in premarket trading, after the e-commerce giant’s Hong Kong shares rose 9.5%. Tencent stock climbed close to 9% in Hong Kong trading, while Baidu was 4% up in New York premarket trading. A promise by China’s central bank to keep monetary policy stable was also seemingly behind the rally. “The People’s Bank of China will keep monetary policy stable with a good cross-cyclical design and will support high-quality economic expansion with ‘appropriate money growth,'” the PBOC said in a statement late Monday. “We think the reversal in Hong Kong of 7% off lows, the general rise of Asian equities, the bounce back of 11% from Alibaba, and the soaring commodities prices, where iron ore was up 10% at one point overnight in Singapore… All can be linked back to that statement,” Andrew Brenner, head of international fixed income at NatAlliance Securities, said in a note. This post has been edited by Red_rustyjelly: Aug 25 2021, 02:54 PM |

|

|

Aug 26 2021, 04:27 PM Aug 26 2021, 04:27 PM

Return to original view | Post

#96

|

Junior Member

867 posts Joined: Feb 2017 |

QUOTE(jj_jz @ Aug 26 2021, 03:02 PM) just curious, when you mention about longer, the actual range is? no offence im new, just wonder how long would it takes to accumulate to 30% it depends how long u want to put and your target.High risk high return. but then you also need to see the fund performance over 1v3v5 years or even 10 years. don't play with emotion. alot of people make mistakes when it drops they sell quickly. |

|

|

Sep 7 2021, 01:54 PM Sep 7 2021, 01:54 PM

Return to original view | Post

#97

|

Junior Member

867 posts Joined: Feb 2017 |

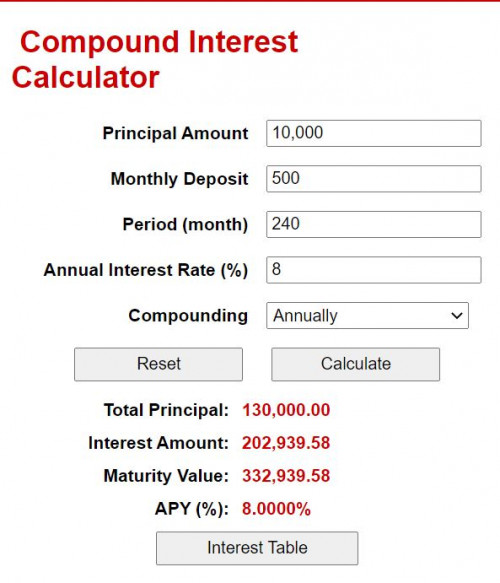

Just to share some investment strategies for children. in 2015 I started investing in Unit trust. My target was and is to generate 8-12% of return from few portfolios. Regardless of China/US/ Asia Pacific. And also to beat country inflation rate of 3-4% average. Assuming I put my principal amount of RM 10k into few good portfolios and a monthly depo of RM 300-500 for 20 years. This is the result. I would say enough for a good private University locally but for overseas education, I will require to use my own savings and other investment by then. Relying on EPF is not always the best option because after minus the inflation rate, we are only getting back 1-2% recently. So far, my target is on track. My second kid, I did the same. The only challenge I have is emotion, when the market is down I have to train myself from panic. and to look at bigger picture.  KingArthurVI, nike89, and 1 other liked this post

|

|

|

Sep 7 2021, 03:33 PM Sep 7 2021, 03:33 PM

Return to original view | Post

#98

|

Junior Member

867 posts Joined: Feb 2017 |

QUOTE(jj_jz @ Sep 7 2021, 02:19 PM) very good sharing, but just wonder from 2015 until latest right, did you managed to achieve the 8-12% every year? I didn't do well in 2018, but if I average out each year yes. For example, if you look at Eastspring Dinasti out from the 5 years, if you divide it will be around 17%. But my other port folio will need to do the average out performance to the value around 8-12% window. So selecting the right fund is crucial, and also know when to exit, or enter. Can't say I am 100% right. But the setting of dividends should be at least at a realistic level. anything that has 15% over return is considered a bonus to overcome any shortcoming like 2018 year. |

|

|

Sep 8 2021, 02:35 PM Sep 8 2021, 02:35 PM

Return to original view | Post

#99

|

Junior Member

867 posts Joined: Feb 2017 |

QUOTE(2387581 @ Sep 8 2021, 10:29 AM) Hard to have that kind of mentality QUOTE(cempedaklife @ Sep 8 2021, 11:48 AM) thank you for sharing. Wish I can reverse back 10-15 years ago. if not today, the return and capital appreciation could be more.i was hotheaded, and hence, i make a lost in my investments. now my thinking become uncle. i don't want to aim for myself, but for my kids. so similar with your line of thought. and it make me more peaceful and view investment as a longer term thingy. But i sure done a lot of mistakes in the past myself, panic sell, listen to wind too much and etc. |

|

|

Sep 11 2021, 06:31 PM Sep 11 2021, 06:31 PM

Return to original view | Post

#100

|

Junior Member

867 posts Joined: Feb 2017 |

QUOTE(YoungMan @ Sep 11 2021, 02:48 PM) at the beginner level, I was looking at forums, social media groups, friends.At a later stage, I start to realize News like recently China imposing game regulations that will be the biggest threat for Tencent group. Or previously China scrutinize Alibaba Jack ma, but that was long ago. All this news is the key point to determine when is the best time to buy for me. If I want to buy Malaysian small cap, i will look at the direction of Malaysian situation. Like when they will re-open parliament. or when is the MCO relaxation, which means business come back. I am also constantly looking at health funds, like United Global Healthcare Fund, because the world now in Pandemic, health sector will boost. I can be wrong. I am still learning. jj_jz liked this post

|

| Change to: |  0.0858sec 0.0858sec

0.55 0.55

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 08:05 PM |