QUOTE(viktorherald @ Oct 13 2020, 05:48 PM)

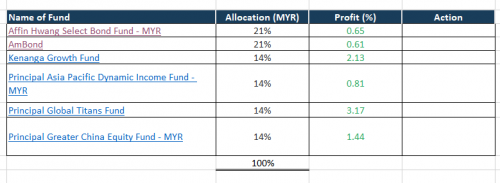

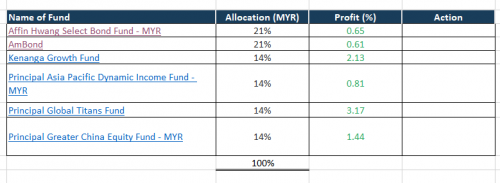

My current allocation, i did contact with their advisor and this is the fund that he recommend to me.

I consider my self a moderately risk person

i did read the individual funds, but lets just say.. i didnt put too much thinking to it

i just feel that this is quite diverse in regionality, previously some fund dip into reds and now had all recovered

Anyone have good insights to offer?

Mine kinda similar with yours 👍

Kinda high risk, focusing on equity to maximize profit

All through EPF

15% affin hwang select asia (ex japan) balanced fund

15% eastspring investments small-cap fund

15% principal islamic asia pacific dynamic equity fund

15% principal global titans fund

40% principal greater china equity fund

Sep 8 2020, 09:40 AM

Sep 8 2020, 09:40 AM

Quote

Quote.gif)

0.0656sec

0.0656sec

0.31

0.31

7 queries

7 queries

GZIP Disabled

GZIP Disabled