Outline ·

[ Standard ] ·

Linear+

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

whirlwind

|

Nov 9 2020, 11:04 AM Nov 9 2020, 11:04 AM

|

|

QUOTE(backspace66 @ Nov 9 2020, 10:13 AM) That is sales charge ,switching fee is not zero. Nevermind , i am just trying to give info. If dont want to believe or think you know better it is up to you. I just wanna share what is written on the switching fee. Not trying to prove anything here. In terms of knowledge I’m a newbie. Yup it’s not zero but there’s a value of RM100 written there. “You will be charged a Switching Fee equal to the difference between the application fees of two funds/classes. You will not be charged if the fund/class to be switched into has a lower application fee. The Manager may impose RM100 administrative fee for every switch made out of a fund/class” |

|

|

|

|

|

whirlwind

|

Nov 9 2020, 11:08 AM Nov 9 2020, 11:08 AM

|

|

QUOTE(WhitE LighteR @ Nov 9 2020, 09:58 AM) happy or not see the market pop up this few days, after like 2 months of going sideways?  Do you think Malaysia market also going up? Was checking out Hong Leong Dana Makmur fund and I realize there’s a little bit more fund in my epf to invest. Or I should get RHB Islamic Global Developed Markets Fund? |

|

|

|

|

|

whirlwind

|

Nov 9 2020, 11:21 AM Nov 9 2020, 11:21 AM

|

|

QUOTE(MUM @ Nov 9 2020, 11:17 AM) i think it is better to first try to see what you lacking in your overall composition required in your UT portfolio? this Hong Leong Dana Makmur is a Malaysia Mid/Small-cap while the other is Global Developed Markets. what is lacking in your personally desired UT portfolio and it % of allocation? For Malaysia market i have Eastspring Small Cap and for global market I already switched out my Principal Global Titans |

|

|

|

|

|

whirlwind

|

Nov 9 2020, 11:38 AM Nov 9 2020, 11:38 AM

|

|

QUOTE(MUM @ Nov 9 2020, 11:27 AM) since you have switched out Principal Global Titans, so now the final composition in your port is EXCLUDE global developed markets? if you do not intend to have Developed Market in your UT portfolio, then do take NOT the Global Developed Markets as you posted earlier since you have Eastspring Small cap in you current portfolio, is the % to be allocated in your current portfolio is already full with this Eastspring Small cap fund? if YES, don't take in that Hong leong Dana Makmur, if NOT yet full, then can still take it in till your desired % filled for the Small cap sector QUOTE(WhitE LighteR @ Nov 9 2020, 11:27 AM) I am in favor of Malaysia small cap. I kept about 10-15% exposure to Malaysia fund. I don't foresee any reason for Malaysia small cap to slowdown. Be reminded however, this kind of funds can have very high volatility. I didn’t know Eastspring Small Cap and Hong Leong Dana Makmur is in the same category then I would go for RHB Global Developed Market |

|

|

|

|

|

whirlwind

|

Nov 9 2020, 12:45 PM Nov 9 2020, 12:45 PM

|

|

QUOTE(MUM @ Nov 9 2020, 11:42 AM) it is better for you to check the prospectus of that hong leong fund and its composition...then compare it with Eastspring one...to confirm whether they are the same or about the same or exactly the same category, then determine if in your mind, they can be classified under the same or it will be accepted to be classified to be the same with slight acceptable % of variance btw, you just switched out of one global one and now wanted to go in another global one? Thanks for the info Yup, switched out because was worried of us stocks meltdown due to the election. Since Biden won and so far everywhere looks green, wanna go in back. Anyway RHB Global looks better than Principal Global |

|

|

|

|

|

whirlwind

|

Nov 9 2020, 01:12 PM Nov 9 2020, 01:12 PM

|

|

QUOTE(WhitE LighteR @ Nov 9 2020, 01:04 PM) Don't go in and out like that. Getting the correct re-entry will be a problem as well as the need to pay more sales charges. Think of your portfolio as a whole rather than its individual components only. I thought since epf no sales charge, I’ll take the advantage to go in. I’ll just have to be mindful on my switching and be more patience in the future. Since my portfolio do not have any US allocation, I should add for diversification |

|

|

|

|

|

whirlwind

|

Nov 9 2020, 01:33 PM Nov 9 2020, 01:33 PM

|

|

QUOTE(WhitE LighteR @ Nov 9 2020, 01:31 PM) yes, in epf case, no sales charge. so just be mindful when u think of switching. dont try to time any event. human is a terrible predictor of the future. Yup, learned my lesson with a 5% losses through my Principal Global Titan Fund |

|

|

|

|

|

whirlwind

|

Nov 9 2020, 01:43 PM Nov 9 2020, 01:43 PM

|

|

QUOTE(GrumpyNooby @ Nov 9 2020, 01:36 PM) That is not only losses you incurred right? Are you the one who also panicked with AmPrecious Metal? Yup, you still remembered That was my 1st mistake Assuming that gold will continue to climb to 3k Silly me 🤦♂️ |

|

|

|

|

|

whirlwind

|

Nov 9 2020, 01:48 PM Nov 9 2020, 01:48 PM

|

|

QUOTE(WhitE LighteR @ Nov 9 2020, 01:38 PM) try keep things in a balance between different regions. they tend to perform slightly offset from one another from time to time. that is when u can see your diversification working. i aim to keeps roughly 2x% GC, 2x% China, 2x% US, 1x% Malaysia, 1x% Gold, 2x% cash actual percentage fluctutate from month to month. but the idea is to keep everything balance with respect to each other. How about AP? Not a good choice for region? AP = GC? I have 2 funds under AP (Asia Pacific) |

|

|

|

|

|

whirlwind

|

Nov 9 2020, 01:51 PM Nov 9 2020, 01:51 PM

|

|

QUOTE(WhitE LighteR @ Nov 9 2020, 01:48 PM) its still possible. the key is dont try to time it. if u have confidence of the fund performance. just let it be. thats why u see sometimes some members here log off and dont see their account for months on end. its because they knew if they look at it, the emotion will cause them to do some silly mistake. but not means u dont monitor your portfolio at all. look at it every quartly at least. This is a very good idea but I just can’t stop looking at them everyday 😥 Wanting to learn how to choose and invest in UT through epf so that when I really have cash in hand, I can also invest in FSM |

|

|

|

|

|

whirlwind

|

Nov 10 2020, 02:38 AM Nov 10 2020, 02:38 AM

|

|

Vaccine news catapults investors' economic-recovery bets https://www.theedgemarkets.com/article/vacc...icrecovery-betsVaccine with 90% effective rate 👍 Gold sliding down This post has been edited by whirlwind: Nov 10 2020, 02:45 AM |

|

|

|

|

|

whirlwind

|

Nov 10 2020, 08:45 AM Nov 10 2020, 08:45 AM

|

|

QUOTE(GrumpyNooby @ Nov 10 2020, 08:29 AM) Want to go into AmPrecious Metal?  Phobia with precious metal 1st mistake was the hardest to swallow My gut feeling says the gold won’t hit above 2k since vaccine is just around the corner Us stocks went up but the tech stocks went down. Wonder what will happen to principal global Titan/RHB Islamic global Developed Market This post has been edited by whirlwind: Nov 10 2020, 08:46 AM |

|

|

|

|

|

whirlwind

|

Nov 10 2020, 04:17 PM Nov 10 2020, 04:17 PM

|

|

QUOTE(GrumpyNooby @ Nov 10 2020, 04:09 PM) I got MYR only and purchased the MYR version without hedging. May I know the definition of hedging? By the way KLCI went up so much Normally which fund will be affected? |

|

|

|

|

|

whirlwind

|

Nov 10 2020, 06:22 PM Nov 10 2020, 06:22 PM

|

|

QUOTE(GrumpyNooby @ Nov 10 2020, 05:23 PM) How This Medium-Risk Unit Trust Fund Generated 81.90% Returns In A Recession https://ringgitplus.com/en/blog/sponsored/h...6w3-jgvNzk2T_uQ https://ringgitplus.com/en/blog/sponsored/h...6w3-jgvNzk2T_uQThe United Malaysia Fund is just one of several unit trust funds managed by UOBAM. Visit UOBAM Malaysia’s website to learn more about UOBAM Malaysia and its high-performing United Malaysia Fund (UMF). The UMF’s prospectus and disclosure sheets can be accessed here. Fund link: http://www.uobam.com.my/our-funds/funds-de...arid=F000013SW8 I didn’t know glove is under health care sectors. All the while I thought it’s under industrial sector. |

|

|

|

|

|

whirlwind

|

Nov 10 2020, 09:54 PM Nov 10 2020, 09:54 PM

|

|

QUOTE(GrumpyNooby @ Nov 10 2020, 06:24 PM) All the famous glove counters are grouped under Health Care sector in Bursa Malaysia. You can see this in the share trading platform (if you have).  🤔 I’m predicting pharmaceutical companies gonna go up trend while gloves companies gonna go down trend but if both under healthcare then my plan to focus on healthcare sector will be halt |

|

|

|

|

|

whirlwind

|

Nov 11 2020, 01:29 AM Nov 11 2020, 01:29 AM

|

|

QUOTE(ericlaiys @ Nov 10 2020, 11:35 PM) based onhttps://www.fsmone.com.my/admin/buy/factsheet/factsheetMYUGHFMYR.pdf , dont see any glove listed. Confirm or not it got gloves as it is suicide mission if got. Can see from today share market on gloves. updated- sorry. misunderstanding. they are discussed about United Malaysia Fund. please ignore my question above I think my concern will be on the Malaysia Funds under epf list. While other region might not be the case |

|

|

|

|

|

whirlwind

|

Nov 11 2020, 12:31 PM Nov 11 2020, 12:31 PM

|

|

sifus, how to check which funds focusing on banks?

Financial allocation?

Any example?

This post has been edited by whirlwind: Nov 11 2020, 12:39 PM

|

|

|

|

|

|

whirlwind

|

Nov 11 2020, 12:35 PM Nov 11 2020, 12:35 PM

|

|

China tech selloff swells to US$200b on antitrust rules https://www.theedgemarkets.com/article/chin...antitrust-rulesChina stocks gonna drop right? |

|

|

|

|

|

whirlwind

|

Nov 11 2020, 01:32 PM Nov 11 2020, 01:32 PM

|

|

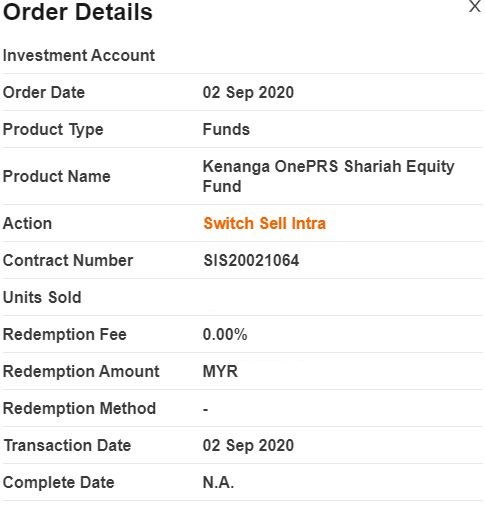

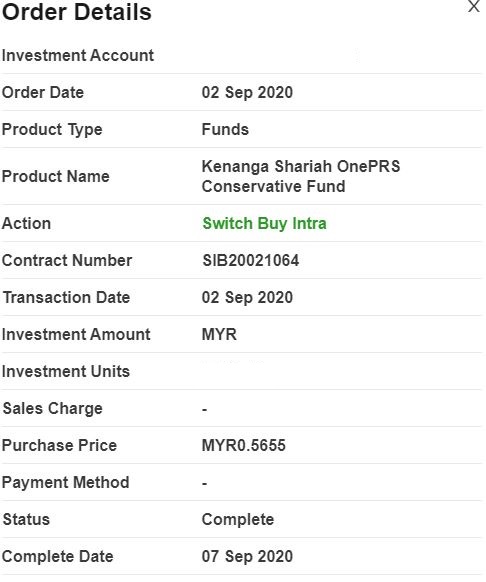

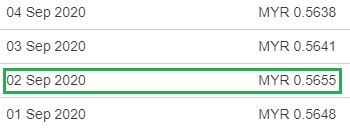

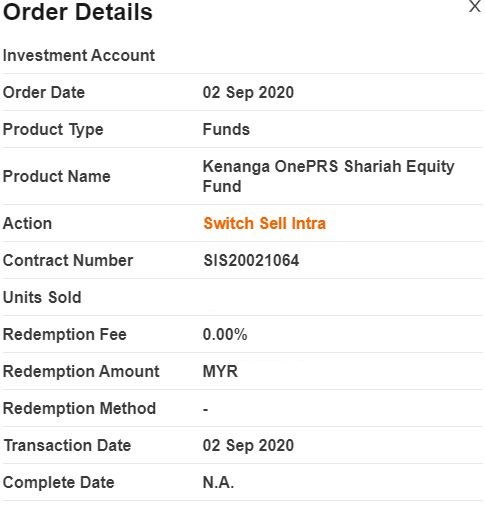

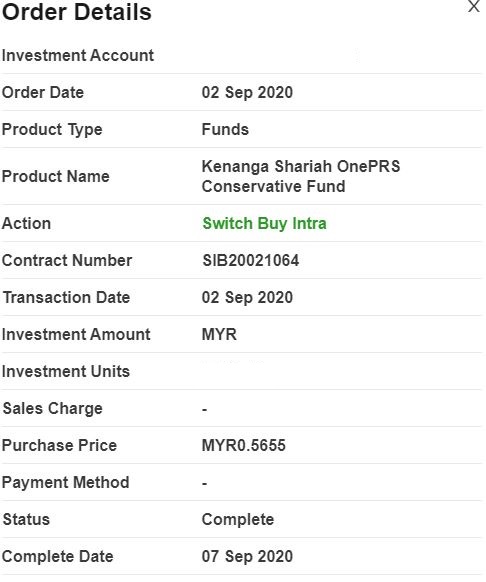

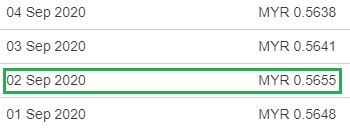

QUOTE(GrumpyNooby @ Nov 11 2020, 11:03 AM) I got example for PRS only: A. Switch out  B. Switch in   To which fund? Can share? To Principal Asia Pacific Dynamic Income Fund - MYRLooks like a better fund compare to principal islamic asia pacific dynamic equity fund More balanced with a good percentage of financial sector. I’ll consider switching this too. Hehehe |

|

|

|

|

|

whirlwind

|

Nov 11 2020, 06:19 PM Nov 11 2020, 06:19 PM

|

|

Wah! Principal Greater China drop 5% 😱

|

|

|

|

|

Nov 9 2020, 11:04 AM

Nov 9 2020, 11:04 AM

Quote

Quote

0.0625sec

0.0625sec

0.18

0.18

7 queries

7 queries

GZIP Disabled

GZIP Disabled