Outline ·

[ Standard ] ·

Linear+

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

xcxa23

|

Oct 7 2020, 11:43 AM Oct 7 2020, 11:43 AM

|

|

personal opinion and observation

be caution if wanting to invest in china

potus most likely will hit china hard due to

''reported'' losing popularity

deficit in trade widen

china does not trade as much as per last agreed deal

|

|

|

|

|

|

xcxa23

|

Nov 1 2020, 09:01 AM Nov 1 2020, 09:01 AM

|

|

nope, mine still at 1.25%

|

|

|

|

|

|

xcxa23

|

Nov 1 2020, 11:34 AM Nov 1 2020, 11:34 AM

|

|

QUOTE(Amanda85 @ Nov 1 2020, 09:46 AM) i am silver too but my last transaction on 30/10 was 1.5% looks like the offer only 1.75 to 1.50 macam not fair to others categories  |

|

|

|

|

|

xcxa23

|

Nov 1 2020, 03:18 PM Nov 1 2020, 03:18 PM

|

|

QUOTE(WhitE LighteR @ Nov 1 2020, 12:16 PM) Probably did so to shut up all those that says eut min charge is 1.5% ahh.. i see lets see if eut fight back |

|

|

|

|

|

xcxa23

|

Nov 11 2020, 06:43 PM Nov 11 2020, 06:43 PM

|

|

QUOTE(whirlwind @ Nov 11 2020, 06:19 PM) Wah! Principal Greater China drop 5% 😱 dayum.. wipe out approximately 8k of gain  |

|

|

|

|

|

xcxa23

|

Nov 11 2020, 08:49 PM Nov 11 2020, 08:49 PM

|

|

QUOTE(whirlwind @ Nov 11 2020, 07:44 PM) Hopefully the rebound is even better 🙏 definitely, im gonna pump in more money, but too bad money only can reach on fri. QUOTE(polarzbearz @ Nov 11 2020, 08:10 PM) 5% drop for -8k. Portfolio must be huge  Jokes aside - just ride with the flow. Maybe can top up  I just topped up my China Tech exposure given the recent shock (but not via FSM, I only do ETF now.)  i have been dca consistently since 3 years ago, imo the amount should be sizeable. but of course there's alot silent reader here 5x or even 100x bigger than mine. im topping up for sure but had to wait until friday  |

|

|

|

|

|

xcxa23

|

Nov 30 2020, 11:54 AM Nov 30 2020, 11:54 AM

|

|

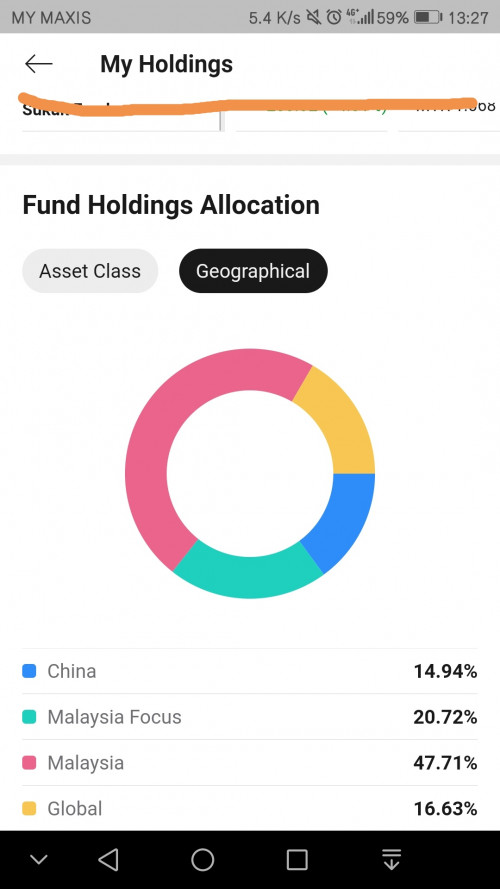

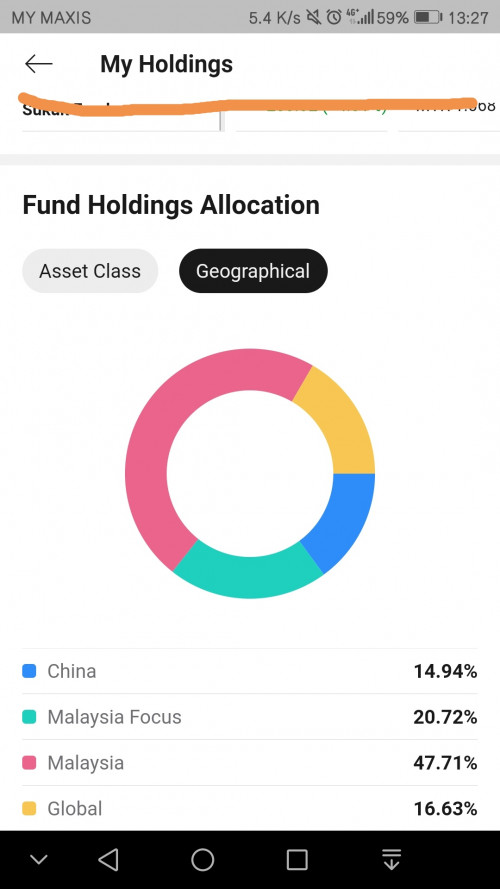

|

|

|

|

|

|

xcxa23

|

Dec 10 2020, 04:27 PM Dec 10 2020, 04:27 PM

|

|

QUOTE(GrumpyNooby @ Dec 10 2020, 03:26 PM) Anything should we be worry for? AmanahRaya's fund management inefficient, in deficit from 2008 to 2019 — Auditor-General's ReportKUALA LUMPUR (Dec 10): AmanahRaya Bhd’s fund management was found to be inefficient as the fund had experienced a deficit from 2008 to 2019, according to the Auditor-General's Report (LKAN) 2019 Series 1. The report, which was tabled in Parliament today, concluded that the current year's net income could not cover the total income distribution, and the investment performance of the Kumpulan Wang Bersama (KWB) was also inefficient. However, it noted that AmanahRaya has been making efforts towards the recovery of the KWB fund starting from 2019. “AmanahRaya needs to depend on the government's guarantee for its inability to perform as a trustee to cover the KWB fund deficit of RM1.02 billion when there is a demand," it said. https://www.theedgemarkets.com/article/aman...generals-reportWas tempted to buy in But... Definitely will avoid such fund |

|

|

|

|

|

xcxa23

|

Dec 18 2020, 02:13 PM Dec 18 2020, 02:13 PM

|

|

QUOTE(killdavid @ Dec 18 2020, 12:22 PM) Many investors fleeing US bonds. There is a sense of feeling that bubble will burst is it? https://www.reuters.com/article/us-swf-mark...s-idUSKBN27Y1PKSovereign wealth funds pulled $4.1 billion from United States stocks in the third quarter, while adding to their U.S. bond holdings by the most in at least three years, data showed on Wednesday. |

|

|

|

|

|

xcxa23

|

Dec 18 2020, 03:55 PM Dec 18 2020, 03:55 PM

|

|

QUOTE(killdavid @ Dec 18 2020, 03:12 PM) “The goal was to restore liquidity to the credit markets,” Yardeni said. “They are clearly functioning well again. If the Fed persists in flooding the markets with liquidity, the risk is that the Fed will create the greatest financial bubble of all times.” https://www.cnbc.com/2020/06/22/the-feds-co...bble-fears.htmlFeds pumping money into bonds and ETFs to prop up the economy. They are pumping money into companies that are walking dead. Do take note of another new stimulus package soon to be approved. More money printed Bond yields are damn low, and USD going to lose value. If you hold US bonds in USD denominations .....run. this was reported on june but the link i posted is november. its no secret that US fed are pumping unlimited QE during the crash, but latest statement from Powell mentioned they indented to support their market thru QE. nope. i dont own any bond. ETF's and US stock  This post has been edited by xcxa23: Dec 18 2020, 03:57 PM This post has been edited by xcxa23: Dec 18 2020, 03:57 PM |

|

|

|

|

|

xcxa23

|

Dec 28 2020, 05:22 PM Dec 28 2020, 05:22 PM

|

|

QUOTE(killdavid @ Dec 18 2020, 12:22 PM) Many investors fleeing US bonds. There is a sense of feeling that bubble will burst just to add on where the money/investor might go to Record-Shattering Flows Into Stock ETFs Leave Bond Funds in Dust https://www.bloomberg.com/news/articles/202...d-funds-in-dustThis post has been edited by xcxa23: Dec 28 2020, 05:27 PM |

|

|

|

|

|

xcxa23

|

Dec 28 2020, 06:38 PM Dec 28 2020, 06:38 PM

|

|

QUOTE(killdavid @ Dec 28 2020, 05:47 PM) Like i said when everyone is doing it, then you have to be really scared. The big investment managers might rotate leaving retail investors in the dust. Remember late 2018. late 2018, as in dec 2018? lol the tariff man  https://www.washingtonpost.com/graphics/201...20as%20of%20Dec https://www.washingtonpost.com/graphics/201...20as%20of%20Dec. this might shed some light what caused the dip tho, most dip happen throughout 2016 to late 2019 is due to trump, specifically trade war you are scared now? what you do to protect yourself when the crash come? |

|

|

|

|

|

xcxa23

|

Jan 5 2021, 06:37 PM Jan 5 2021, 06:37 PM

|

|

QUOTE(whirlwind @ Jan 5 2021, 02:30 PM) Time to plan for rebalancing. Probably reduce Greater China and increase Asia or Global 😱 Hopefully global healthcare stocks still got potential 🤞 i am increasing portfolio on china instead  |

|

|

|

|

|

xcxa23

|

Jan 13 2021, 11:36 AM Jan 13 2021, 11:36 AM

|

|

QUOTE(ganesh1696 @ Jan 13 2021, 07:26 AM) Hi guys Can I expect my MALAYSIA based portfolio will face a slight pullback in NAV (price) as MCO and EMERGENCY declared? Hopefully I will pump in more during fall in prices. Expecting all the unit trust prices' will fall to the worst by FRIDAY. How about your opinion guys?  going abit extreme go to the factsheet look for top holdings do some analysis This post has been edited by xcxa23: Jan 13 2021, 11:36 AM |

|

|

|

|

|

xcxa23

|

Jan 14 2021, 07:25 AM Jan 14 2021, 07:25 AM

|

|

QUOTE(ky33li @ Jan 13 2021, 09:30 PM) This week china funds perform but Amchina outperform all china funds. if you buy in December 2020 you will achieve >15% return already. yup and i am expecting it to rally until CNY... been adding position into china fund since last year |

|

|

|

|

|

xcxa23

|

Jan 14 2021, 10:10 AM Jan 14 2021, 10:10 AM

|

|

QUOTE(ky33li @ Jan 14 2021, 09:14 AM) I am of the view that China will be the fastest to recover if vaccine works! Who is willing to spend and travel if none other than the Chinese? So if there is dip in China funds can consider topping up. Internally China has also been recovering also and not to mention it has 1 billion population to drive the growth. Same view.. that's why been increasing china possition since last year.. I just sell off underperforming fund and currently waiting for the money to settle.. Damn.. time for completion 19th of January.. |

|

|

|

|

|

xcxa23

|

Jan 14 2021, 10:45 AM Jan 14 2021, 10:45 AM

|

|

QUOTE(lee82gx @ Jan 14 2021, 10:33 AM) Just go for ETF. Low fees and you can see the live value ticking until you fall asleep tired. I took it 1 step further, full liquidate Malaysia funds and was in process of liquidating Principal Asia Pac Dynamic income fund too. Was wanting to follow uncle Xuzen for KAF Tactical, but gonna hold back due to MCO2.0 For Malaysia, my view probably small rally until August. Hence I'm still holding kgo. Not gonna top up since myself also actively trading in bursa Based on my knowledge, as of now the performing UT that heavily in HK are Principal Asia Pacific Dynamic Income. So I'm still holding with monthly DCA. |

|

|

|

|

|

xcxa23

|

Jan 14 2021, 12:01 PM Jan 14 2021, 12:01 PM

|

|

QUOTE(ky33li @ Jan 14 2021, 11:15 AM) Just to show you Principal Asia Dynamic Income Fund is worst performing fund in FSM Singapore for past one month.

but the total return higher than its SGD peer  and here's the annualised return  This post has been edited by xcxa23: Jan 14 2021, 12:03 PM

This post has been edited by xcxa23: Jan 14 2021, 12:03 PM |

|

|

|

|

|

xcxa23

|

Jan 14 2021, 12:10 PM Jan 14 2021, 12:10 PM

|

|

QUOTE(lee82gx @ Jan 14 2021, 10:55 AM) Ya, but it was lagging behind behind its peers (Affin Hwang Asia Pac opportunity). Recently bounced a bit harder, so I am switching to lock in my profit so to speak. affin hwang quite heavily in china and us, total about 57% since i already have position in US and china so im still holding asia pacific dynamic income i believe affin hwang outperforming asia pacific heavily due their allocation in china and usa since both of them have been rallying

|

|

|

|

|

|

xcxa23

|

Jan 16 2021, 09:34 PM Jan 16 2021, 09:34 PM

|

|

QUOTE(killdavid @ Jan 16 2021, 08:56 PM) On thing that caught my eye, 21% in semiconductor industry. You need to have the stomach for that. with talks of tech burst soon imo, pretty good diversification towards clean energy high chance the future trend will be clean energy. as the world two biggest powerhouse heavily focusing in green energy, we might see bull run in those sector i am pretty sure semiconductor will play an important role |

|

|

|

|

Oct 7 2020, 11:43 AM

Oct 7 2020, 11:43 AM

Quote

Quote

0.0575sec

0.0575sec

0.48

0.48

7 queries

7 queries

GZIP Disabled

GZIP Disabled