QUOTE(killdavid @ Feb 27 2021, 09:57 AM)

Bank run !https://www.theedgemarkets.com/article/amba...db-transactions

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Feb 27 2021, 09:59 AM Feb 27 2021, 09:59 AM

Return to original view | IPv6 | Post

#41

|

Senior Member

1,377 posts Joined: Aug 2009 |

QUOTE(killdavid @ Feb 27 2021, 09:57 AM) Bank run !https://www.theedgemarkets.com/article/amba...db-transactions |

|

|

|

|

|

Mar 1 2021, 10:13 PM Mar 1 2021, 10:13 PM

Return to original view | Post

#42

|

Senior Member

1,377 posts Joined: Aug 2009 |

|

|

|

Mar 1 2021, 10:14 PM Mar 1 2021, 10:14 PM

Return to original view | Post

#43

|

Senior Member

1,377 posts Joined: Aug 2009 |

|

|

|

Mar 2 2021, 01:06 PM Mar 2 2021, 01:06 PM

Return to original view | IPv6 | Post

#44

|

Senior Member

1,377 posts Joined: Aug 2009 |

Bila promo, you know something is coming

|

|

|

Mar 5 2021, 03:31 PM Mar 5 2021, 03:31 PM

Return to original view | IPv6 | Post

#45

|

Senior Member

1,377 posts Joined: Aug 2009 |

|

|

|

Mar 17 2021, 03:22 PM Mar 17 2021, 03:22 PM

Return to original view | IPv6 | Post

#46

|

Senior Member

1,377 posts Joined: Aug 2009 |

|

|

|

|

|

|

Mar 23 2021, 09:25 PM Mar 23 2021, 09:25 PM

Return to original view | Post

#47

|

Senior Member

1,377 posts Joined: Aug 2009 |

|

|

|

Mar 23 2021, 09:27 PM Mar 23 2021, 09:27 PM

Return to original view | Post

#48

|

Senior Member

1,377 posts Joined: Aug 2009 |

QUOTE(T231H @ Mar 23 2021, 07:18 PM) just a note for those holding any of these Bond funds.... Winner is rhb as usual. Top fixed income guy failed but still getting Lipper awardsDowngrade of MEX I Capital Sukuk On 19 March 2021, RAM Ratings downgraded MEX I Capital Bhd’s RM1.35 billion Sukuk Musharakah (2014/2031) by 8 notches to C3 (which is one notch above Default) from BB1 due to the company’s continued liquidity problems and increased default risk due to lower Maju Expressway (MEX) traffic volumes and delays in the restructuring exercise. iFAST Research Team 23 Mar 2021 https://www.fsmone.com.my/funds/research/ar...sukuk?src=funds yklooi liked this post

|

|

|

Apr 1 2021, 11:33 PM Apr 1 2021, 11:33 PM

Return to original view | Post

#49

|

Senior Member

1,377 posts Joined: Aug 2009 |

QUOTE(yklooi @ Apr 1 2021, 11:24 PM) The S&P 500 shoots above 4,000 points for the first time ever Yield been low for 10 years. It’s acceptable to raise it.https://edition.cnn.com/2021/04/01/investin...ints/index.html April has historically been a strong month for US stocks. They've closed higher during the month 14 out of the past 15 years, according to LPL Financial market strategist Ryan Detrick. Inflation is good for property. |

|

|

Apr 1 2021, 11:57 PM Apr 1 2021, 11:57 PM

Return to original view | Post

#50

|

Senior Member

1,377 posts Joined: Aug 2009 |

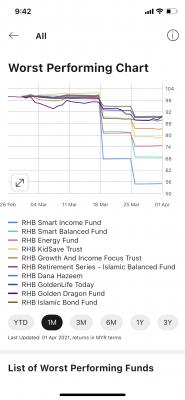

QUOTE(ChessRook @ Mar 31 2021, 12:03 AM) Anyone know what happen to RHB islamic bond fund? YTD is -11.04%. I don’t think it is income distribution as the past few years distribution is in September. Any of its bond holdings has problems? Their infamous award winning cio invested in Mex II bonds.Now a junk bond. |

|

|

Apr 2 2021, 07:46 AM Apr 2 2021, 07:46 AM

Return to original view | IPv6 | Post

#51

|

Senior Member

1,377 posts Joined: Aug 2009 |

QUOTE(ChessRook @ Apr 2 2021, 07:11 AM) There are also more rhb bond funds that are affected by MEX II. Anyway, I disinvest all my rhb islamic bonds. I just have to cut my losses. Aiyah, luckily my investments are not much. Yes, I Suspect they did rebalancing and spread to other funds. Avoid rhb at all cost for now. Cut loss |

|

|

Apr 3 2021, 09:44 PM Apr 3 2021, 09:44 PM

Return to original view | Post

#52

|

Senior Member

1,377 posts Joined: Aug 2009 |

QUOTE(izzudrecoba @ Apr 3 2021, 04:54 PM) Just invested in stocks - technology company - via FSMOne. Already recorded 6.3% ROI in two days. Grateful Just don’t invest in RHB UT. See attachA steep learning curve - still need to understand stocks fundamental as compared to UT. Happy to know that FSM supplemented articles under "Stocks & ETFs Ideas' on their website / app Attached thumbnail(s)

|

|

|

Apr 4 2021, 08:41 PM Apr 4 2021, 08:41 PM

Return to original view | IPv6 | Post

#53

|

Senior Member

1,377 posts Joined: Aug 2009 |

QUOTE(WhitE LighteR @ Apr 4 2021, 12:21 AM) Terrible. What kind of fund manager is this. This looks more like a scam than a proper fund with this kind of concentration. Look like fund manager helping “someone” by buying a lot of it. Don’t play play. Rhb fixed income cio Micheal no 1 in the industry . Dapat awards |

|

|

|

|

|

Apr 4 2021, 08:42 PM Apr 4 2021, 08:42 PM

Return to original view | IPv6 | Post

#54

|

Senior Member

1,377 posts Joined: Aug 2009 |

QUOTE(killdavid @ Apr 3 2021, 10:18 PM) Proper term is call “feeder fund” TOS liked this post

|

|

|

Apr 21 2021, 09:34 AM Apr 21 2021, 09:34 AM

Return to original view | IPv6 | Post

#55

|

Senior Member

1,377 posts Joined: Aug 2009 |

More bad news for those funds holding this junk bond

https://www.theedgemarkets.com/article/high...-coupon-payment |

|

|

Apr 27 2021, 09:12 PM Apr 27 2021, 09:12 PM

Return to original view | Post

#56

|

Senior Member

1,377 posts Joined: Aug 2009 |

|

|

|

May 4 2021, 10:15 PM May 4 2021, 10:15 PM

Return to original view | Post

#57

|

Senior Member

1,377 posts Joined: Aug 2009 |

QUOTE(ChessRook @ Apr 28 2021, 03:32 PM) I wish what you say is 100% true. I got this two bond funds from R**; R** bond fund and R** Islamic bond fund which has increasing exposure to this Maju Holdings and the MEX project. First in 2019 from Bright Focus bonds, then, 2020 and again 2021 from MEX downgrade. Is it too much to expect UT funds to diversify? My bond funds are causing me more problems than my equity funds Rhb la tuI have since disinvest all my bond holdings from R** bond funds in Mar. |

|

|

May 20 2021, 05:49 PM May 20 2021, 05:49 PM

Return to original view | Post

#58

|

Senior Member

1,377 posts Joined: Aug 2009 |

QUOTE(yklooi @ May 18 2021, 09:59 AM) I think a fund manager will die die hv to be bullish abt his/her fund.... Just wonder what would happens if they publicly displayed their doubt? https://www.smartinvestor.com.my/recognitio...uit-for-rhb-am/Some are abit more indirect by saying, We are in a defensive mode, stacking cash to buy more on dips or opportunity.... Ha-ha. See talk cock. If face to face ask her mex2 next time. |

|

|

Jun 3 2021, 12:39 PM Jun 3 2021, 12:39 PM

Return to original view | Post

#59

|

Senior Member

1,377 posts Joined: Aug 2009 |

All up except public mutual funds

|

|

|

Jun 22 2021, 12:31 AM Jun 22 2021, 12:31 AM

Return to original view | Post

#60

|

Senior Member

1,377 posts Joined: Aug 2009 |

QUOTE(backspace66 @ Jun 16 2021, 02:35 PM) Thanks to everyone that highlight the issue back then in february, it save me some pain on rhb bond fund which has less exposure to mex compare to others bond fund, although the drop was not entirely due to mex. You are welcome. I warned everyone ahead but got 1-2 members kecam saya 🤭Tayor backspace66 liked this post

|

| Change to: |  0.0727sec 0.0727sec

0.48 0.48

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 06:06 AM |