Outline ·

[ Standard ] ·

Linear+

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

dasecret

|

Sep 28 2017, 02:48 PM Sep 28 2017, 02:48 PM

|

|

QUOTE(xuzen @ Sep 28 2017, 02:33 PM) I hold the same UTF in my port since my last Algozen™ ver four revision which is about two months ago. No change to my composition. That is: 1) TA Tech @ 30% 2) Manureits @ 10% 3) IDS @ 15% 4) Esther bond @ 25% 5) RHB EMB @ 20% (No Pokemon Go style) BTW I will be doing another Algozen™ ver four port run in Dec 2017 if there is no major news. As of this moment, looking at the composition, no major movement needed. Walkman660, My India IRR is meaningless as I held the UTF for about a year only. Hence ROI is more applicable which is around 19.XX% from my memory. Xuzen EMB still good ka? 1 yr 4% 2 yrs annualised 5% ManuREITs also, after ramjade convinced you to switched it has gone completely quiet. But to be fair, from the few REITs option, it's still the better one. But question is, is REITs a good choice compared to asia pac equity funds. For one year and 2 years Asia pac EQ funds have done much better than REITs. Of course, at a higher volatility On an unrelated note, I'm waiting for FSM to re-open ponzi 1.0. Now ponzi 2.0's volatility is close to ponzi 1.0 jor Edit: Just saw this https://www.fundsupermart.com.my/main/admin...ticeMYHWAQF.pdfSo I think can buy from next Monday onwards This post has been edited by dasecret: Sep 28 2017, 05:25 PM |

|

|

|

|

|

dasecret

|

Sep 28 2017, 05:27 PM Sep 28 2017, 05:27 PM

|

|

QUOTE(Avangelice @ Sep 28 2017, 04:42 PM) last years 2016 Asian bond rout will happens again after trump announced a tax cut. now to jump into global tech and let go of Malaysia Wah, such contrarian move. So you are on the same page as our PM instead of FSM?  |

|

|

|

|

|

dasecret

|

Oct 2 2017, 09:47 AM Oct 2 2017, 09:47 AM

|

|

QUOTE(Avangelice @ Sep 29 2017, 12:49 PM) Managed Portfolios Currency MYR Subscription Fee * 0.50% Portfolio Management Fee* 0.50% p.a. Minimum Initial Investment MYR 10,000 Minimum Incremental Amount MYR 1,000 I got this from them. how come this is cheaper than diy? i get charged 1.50% or am I missing something here? QUOTE(Avangelice @ Sep 29 2017, 12:58 PM) I'm tempted to just dump all my money to them to manage. dont have the energy and heart to do it anymore. The 0.5% portfolio management fee is per annum, so if you keep it for 10 years it'll be 5% accumulated, similar to the platform fees of 0.05% per quarter or 0.2% per annum for certain FI funds. Some ppl are allergic to this type of charges  Anyway, it depends on what type of investor you are in order to decide which type of product suits you. In the past month I think all those who invested in managed portfolio will tell you that the managed portfolio fell in lesser % than their DIY portfolio |

|

|

|

|

|

dasecret

|

Oct 2 2017, 10:04 AM Oct 2 2017, 10:04 AM

|

|

QUOTE(Avangelice @ Oct 2 2017, 09:59 AM) think I'll shoot an email to fsm see if they can take over my entire portfolio without the need to break it into 10k 10k is just the minimum investment, of course you can put in more than 10k at one go, but it's also a matter of whether doing everything one lumpsum is a good choice. One can do gradual buy in, minimum initial investment of 10k, subsequent investment min of 5k each time I think you first need to sell your existing holdings before you can purchase the managed portfolio. You may want to ask them to waive sales charge for that so you don't pay twice. Timing of the redemption defers by fund as well |

|

|

|

|

|

dasecret

|

Oct 2 2017, 10:12 AM Oct 2 2017, 10:12 AM

|

|

QUOTE(Avangelice @ Oct 2 2017, 10:08 AM) what a turn off. another way I can think of is keep my current portfolio and start building up my managed portfolio. this makes my investment into 1) diy unit trust port 2) managed port 3) stock port 4) main income Of course that's the other option. Actually the most important consideration is - what is your IRR on the DIY portfolio and whether that's better or worse than the managed portfolio. But since you don't keep track, I can't help you with that Out of curiosity, do you keep track of your stock portfolio IRR? How do you know you are better/worse off investing in stock/UT? |

|

|

|

|

|

dasecret

|

Oct 2 2017, 10:13 AM Oct 2 2017, 10:13 AM

|

|

QUOTE(Ramjade @ Oct 2 2017, 09:49 AM) Speaking of this fees, written by one of top SG financial blogger AUM Fees vs Commission Sales Charges – Which is Cheaper?For those who are interested. That's why I don't get what are you doing in UT, UT is the worst vehicle you can use if you are allergic to fees There are lots of more cost effective vehicles out there since time and effort is not an issue for you |

|

|

|

|

|

dasecret

|

Oct 2 2017, 12:15 PM Oct 2 2017, 12:15 PM

|

|

QUOTE(wengherng @ Oct 2 2017, 11:55 AM) Aiks......really ah? Need to investigate more. I was only thinking to buy this fund because I already hold some. What other Asia Pac funds are recommended? (EPF-compliant)? Ponzi 2.0 is popular I'm topping up ponzi 1.0 since it fell quite a bit and I somehow still have faith with their investment style. Let see if I'm cursing them in 6 months or sing praises for them |

|

|

|

|

|

dasecret

|

Oct 4 2017, 03:24 PM Oct 4 2017, 03:24 PM

|

|

QUOTE(Avangelice @ Oct 4 2017, 10:24 AM) why I stated that was because my return was near 25% now its 9%. weird QUOTE(Avangelice @ Oct 4 2017, 10:29 AM) didn't touch it ever since it met its target allocation. QUOTE(puchongite @ Oct 4 2017, 10:56 AM) The ponzi 2.0 dropped from max to min is about 5%. No way it can account for the 25% dropped to 9%. Agree, mathematically impossible. Only plausible reason for the drop is top up That's why ROI is a poor measure of performance. Beancounter can't help it  |

|

|

|

|

|

dasecret

|

Oct 10 2017, 09:04 AM Oct 10 2017, 09:04 AM

|

|

QUOTE(Vk21 @ Oct 10 2017, 02:39 AM) Hi all sifus, I'm about to make my first unit trust investment, probably from fundsupermart. While studying, found this thing called FSM Managed Portofolio. To me it looks like... unit trust of unit trust? lol, looks funny to me since it is in fact another layer of "distributor" from stock market. What do you think about this feature? Edit: Instead of using managed portofolio. What if: 1. One just switch around based on FSM reccomended UT? OR 2. Put minimum amount in managed portofolio, then create your big account, that do 100% mirror of managed portofolio? ( yeah there will be switching fee ) Assuming the investor want minimum monitoring, but still earn steady by diversification. Sure you can do that, just more work lor. It should still work out to be cheaper in the long run. Managed portfolio is designed for people who don't want to spend time to monitor, that's what ppl pay 0.5% per annum fee for. So if you are willing to invest the time, there are other options |

|

|

|

|

|

dasecret

|

Oct 10 2017, 09:54 AM Oct 10 2017, 09:54 AM

|

|

QUOTE(funnyface @ Oct 10 2017, 09:18 AM) Actually no. It is impossible to 100% mimick the managed portfolio. The main reason being you wont know when the manager will do switching (which happens quite frequently based on monthly statement). Secondly also no, it will be more expensive for your own DIY due to sale charge (1.75% own DIY vs 1% aggressive managed portfolio) Last statement is true though  That's where bean counters come in. In order to mimick the managed portfolio I think you need to buy into managed portfolio to track. For FSM SG, they actually open up the factsheet to non-subsribers. So in that case it's easier to track In terms of the cost, actually you only pay 1.75% on the equity funds which for moderately aggressive managed portfolio is 70%; so the effective sales charge would be 1.23%. Further, the switching charges would unlikely to be applied to 100% of your porfolio, chances are is just 5% - 10% of switching between EQ fund and FI fund. So again, assuming 5% switch every month (6 months switch to FI and 6 months switch to EQ) also only costs you 1.75%*5*6 times a year = 0.5% But imagine the amount of work you need to do to mimick  |

|

|

|

|

|

dasecret

|

Oct 10 2017, 10:55 AM Oct 10 2017, 10:55 AM

|

|

QUOTE(funnyface @ Oct 10 2017, 10:04 AM) I have 3 Managed Portfolios and i would say it is close to impossible to track  By the time you notice the numbers changed, it was already 2-3 days after the switch happened.  For 2nd point, Moderately Aggressive is 1% sale charge. So assuming your calculation is correct that means the annual manage fee is the same as your DIY switching fee. So your own DIY port will be still more expensive due to sale charge (1.23% vs 1%) **Assuming your calculation is correct**  My calculation is a lot of assumption. Anyway, why do you need 3 different managed portfolios? It's all same funds just slight difference in % of allocation |

|

|

|

|

|

dasecret

|

Oct 10 2017, 01:02 PM Oct 10 2017, 01:02 PM

|

|

QUOTE(Avangelice @ Oct 10 2017, 01:01 PM) I believe there are other annual fees that's charged by fund houses aside from FSM management fees. correct me if I'm wrong. It's the same management fee and expenses charged by fund house which is the same if you DIY or buy from UTC or buy managed portfolio |

|

|

|

|

|

dasecret

|

Oct 10 2017, 04:43 PM Oct 10 2017, 04:43 PM

|

|

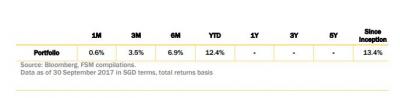

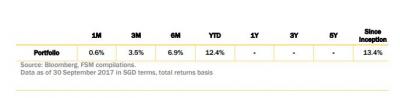

QUOTE(mas1900 @ Oct 10 2017, 01:45 PM) So how is the performance of managed portfolio? See below. The moderately aggressive managed portfolio is 4 months old, since inception 4.1%

I also attach the moderately aggressive MAPS portfolio in FSM SG performance

The SG one performs better so far, i supposed due to more choices when it comes to funds |

|

|

|

|

|

dasecret

|

Oct 10 2017, 05:13 PM Oct 10 2017, 05:13 PM

|

|

QUOTE(funnyface @ Oct 10 2017, 04:55 PM) I would say they are close enough  MY FSM managed port only started around May 2017 i think? So it basically missed the 1H of bull market.  To be fair, i think compare Q3 return will be a better comparison  That's a valid argument too But in the end, the most relevant comparison is, anyone's DIY portfolio does better than managed portfolio so far? I for one can say mine don't |

|

|

|

|

|

dasecret

|

Oct 10 2017, 05:32 PM Oct 10 2017, 05:32 PM

|

|

QUOTE(puchongite @ Oct 10 2017, 05:25 PM) Someone who invested heavily into interpac funds at the beginning of the year and then subsequently jump off from interpac funds and move on to top up greater china will do better than the FSM managed portfolio. That will be the miao miao person. LOL. Waiting for that person to come comment lor... What about you? You were following interpac closely ma |

|

|

|

|

|

dasecret

|

Oct 11 2017, 03:57 PM Oct 11 2017, 03:57 PM

|

|

QUOTE(xuzen @ Oct 11 2017, 11:14 AM) Portfolio UP UP UP After a lull in Sep, port came back with a vengeance. UTF Participants, Happy or not? Happy... top up during the dip lagi happy  |

|

|

|

|

|

dasecret

|

Oct 11 2017, 04:34 PM Oct 11 2017, 04:34 PM

|

|

QUOTE(Vk21 @ Oct 11 2017, 04:07 PM) Dear all, About managed portofolio, I'm torn between balanced vs moderately agressive. My profile fits more to mod aggressive, but I saw in previous pages of this thread ( will update if I found it ), back tested, balanced is performing so well compared to mod aggressive. More bang for the bucks. Any opinion? No one can really tell you what to do. No one can tell if this would be the case in the future as well But what you would observe is, a lot of ppl here would go for 100% equity in their DIY portfolio and a less risky managed portfolio. Mainly because there's no 100% EQ managed portfolio as an option  |

|

|

|

|

|

dasecret

|

Oct 11 2017, 05:28 PM Oct 11 2017, 05:28 PM

|

|

QUOTE(David3700 @ Oct 11 2017, 05:05 PM) Top up Ponzi 1.0 lar...... Kan I already announce loud loud that I topped up on 2 Oct itself  |

|

|

|

|

|

dasecret

|

Oct 13 2017, 07:06 PM Oct 13 2017, 07:06 PM

|

|

QUOTE(Avangelice @ Oct 13 2017, 05:12 PM) both have free switch capabilities. cannot use xuzen. the other spectrum is to use lady dasecret port. no need to switch here and there Hmm? I posted before? mine lose to managed portfolio ler around 8.5% to 9% only This post has been edited by dasecret: Oct 13 2017, 07:09 PM |

|

|

|

|

|

dasecret

|

Oct 16 2017, 12:50 AM Oct 16 2017, 12:50 AM

|

|

QUOTE(yklooi @ Oct 16 2017, 12:29 AM) ok...noted.... I was contemplating to "sailang" all (include my whole EPF) into it  (plan to keep 10% of it into AHSB & CMF as house whole emergency fund) then withdrawing annually (from managed port's assets) to cover the annual expenses workable??  or  Don't think managed portfolio can use EPF to buy at the moment. EPF is still tied to your name whereas managed portfolio is under FSM nominee account but parked at an external trustee, at the moment with maybank trustees It depends on how much confidence you have in FSM and in yourself lor. I don't think I'll pull out what I already put in funds other than those lousy fund that I switch out. But for future savings will likely put in managed portfolio. That's why if they start RSP I'd certainly do it as forced savings |

|

|

|

|

Sep 28 2017, 02:48 PM

Sep 28 2017, 02:48 PM

Quote

Quote

0.0426sec

0.0426sec

0.68

0.68

7 queries

7 queries

GZIP Disabled

GZIP Disabled