QUOTE(torres09 @ Dec 31 2016, 08:04 AM)

FYI, There has SCB temp booth at 1u shopping mall this weekends if you stay KVCredit Cards Recommendation for Credit Cards V4, Please post according to Format stated

Credit Cards Recommendation for Credit Cards V4, Please post according to Format stated

|

|

Dec 31 2016, 10:32 PM Dec 31 2016, 10:32 PM

Return to original view | Post

#1

|

Senior Member

6,483 posts Joined: Apr 2012 |

|

|

|

|

|

|

May 10 2017, 07:48 AM May 10 2017, 07:48 AM

Return to original view | Post

#2

|

||||||||||

Senior Member

6,483 posts Joined: Apr 2012 |

QUOTE(diversity @ May 10 2017, 01:34 AM) QUOTE(fly126 @ Feb 15 2017, 09:41 AM) General Usage CC: I) HLB Fortune - 1% CB but need min. Spend Rm2K /month to Activate the 1% CB Mechanism https://www.hlb.com.my/main/personal/cards/fortune-card II) HLB Essential: 0.6% on 1st RM5000 spend, 1% cash back on Subsequent spend, NO cashback on Petrol Transaction. III) SCB Cashback Gold: 2 - 5% CB with min spend $500, NO CB for Petrol, Insurance Transactions. https://www.sc.com/my/credit-cards/goldcard/gold-card.html IV) OCBC 365 Mastercard: 1% CB on 1st RM1K Spend, 0.5% cash-back on subsequent spend (Annual Fee RM106) V) Alliance You:nique: 0.5 - 3% CB from RM0 - RM3000 Spending http://www.alliancebank.com.my/younique

QUOTE(fly126 @ Mar 19 2017, 12:47 PM) |

||||||||||

|

|

Jul 8 2017, 11:04 AM Jul 8 2017, 11:04 AM

Return to original view | Post

#3

|

Senior Member

6,483 posts Joined: Apr 2012 |

QUOTE(realitec @ Jul 8 2017, 10:47 AM) Hi thanks for the reply. But i want something like i can swipe any amount, then call bank for 0% interest instalment. i heard PBB credit cards allowed to do this though. Are you referring to SenQ ? SenQ is able to process for you regarding 0% interest instalment plan, no need to call bank. Quite number of banks' CC can be process for 0% depend on the instalment months that you prefer. As I know, MBB, CIMB and Aeon can be done in SenQ |

|

|

Jul 8 2017, 11:18 AM Jul 8 2017, 11:18 AM

Return to original view | Post

#4

|

Senior Member

6,483 posts Joined: Apr 2012 |

QUOTE(realitec @ Jul 8 2017, 11:06 AM) Currently I have HLB. Should i go for CIMB/AEON? As MBB needs 36k and above, which does not meet for my requirement. No idea how many months of instalment can be up to for Aeon Card, only know CIMB CC can be mix until 36 months in SenQ.CIMB or Aeon, depend on how many months of instalment you are prefer. If you keen on the instalment, you may apply for "CIMB Cash Rebate Platinum MasterCard", refer HERE for other Features & Benefits of the card. |

|

|

Sep 7 2017, 12:17 PM Sep 7 2017, 12:17 PM

Return to original view | Post

#5

|

Senior Member

6,483 posts Joined: Apr 2012 |

|

|

|

Sep 23 2017, 10:06 AM Sep 23 2017, 10:06 AM

Return to original view | Post

#6

|

Senior Member

6,483 posts Joined: Apr 2012 |

QUOTE(azrazrazrazr @ Sep 23 2017, 01:15 AM) 1. Annual Income: RM90K 2. Free Lifetime Annual Fee: Yes or waivable with 12 swipes per year or thru CS 3. Card required for: Oversea use 4. Existing credit cards (if any): hsbc amanah, maybank ikhwan platinum (both v and mc) 5. Interested in CC from: Ambank 6. Others: Looking for cards best used abroad (points, fees etc...) QUOTE(fly126 @ Sep 23 2017, 08:46 AM) How about SCB WorldMiles Master card, maybe can have a look https://www.sc.com/my/campaign/worldmiles/ |

|

|

|

|

|

Sep 29 2017, 06:45 PM Sep 29 2017, 06:45 PM

Return to original view | Post

#7

|

Senior Member

6,483 posts Joined: Apr 2012 |

|

|

|

Oct 1 2017, 09:10 PM Oct 1 2017, 09:10 PM

Return to original view | Post

#8

|

Senior Member

6,483 posts Joined: Apr 2012 |

QUOTE(Leroi2x @ Oct 1 2017, 06:53 PM) 1. Annual Income: RM60k Regarding the AIA insurance payment, you may look for PBB Quantum MasterCard2. Free Lifetime Annual Fee: At least free for 1st years 3. Card required for: cash back for insurance ,AIA (anyway to pay online ?) 4. Existing credit cards (if any): sc visa plat , uob one (going chop) 5. Interested in CC from: thinking get public AIA for 2% rebate on insurance, any better option ? (can AIA pay online ?) It will get 5% rebate if you pay through AIA website For more detail on the card itself, please refer HERE |

|

|

Jun 1 2018, 07:55 PM Jun 1 2018, 07:55 PM

Return to original view | Post

#9

|

Senior Member

6,483 posts Joined: Apr 2012 |

QUOTE(Tellmeyourstory @ Jun 1 2018, 05:45 PM) 1. Annual Income: 70k I think you can consider use those credit card to reload into BigPay and pay TNB by your BigPay 2. Free Lifetime Annual Fee: waive with swipe 3. Card required for: TNB bills 4. Existing credit cards (if any): none 5. Interested in CC from: any 6. Others: Want to get 1 card mainly to pay for my shop TNB bills ~ RM 11k monthly. Please suggest either CB or best for miles points. If can consolidate with BigPay card better Thanks - Standard Chartered Bank Gold card (RM1500 = RM50) - Standard Chartered Bank JustOne card (RM2500=RM85) - Public Bank Quantum Card (RM600 =RM30) - Public Bank Visa Signature (RM634 = RM38) - Maybank FCB Card ( RM2500=RM50) - UOB yolo card (refer UOB thread whether entitled rebate for BigPay) Or no headache to be holding a dozen of cards, may consider other Hong Leong / Alliance / OCBC those unlimited cash back |

|

|

Jul 29 2018, 11:46 AM Jul 29 2018, 11:46 AM

Return to original view | Post

#10

|

Senior Member

6,483 posts Joined: Apr 2012 |

QUOTE(atjm88 @ Jul 29 2018, 11:39 AM) Hi, anyone know which card is the best for auto billing purpose like Insurance? Any bank is fine to recommend. Thanks a lot Can consider this card - Maybank FC Barcelona Visa Signature1. Annual Income: RM36k 2. Free Lifetime Annual Fee: Optional 3. Card required for: For Auto billing like Insurance 4. Existing credit cards (if any): PB Quantum/AIA/Gold, Alliance Younique, RHB Cash Value, HSBC Amanah, AmBank Carz, SCB Platinum Master/360 5. Interested in CC from: Any |

|

|

Jul 30 2018, 12:44 PM Jul 30 2018, 12:44 PM

Return to original view | Post

#11

|

Senior Member

6,483 posts Joined: Apr 2012 |

|

|

|

Jan 19 2019, 08:10 PM Jan 19 2019, 08:10 PM

Return to original view | IPv6 | Post

#12

|

Senior Member

6,483 posts Joined: Apr 2012 |

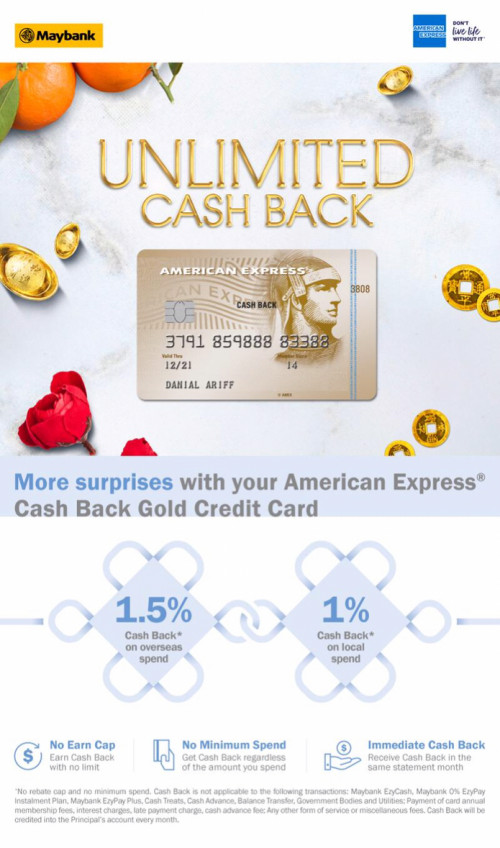

QUOTE(vondutch @ Jan 19 2019, 08:03 PM) What is the best credit card to make big purchase(around 30k) and get maximum cashback/points? Since you have two banks of credit card, perhaps you can add one more Maybank card as below:I currently hold: 1. Maybank2card Amex- This will only gives me RM50 cashback + 30000 treatpoints (equal to RM60). Assuming i can only swipe on weekday. 2. PB QM - RM30 cashback+30000 VIP points(donno how much this worth) Any other card that is better foe me to maximize this purchase?  |

|

|

Jul 20 2019, 07:21 AM Jul 20 2019, 07:21 AM

Return to original view | IPv6 | Post

#13

|

Senior Member

6,483 posts Joined: Apr 2012 |

|

| Change to: |  0.0420sec 0.0420sec

0.20 0.20

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 03:08 AM |