QUOTE(wodenus @ Jan 4 2017, 01:51 PM)

Yea this is like any business venture.. you lose money in the beginning, then you analyze your mistakes and learn. Then you lose less next time. Then eventually you will gain a profit

used to chase hot funds too.. but then you realize that is a losing strategy in the end

Trying to stick to one strategy now.

QUOTE(dasecret @ Jan 4 2017, 02:08 PM)

I believe many others have kind of answer your question

My take? I too have close to 20 funds in my first portfolio; slowly cutting down but still no where near 5-7 funds. The idea is simple, same geographical segment, just stick to the fittest horse, what for split your bets and end up with less. It's diworsification

QUOTE(wodenus @ Jan 4 2017, 02:14 PM)

It's a way to reduce volatility. More volatility usually means more profit, it all depends on where in the sliding scale of volatility/profit you want to be I guess.

QUOTE(shankar_dass93 @ Jan 4 2017, 02:34 PM)

Would you mind sharing the list of 25 funds that you invested in ?

I'm only holding 3 funds at the moment

ya.. Learning Curve for me...

Is time to seat down and study prperly

I really found no one for proper guide. And I am from medical field too, learning investment from zero since 3 yrs ago.

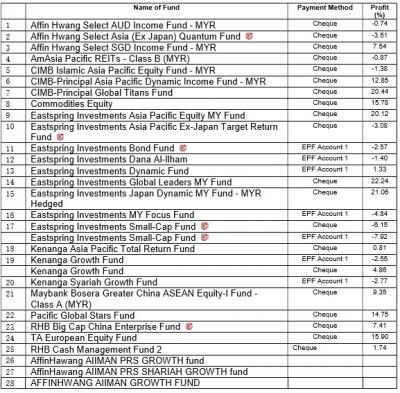

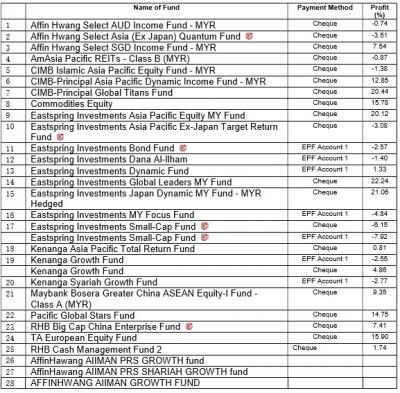

OK, THis is my Investements

I know got lot of Overlapping

The last three was investement with affinhwang agent.

YA Learning Curve for me..

I need sometime to analysis it again.

As requested

Name of Fund Payment Method Profit (%)

1 Affin Hwang Select AUD Income Fund - MYR Cheque -0.74

2 Affin Hwang Select Asia (Ex Japan) Quantum Fund Cheque -3.51

3 Affin Hwang Select SGD Income Fund - MYR Cheque 7.54

4 AmAsia Pacific REITs - Class B (MYR)Cheque -0.87

5 CIMB Islamic Asia Pacific Equity Fund - MYR Cheque -1.38

6 CIMB-Principal Asia Pacific Dynamic Income Fund - MYR Cheque 12.85

7 CIMB-Principal Global Titans Fund Cheque 20.44

8 Commodities Equity Cheque 15.78

9 Eastspring Investments Asia Pacific Equity MY FundCheque 20.12

10 Eastspring Investments Asia Pacific Ex-Japan Target Return Fund Cheque -3.08

11 Eastspring Investments Bond Fund EPF Account 1 -2.57

12 Eastspring Investments Dana Al-IlhamEPF Account 1 -1.40

13 Eastspring Investments Dynamic FundEPF Account 1 1.33

14 Eastspring Investments Global Leaders MY FundCheque 22.24

15 Eastspring Investments Japan Dynamic MY Fund - MYR HedgedCheque 21.06

16 Eastspring Investments MY Focus Fund EPF Account 1 -4.84

17 Eastspring Investments Small-Cap Fund Cheque -6.15

Eastspring Investments Small-Cap Fund EPF Account 1 -7.92

18 Kenanga Asia Pacific Total Return Fund Cheque 0.81

19 Kenanga Growth Fund EPF Account 1 -2.55

Kenanga Growth Fund Cheque 4.86

20 Kenanga Syariah Growth Fund EPF Account 1 -2.77

21 Maybank Bosera Greater China ASEAN Equity-I Fund - Class A (MYR) Cheque 9.35

22 Pacific Global Stars Fund Cheque 14.75 (left over Profit)

23 RHB Big Cap China Enterprise Fund Cheque 7.41 (left over Profit)

24 TA European Equity Fund Cheque 15.90 (left over Profit)

25 RHB Cash Management Fund 2 Cheque 1.74

26 AffinHawang AIIMAN PRS GROWTH fund

27 AffinHawang AIIMAN PRS SHARIAH GROWTH fund

28 AFFINHWANG AIIMAN GROWTH FUND

Long list ya...

Those EPF one I admit, I didnt study properly just tembak... was inveested to aim total amount into reward programs

Attached thumbnail(s)

Jan 4 2017, 01:43 PM

Jan 4 2017, 01:43 PM

Quote

Quote

0.0262sec

0.0262sec

0.69

0.69

7 queries

7 queries

GZIP Disabled

GZIP Disabled