Anyone invested in PRS?

I want to ask about AMPRS. what is the different between Class I and Class D?

In fundsupermart only class D.

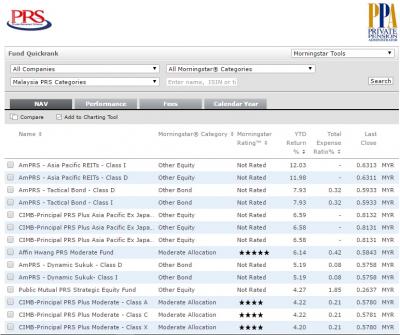

from PPA website, best perforamce for past one year is AMPRS Asia Pacific REITs Class I. more than 10 percent this year.

Mine was Affin Hwang PRS Growth, normal perforamce for pass 3 years, lesser than 6 persent

I am planning to Transfer IN all my affin Hwang into Fundsupermart. Clienthelp infrom it take 2 months to complete transfer. Anyone tried transferred before?

This post has been edited by fense: Dec 30 2016, 05:59 PM

FundSuperMart v17 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

Dec 30 2016, 05:57 PM

Dec 30 2016, 05:57 PM

Quote

Quote

0.1202sec

0.1202sec

1.03

1.03

7 queries

7 queries

GZIP Disabled

GZIP Disabled