[quote=zhengyizhisheng,Nov 2 2017, 08:24 PM]

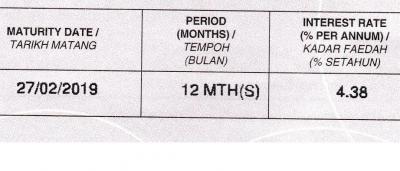

Did anyone cracked this, 4.88% per annum, means 6 months is only 2.44%??

Correct me if i'm wrong.

[/quote]

What were u expecting ? 4.88% per month ?[quote=okuribito,Nov 3 2017, 08:27 PM]

You think so? Best rate? But based on these 2 posts in the spoiler, it's a trap to catch suckers wor. Tak sampai 2.44% pun & mis-advertising. Now I feel like a stupid water fish. I wonder how many forummers here were saved from the trap by these 2 posts

Remember ... if they try this stunt in JB & Penang, warn everybody it's a trap

» Click to show Spoiler - click again to hide... «

[quote=lowya,Nov 3 2017, 01:47 PM]

btw i think that qualifies as mis-advertising. Perhaps that's why they can afford to give lucky thermos and printers.

[/quote]

sarcasm posting[quote=babienn,Nov 3 2017, 09:09 PM]

2.4X% per 6 months?

4.8X% per year?

That's a steal bro.

[/quote]

[quote=ikanbilis,Nov 3 2017, 09:58 PM]

Are you sure you know how to compute FD interest rate?

OKOK, so somebody calculated as 2.4199% for 6 months. I just take 2.4% for 6 months is enough. That's 4.8% pa which is 0.6% more than the current Ambank promo 4.2%pa

[/quote]

They were just being sarcastic la

Jan 10 2017, 06:37 PM

Jan 10 2017, 06:37 PM

Quote

Quote

0.0508sec

0.0508sec

0.35

0.35

7 queries

7 queries

GZIP Disabled

GZIP Disabled