No possible, CIXX staff not allowed or rejected open BSA, want yearly annual fee ATM RM 8.48 or Debit card RM 15.90.

CIXX staff said : "CIXX no BSA account, can't open. Only old day got BSA account, now only RM 250 with annual fee card."

When you step the CIXX door tell want open account, the staff ready ask you pocket has money RM 250 or not, if not you unable received a ticker meet the banker.

After saw the CIXX banker, the CIXX banker also "CIXX no BSA" how can open to you? (Whatever CIXX website, BNX show can BSA.)

If put RM 250 with paid annual fee sure can, so please calm down.

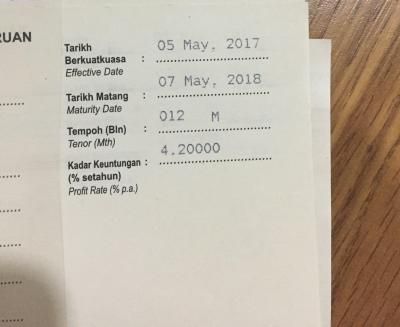

When you FD with BC, the CIXX delay 2 days date, you lost 2 days interest.

When you want take out, the officer don't know where to go but the system very very very slow. The process look like very security but very trouble the customer. If not wrong can 2-3 hours compared with UOX(Very fast), OCBX(Not bad) and PXX(Ok).

The BC also others RM 0.53 or RM 2.12, If not wrong CIXX, PXX and MaXbank RM 5.98

Don't know what happen of CIXX, please calm down and take care your blood pressure when deal with CIXX.

I think the branch is taking you guys for a ride, I would definitely request to speak to brach manager, and file a complain if they can't solve it to my satisfaction.

1. BSA is a requirement from BNM, they

offer it.

2. From my experience with few diff CIMB branches, BC/personal cheque always dated same date. Only thing is can't uplift for 2 or 3 business days.

3. BC from FD in the same name as FD account is less than RM1, forgot the exact amount even for non preferred customer.

Mar 1 2017, 10:18 PM

Mar 1 2017, 10:18 PM

Quote

Quote

0.0532sec

0.0532sec

0.49

0.49

7 queries

7 queries

GZIP Disabled

GZIP Disabled