Update 5 Mar 2019

OCBC4.20% 12-mth FD/i Min RM10K . End date 31/3/2019

4.00% 6-mth FD/-i Min RM10K . End date 31/3/2019

4.30% 12-mths for additional fresh fund RM30K topup to exisitng funds in OCBC. (@kmarc)

Bank IslamGo 74.65% 24-mth. Min RM 50k. End date 30 June 2019 (@enriquelee). 2 options available, profit credited every 3mths or profit rollover every 3 months (@neil888)

Tawarruq4.20% 3 mths. Min RM 5K. End date 30 June 2019 (@Wong Kit yew) -- New added

4.40% 6 mths. Min RM 5K. End date 30 June 2019 (@Wong Kit yew) -- New added

RHB4.38% 12-mth. Min RM10k. OTC. End date 18/3/2019 (@enriquelee)

HLB4.50% 3-mth tenure for Astro Subscriber (@a.lifehacks)

4.20% 6-mths eFD/-i. Min RM10K. End date 30 Apr 2019 (@cybpsych)

MBSB4.48% 12-mth. Min RM28,888. End date 31/5/2019 (@dudester)

4.18% 6-mth. Min RM18,888. End date 31/5/2019 (@dudester)

4.08% 3-mth. Min RM8.888. End date 31/5/2019 (@dudester)

4.55% 24-mth. Min RM100K. Monthly interest. Must open current/SA account for new customer. (@hammerjit)

Affin Bank4.05% 12-mth

4.25% 15to60-mth (@Wong Kit yew)

4.49% 18-mth (20k to 200k). Islamic. Every 6months interest deposit. For 5k or 10k required for CASA will get 4.55% (@Gary1981)

Ambank4.28% 8-mths (@jack2)

4.25% 12-mth Conventional.

4.30% 12-mth Islamic (@boomchacha)

UOB4.2% 12-mths. Min RM10K. Monthly interest. End date 31/3/2019 (@boomchacha)

4.15% 7-mths. Min RM10K. Monthly interest. End date 31/3/2019 (@boomchacha)

4.00% 4-mths. Min RM10K. Monthly interest. End date 31/3/2019 (@boomchacha)

If you do not want monthly interest or if you do not want to open a saving account, then ask for Islamic FD

Alliance Bank4.20% 3-mth. Min RM 10K (@cybpsych)

CIMB Bank4.20% 12-mths (@syhuang)

Bank Rakyat4.60% 60-mth. Min RM5k. Monthly interest (@Wong Kit yew)

** Guys - Just update this info as and when you have new findings for now I have removed those promo which have ended.

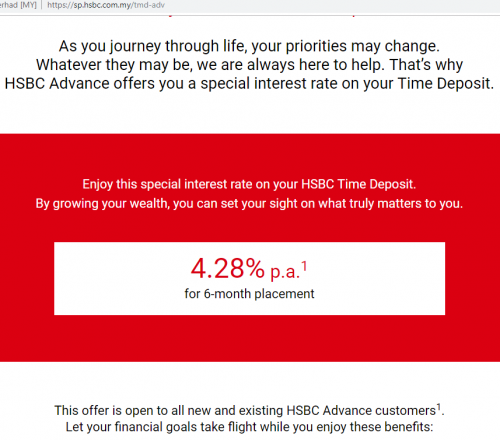

4.28%pa, Tenure: 6-mth, Min: RM10,000, Max: fresh fund RM100,000, For new/existing HSBC Advance Customers Only

Mar 1 2018, 12:57 PM

Mar 1 2018, 12:57 PM

Quote

Quote

0.1452sec

0.1452sec

0.64

0.64

7 queries

7 queries

GZIP Disabled

GZIP Disabled