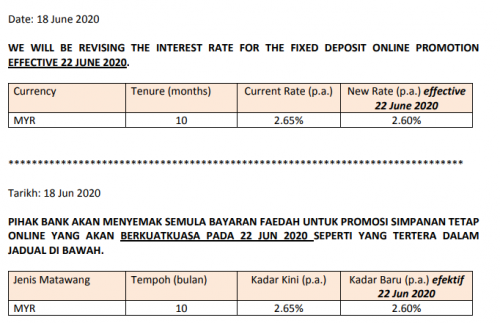

w.e.f. 22/06/2020.

10-months FD 2.60%pa (Min: RM1k, Max: RM50k)

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

Jun 19 2020, 01:26 PM Jun 19 2020, 01:26 PM

Return to original view | IPv6 | Post

#21

|

Junior Member

196 posts Joined: Aug 2017 |

|

|

|

|

|

|

Jul 5 2020, 11:28 AM Jul 5 2020, 11:28 AM

Return to original view | IPv6 | Post

#22

|

Junior Member

196 posts Joined: Aug 2017 |

|

|

|

Jul 8 2020, 02:28 AM Jul 8 2020, 02:28 AM

Return to original view | IPv6 | Post

#23

|

Junior Member

196 posts Joined: Aug 2017 |

ICBC Bank FD Promotion (For all ICBC branches)

Promotion Period: 1/7/2020-30/9/2020 6 months @ 2.6%pa -Minimum RM1,000 (OTC / Online Placement) -Applicable for: Fresh Fund & Existing Fund 10 months @ 2.8%pa -Mininuk RM1,000 (OTC Placement Only) -Applicable for: Fresh Fund Only TnC: https://v.icbc.com.cn/userfiles/Resources/I...edDepositTC.pdf Promo Page: https://malaysia.icbc.com.cn/icbc/%e6%b5%b7...itPromotion.htm (Can also be retrieved from ICBC home page under “News & Notices” tab at the bottom part- https://malaysia.icbc.com.chttps://n/icbc/�...itPromotion.htm |

|

|

Jul 13 2020, 06:56 PM Jul 13 2020, 06:56 PM

Return to original view | IPv6 | Post

#24

|

Junior Member

196 posts Joined: Aug 2017 |

QUOTE(babysotong @ Jul 13 2020, 05:02 PM) Based on feedback, will try to list top 3 rates only: and ICBC too, retrieved 13/7/2020 from official website. SUMMARY as at 13 July 5pm (valid till 31/7 unless stated otherwise) 3 months: HLB (eFD) @ 2.50% RHB (eFD) @ 2.35% PBB (eFD I think) @ 2.05% 6 months: RHB (eFD) 2.45% OCBC (OTC I think) @ 2.25% 7 months: BR (OTC) @ 2.80% - no PIDM (till 15/7) BR (OTC) @ 2.55% - no PIDM (after 15/7) UOB (OTC) @ 2.40% 9 months: UOB (OTC) @ 2.50% 11months: BR (OTC) @ 3.00% - no PIDM (till 15/7) BR (OTC) @ 2.75% - no PIDM (after 15/7) 12 months: OCBC (OTC I think) @ 2.25% ICBC Bank FD Promotion (For all ICBC branches) Promotion Period: 1/7/2020-30/9/2020 6 months @ 2.6%pa -Minimum RM1,000 (OTC / Online Placement) -Applicable for: Fresh Fund & Existing Fund 10 months @ 2.8%pa -Mininum RM1,000 (OTC Placement Only) -Applicable for: Fresh Fund Only TnC: https://v.icbc.com.cn/userfiles/Resources/I...edDepositTC.pdf Promo Page: https://malaysia.icbc.com.cn/icbc/%e6%b5%b7...itPromotion.htm (Can also be retrieved from ICBC home page under “News & Notices” tab at the bottom part- https://malaysia.icbc.com.cn/ICBC/%E6%B5%B7...91%E7%AB%99/en/ |

|

|

Jul 15 2020, 01:12 PM Jul 15 2020, 01:12 PM

Return to original view | IPv6 | Post

#25

|

Junior Member

196 posts Joined: Aug 2017 |

QUOTE(babysotong @ Jul 14 2020, 07:31 AM) This are the rates before the OPR cut rite. Any changes after the cut? Just contacted ICBC Puchong Branch to confirm (15/07/2020).Any idea anybody before I insert in the summary? The latest FD promo rate: 2.35%pa for 6-months placement, Minimum: RM1,000 Placement Method: OTC / eFD Please be advised that the 10 months FD promo is NO LONGER VALID as of today. |

|

|

Jul 22 2020, 03:31 PM Jul 22 2020, 03:31 PM

Return to original view | IPv6 | Post

#26

|

Junior Member

196 posts Joined: Aug 2017 |

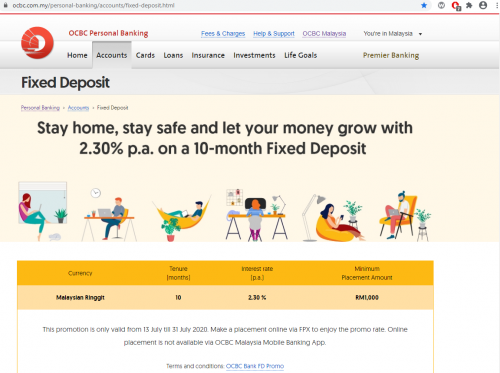

QUOTE(bbgoat @ Jul 22 2020, 09:28 AM) Received from OCBC, dropped slightly vs last week It's okay, they still have 2.3%pa for 10 months eFD promo via FPX transfer.Good Day! ☀️ To update you on *OCBC FD Rate effective 22/07/2020:* 🔸*6 Months FD*🔸 💰 2.15% p.a. - *Existing Funds* 💰2.20% p.a. - *Fresh Funds ONLY* 💰Minimum Placement RM1,000 🔹*12 Months FD*🔹 💰2.15% p.a - *Fresh Funds ONLY* 💰Minimum Placement RM10,000 Applicable for *BOTH Conventional & Islamic FD* *All promotion are subject to availability*  TnC: https://www.ocbc.com.my/personal-banking/ac...X_TC_17July.pdf Promo Link: https://www.ocbc.com.my/personal-banking/ac...ed-deposit.html  OCBC_Online_FD_Promo_FPX_TC_17July.pdf ( 189.49k )

Number of downloads: 10

OCBC_Online_FD_Promo_FPX_TC_17July.pdf ( 189.49k )

Number of downloads: 10 |

|

|

|

|

|

Jul 22 2020, 03:39 PM Jul 22 2020, 03:39 PM

Return to original view | IPv6 | Post

#27

|

Junior Member

196 posts Joined: Aug 2017 |

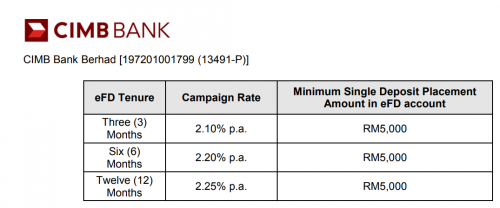

CIMB eFixed Deposit July 2020 Promo

Promo Rate Applicable to eFD Placement Only  Promo Link: https://www.cimbclicks.com.my/efd-july20.ht...D%20July%202020 TnC: https://www.cimbclicks.com.my/pdf/tc-efd-2020-eng-jul.pdf Attached File(s)  tc_efd_2020_eng_jul.pdf ( 238.57k )

Number of downloads: 11

tc_efd_2020_eng_jul.pdf ( 238.57k )

Number of downloads: 11 |

|

|

Jul 27 2020, 07:41 PM Jul 27 2020, 07:41 PM

Return to original view | IPv6 | Post

#28

|

Junior Member

196 posts Joined: Aug 2017 |

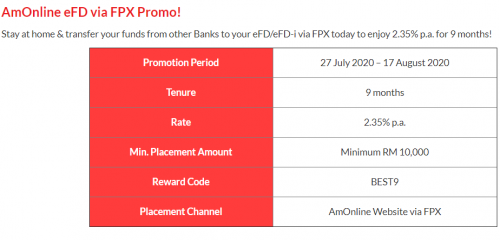

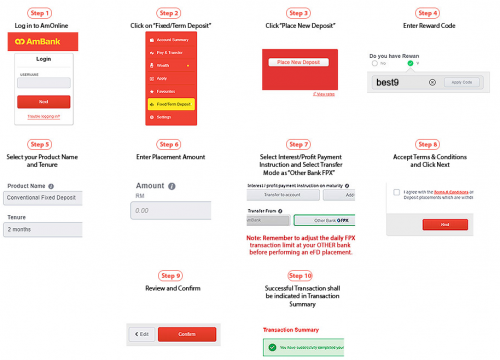

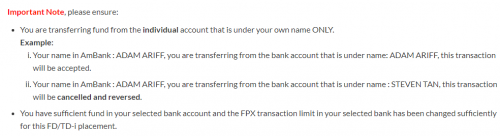

Promo Link: https://www.ambank.com.my/eng/promotions-pa...nline-eFD-Promo Attached File(s)  AmOnlineeFDPromoTnC.pdf ( 240.86k )

Number of downloads: 8

AmOnlineeFDPromoTnC.pdf ( 240.86k )

Number of downloads: 8 AmOnlineInwardFundTransferviaFPXTnC.pdf ( 178.48k )

Number of downloads: 4

AmOnlineInwardFundTransferviaFPXTnC.pdf ( 178.48k )

Number of downloads: 4 |

|

|

Jul 27 2020, 07:44 PM Jul 27 2020, 07:44 PM

Return to original view | IPv6 | Post

#29

|

Junior Member

196 posts Joined: Aug 2017 |

QUOTE(lowya @ Jul 27 2020, 07:01 PM) hi guys which bank offers the highest rate for say 1 year right now? Refer https://forum.lowyat.net/index.php?showtopi...&#entry97557938appreciate even if a short reply. thank you. |

|

|

Sep 23 2020, 05:56 PM Sep 23 2020, 05:56 PM

Return to original view | IPv6 | Post

#30

|

Junior Member

196 posts Joined: Aug 2017 |

QUOTE(GrumpyNooby @ Sep 23 2020, 02:06 PM) OCBC Nuon has been renamed to OCBC FRANK.Please find the details in this link: - https://www.ocbc.com.my/assets/pdf/Accounts...ng_Exercise.pdf |

|

|

Sep 30 2020, 12:10 PM Sep 30 2020, 12:10 PM

Return to original view | IPv6 | Post

#31

|

Junior Member

196 posts Joined: Aug 2017 |

|

|

|

Nov 9 2020, 07:31 PM Nov 9 2020, 07:31 PM

Return to original view | IPv6 | Post

#32

|

Junior Member

196 posts Joined: Aug 2017 |

[09/11/2020] Introduction of Partial Premature Withdrawal as a new feature for selected Malaysian Ringgit Fixed Deposit and Fixed Deposit-i effective 01 December 2020.

OCBC Partial Withdrawal- FD You can now opt for Partial Premature Withdrawal/ Partial Early Settlement on selected Malaysian Ringgit Fixed Deposit (“FD”)/ Fixed Deposit-i (“FD-i”) with OCBC Bank and/or OCBC Al-Amin. Partial Premature Withdrawal/ Partial Early Settlement can be made on FD/FD-i tenures of 2 to 60 months. The partially withdrawn amount must be made in multiples of RM1,000, with a minimum of RM1,000 to be maintained in the FD/FD-i. A penalty/ rebate will be imposed on the partially withdrawn amount, whilst the remaining balance will continue to earn the earlier contracted interest/ profit rate. You can only request for a Partial Premature Withdrawal/ Partial Early Settlement over-the-counter at any of our OCBC Bank and/or OCBC Al-Amin branches. |

|

|

Dec 19 2020, 12:30 AM Dec 19 2020, 12:30 AM

Return to original view | Post

#33

|

Junior Member

196 posts Joined: Aug 2017 |

QUOTE(Human Nature @ Dec 18 2020, 10:53 AM) This promo has ended on 18/12/2020.The new promo w.e.f. 19/12/2020 will be as followed:- (Promo ends on 31/12/2020) [Open to NEW and EXISTING customers, CASA required for MONTHLY interest/ profit crediting] Placement Method: OVER THE COUNTER [OTC] Only CONVENTIONAL / ISLAMIC 7 months 2.2% pa 9 months 2.3% pa FRESH FUND is required. Min. Placement: RM10k Max. Placement: RM5m Source: UOB Klang Branch, Selangor This post has been edited by a.lifehacks: Dec 19 2020, 03:37 PM Human Nature liked this post

|

|

|

|

|

|

Feb 2 2021, 11:06 PM Feb 2 2021, 11:06 PM

Return to original view | Post

#34

|

Junior Member

196 posts Joined: Aug 2017 |

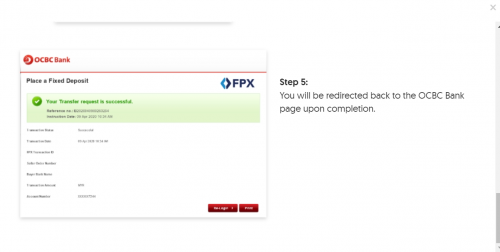

QUOTE(rocketm @ Feb 2 2021, 10:56 PM) Do you know whether the fund need to from other bank or can be from ocbc saving to place this online FD for the limited time promotion FD? Fresh fund required for this promo. You will be prompted to login to your funding bank for FPX's transfer to OCBC for the FD placement. |

|

|

Feb 3 2021, 12:30 AM Feb 3 2021, 12:30 AM

Return to original view | Post

#35

|

Junior Member

196 posts Joined: Aug 2017 |

QUOTE(Human Nature @ Feb 2 2021, 11:11 PM) It is. Please refer to the following image as shown in OCBC website Under this link https://www.ocbc.com.my/personal-banking/ac...ed-deposit.html Scroll down to "Apply now", under "Do you have an OCBC Debit or Credit Card". Once you answered "Yes" for all the questions, you will be prompted to the picture as attached above. This post has been edited by a.lifehacks: Feb 3 2021, 12:31 AM Human Nature liked this post

|

|

|

Mar 24 2021, 01:11 PM Mar 24 2021, 01:11 PM

Return to original view | IPv6 | Post

#36

|

Junior Member

196 posts Joined: Aug 2017 |

QUOTE(cclim2011 @ Mar 24 2021, 08:21 AM) There are two,PBB eFD (FPX) ( https://www.pbebank.com/pdf/Promotions/efd-fpx21-en-tc.aspx ) -Min 5k 1-month 2.0%pa 2-months 2.1%pa 3-months 2.2%pa PBB OTC ( https://www.pbebank.com/pdf/Promotions/tc-f...i-en250121.aspx ) -Min 10k 8-months 2.08%pa |

|

|

Mar 24 2021, 01:18 PM Mar 24 2021, 01:18 PM

Return to original view | IPv6 | Post

#37

|

Junior Member

196 posts Joined: Aug 2017 |

QUOTE(cclim2011 @ Mar 24 2021, 08:21 AM) CIMB eFD promo (22 March 2021- 6 May 2021) ( https://www.cimbclicks.com.my/efd-mar21.html ) [ https://www.cimbclicks.com.my/pdf/tc-efd-mar21-en.pdf ] -Min 5k 3-months 2.05%pa 6-months 2.15%pa 12-months 2.20%pa |

|

|

May 9 2021, 04:55 PM May 9 2021, 04:55 PM

Return to original view | Post

#38

|

Junior Member

196 posts Joined: Aug 2017 |

UOB Bank- Bandar Bukit Tinggi (SELANGOR) Branch Opening FD Promotion

(3 May 2021 until 31 May 2021) https://www.uob.com.my/personal/promotions/...tinggi-pfs.page 9 months* 2.50% p.a. 10% FD amount to be earmarked for CASA (3 months) *FRESH FUND is REQUIRED* Min: RM10,000 Max: RM500,000 *Promotion will be ceased upon reaching the fund size of RM150 million (“Fund Size Limit”). TnC direct URL: https://www.uob.com.my/web-resources/person...nggi-fd-tnc.pdf Attached File(s)  bkt_tinggi_fd_tnc.pdf ( 348.61k )

Number of downloads: 11

bkt_tinggi_fd_tnc.pdf ( 348.61k )

Number of downloads: 11 |

|

|

Sep 10 2021, 10:15 AM Sep 10 2021, 10:15 AM

Return to original view | IPv6 | Post

#39

|

Junior Member

196 posts Joined: Aug 2017 |

QUOTE(gchowyh @ Sep 9 2021, 04:59 PM) It took me about 2 hours to re-open my savings account the other day with a total of about 7 customers in queue with 2 counters opened. The waiting time in Affin Bank is indeed much longer as compared with other banks. Not sure what others think, but I think the staffs there are much friendlier la. This was at the Jalan Ipoh branch, KL. I would say Affin might be slower. Same here, i'm not near 50 years old but been following this forum for years... I guess it’s a trade off between waiting time and friendly service? Hahah |

|

|

Sep 11 2021, 01:47 AM Sep 11 2021, 01:47 AM

Return to original view | Post

#40

|

Junior Member

196 posts Joined: Aug 2017 |

QUOTE(joeblow @ Sep 10 2021, 07:47 PM) Hahaha my apologies for the mistake. CIMB FD is rather low actually, less than 2.4% even. Only their TIA is higher at 2.55% but TIA has a chance of not giving you the full interest rate promised. Though I put TIA before and they gave me full rate. What’s Citibank’s promo? For Citigold / priority only or applies to normal Citi banking customer too? Any min. amount required?It seems Bank M gives highest so far but need to go make new account and hardly any bank M around my area. I will put in Citibank 2.55%... |

| Change to: |  0.0570sec 0.0570sec

0.52 0.52

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 02:17 PM |