QUOTE(Mattrock @ Aug 1 2022, 04:33 PM)

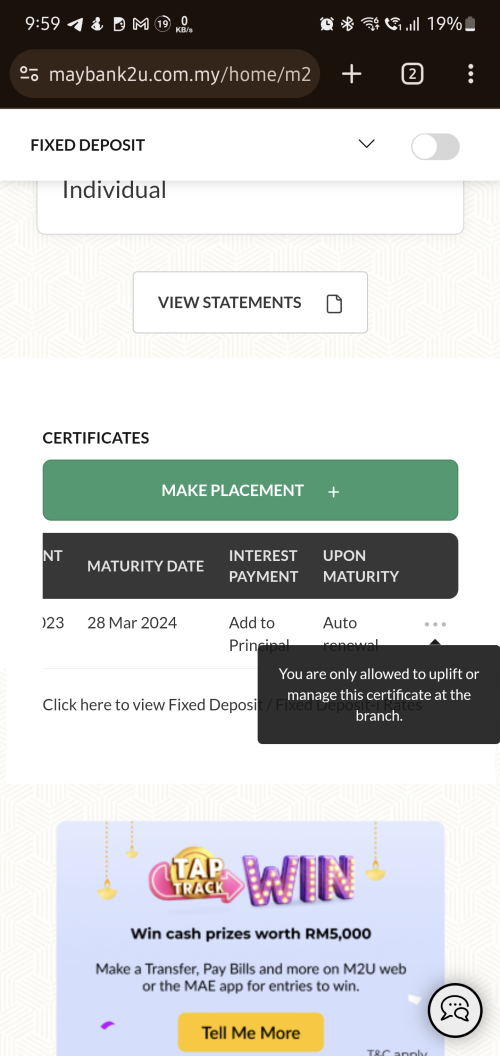

General question out of curiosity - say you have a reasonable sum to place in FD, e.g., 100k, do you place one FD for 100k or multiple FDs, e.g., 50-50, 25-25-25-25 or even 10 x 10s? Just want to survey. I would probably do 4x25s, but there are times I wish I did 10x10s due to emergencies.

depending on your holding period?medium-long term, matures annually

5x5 year

short term, matures monthly

3 x 3 month

12 x 12 month would also be possible for RM 100k

Aug 1 2022, 05:03 PM

Aug 1 2022, 05:03 PM

Quote

Quote

0.0592sec

0.0592sec

0.31

0.31

7 queries

7 queries

GZIP Disabled

GZIP Disabled