Outline ·

[ Standard ] ·

Linear+

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

nexona88

|

Jul 23 2022, 08:27 PM Jul 23 2022, 08:27 PM

|

|

From Malaysia FD to Singapore FD discussion....

Previously about some theory & local / foreign investment strategy...

LYN forummers always amazed me each time...

With various information, BUT too bad it's kinda OT already 😏

|

|

|

|

|

|

nexona88

|

Jul 27 2022, 11:40 AM Jul 27 2022, 11:40 AM

|

|

QUOTE(CommodoreAmiga @ Jul 27 2022, 10:17 AM) Does anybody have this issue. I found out RHB FD is like cheating customers. If your maturity date is today, you can't withdraw until tomorrow or you will lose all your interest. When tomorrow you withdraw, it will say you lost 1 day of interests!  I don't have these kind of issues with other banks so far. Cannot do online 🤔 |

|

|

|

|

|

nexona88

|

Jul 29 2022, 08:35 PM Jul 29 2022, 08:35 PM

|

|

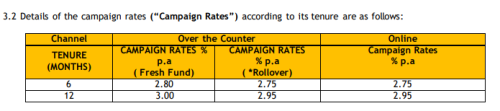

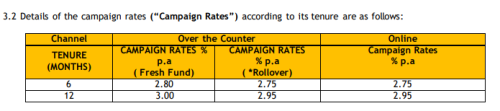

QUOTE(download88 @ Jul 29 2022, 06:19 PM) maybank m2u,mae, otc FRESH FUND (FPX/OTC) 6 Months 2.80% p.a. 12 Months 3.00% p.a. NON-FRESH FUND (Online/OTC) 6 Months 2.75% p.a. 12 Months 2.95% p.a. min placement 10k max 15mil https://www.maybank2u.com.my/maybank2u/mala...-deposit-i.page?  I'm actually surprised Tiger join the ring... On getting serious with FD.... Normally... Since they top in the market... Don't bother... I guessing there's some level of outflows to others bank FD... Thus they make some moves.... |

|

|

|

|

|

nexona88

|

Sep 8 2022, 08:09 PM Sep 8 2022, 08:09 PM

|

|

QUOTE(oldkiasu @ Sep 8 2022, 03:22 PM) Just asking. Will you place if 3.35 %, 3.5 % or 3.73%, or you will wait for more? Those "playing" FD is debt free groups... Or minimal debt... For your question... Each rate 1 batch new placement (fresh fund or existing FD maturing).... So no problem each time OPR hike, new placement.... This post has been edited by nexona88: Sep 8 2022, 08:10 PM |

|

|

|

|

|

nexona88

|

Sep 8 2022, 11:20 PM Sep 8 2022, 11:20 PM

|

|

QUOTE(bbgoat @ Sep 8 2022, 08:56 PM) I got difficulty to understand the long theory that the person trying to say, for a simple topic on FD. U got it ! Don't understand why some get so complicated with just FD... Majority who dump into FD is simple people.. Don't want headache.... If those savvy type... Don't even bother with FD... (Maybe just temporary parking place before moving into risky assets) Many others more complicated & foreign exposure for those inform groups.... |

|

|

|

|

|

nexona88

|

Sep 9 2022, 09:20 AM Sep 9 2022, 09:20 AM

|

|

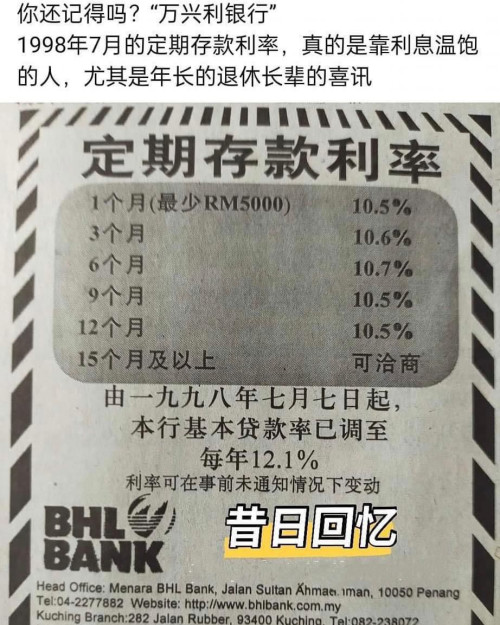

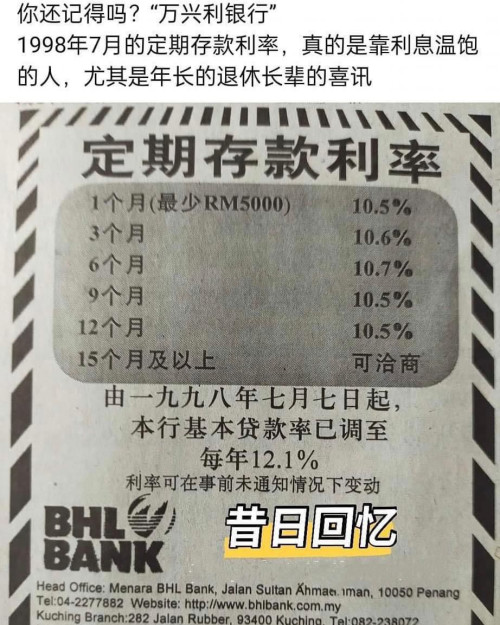

QUOTE(ManutdGiggs @ Sep 9 2022, 05:32 AM)  Dun complicate thgs We can only drool looking at history Get wateva deal suits u best. No need ttly. 🤣🤣🤣 Ahh... The good old days 👍 The bank also GG already 😃 Or become HLB 🧐🤔 |

|

|

|

|

|

nexona88

|

Sep 9 2022, 02:25 PM Sep 9 2022, 02:25 PM

|

|

QUOTE(bbgoat @ Sep 9 2022, 12:34 PM) Affin Bank FD promotion rate FOR INVIKTA CUSTOMER: ONLY FOR CONVENTIONAL FD ACCOUNT 4months 3.05%p.a. 6 months 3.40%p.a. 9 months 3.40%p.a. 12 months 3.50%p.a. Minimum placement amount RM50K Promotion period from 9 September 2022 until 30 September 2022 *rate subject to changes from time to time, will update again if there is any *Invikta FD rate only applicable placement over the counter, not applicable for online FD placement Not bad rate... As for only applies to Invikta Customer.... That one can nego 😁 case on case basis... As long full fill the 50k above $$$... Good to go 👍 Banks branch also want to hit target.... So as long got money 💰🤑 doors open up for u 😁 |

|

|

|

|

|

nexona88

|

Sep 9 2022, 05:29 PM Sep 9 2022, 05:29 PM

|

|

QUOTE(CommodoreAmiga @ Sep 9 2022, 02:58 PM) Hmm..so i can go OTC and try my luck?  Kinda.... See how desperate the branch is... Case on case basis ya.... |

|

|

|

|

|

nexona88

|

Sep 9 2022, 09:57 PM Sep 9 2022, 09:57 PM

|

|

QUOTE(sweetpea123 @ Sep 9 2022, 08:24 PM) wah, can nego ke ? Can get extra berapa % ? I didnt ask also  Those smaller banks easier to negotiate the rate... As long u got the $$$ & fulfill the requirements... More $$$ is better.... Don't go to HQ and ask... Go to branch which have lesser people... And the one I replied is for promotion FD rate for Invikta customer.... U ask nicely & nego.. can get that too....even not Invikta customer... This post has been edited by nexona88: Sep 9 2022, 09:58 PM |

|

|

|

|

|

nexona88

|

Sep 12 2022, 04:12 PM Sep 12 2022, 04:12 PM

|

|

QUOTE(bbgoat @ Sep 12 2022, 01:54 PM) RHB *New promotion for FD* 12 month @ 3.50% - min 500k 12 month @ 3.45% - min 100k 6 month @ 3.30% - min 100k Wah boss... This one really big amount Play.... 50k min don't have? Or they don't bother 😁 |

|

|

|

|

|

nexona88

|

Sep 12 2022, 04:16 PM Sep 12 2022, 04:16 PM

|

|

QUOTE(BrookLes @ Sep 12 2022, 04:15 PM) Maybe got promo... Not yet published 😁 |

|

|

|

|

|

nexona88

|

Sep 12 2022, 04:22 PM Sep 12 2022, 04:22 PM

|

|

QUOTE(BrookLes @ Sep 12 2022, 04:18 PM) Asking someone to put 500k Ppl with that money would have put that monies elsewhere a long time ago already. Unless every month i earn 300k. Just give la ppl put in 50k. or even if they are priviledge customers. Actually... With 500k Can already buy corporate bonds... Which the coupon rate is way higher than FD.... Just the risk is little higher.... |

|

|

|

|

|

nexona88

|

Sep 13 2022, 03:42 PM Sep 13 2022, 03:42 PM

|

|

QUOTE(Sitting Duck @ Sep 13 2022, 02:46 PM) FYI. For premier customer only. min 100k per cert. 200k to become premier customer. Think one of the best FD so far for 6 months. For non premier customer? Got anything interesting 🤔 |

|

|

|

|

|

nexona88

|

Sep 13 2022, 05:44 PM Sep 13 2022, 05:44 PM

|

|

QUOTE(Sitting Duck @ Sep 13 2022, 04:39 PM) For non-premier customer, I think can still request for the promo rate but subject to HQ approval. The min per cert is still RM100k. Initially I didn't want to sign up as premier customer but was told it's not possible to get the promo rate for non-premier customer. Then when I was in the counter, the lady at the counter mention that I need to sign a form to get HQ approval for the promo rate sinceI'm not a premier customer. I also confused and didn't clarify further. Ahh... Typical tactics by the branch especially the Manager 😁 Hide information from customer... Just for fulfill target HQ approvals is just formality.... Easily can get one.... Only if the branch willing to do extra work to submit your application.... Additional documentation.... |

|

|

|

|

|

nexona88

|

Sep 13 2022, 08:19 PM Sep 13 2022, 08:19 PM

|

|

QUOTE(ManutdGiggs @ Sep 13 2022, 06:17 PM) Just an email should be sufficient to do the job 🤣 That' also hard / additional work 😁 Easy way out... Cannot if not premier customer. Case close 😝 |

|

|

|

|

|

nexona88

|

Sep 16 2022, 10:14 AM Sep 16 2022, 10:14 AM

|

|

QUOTE(Alocasia @ Sep 15 2022, 09:38 PM) Wow, finally see 3.x% for 6-12mths, hopefully other banks will follow suit. Then my KDI-SAVE will be no longer promising, some more it is not PIDM protected. Some would take little longer to adjust... But borrowing rate sure faster adjust... Next day itself announced 😁 |

|

|

|

|

|

nexona88

|

Sep 16 2022, 02:25 PM Sep 16 2022, 02:25 PM

|

|

QUOTE(CommodoreAmiga @ Sep 16 2022, 01:43 PM) No. Certain banks like Bank Rakyat (originally Bank Pertanian?) don't have PIDM. Also depends on products. Only savings/current ac and pure FDs are PIDM protected. I think some term investment also not PIDM protected, but i am not so sure. Need some sifus input here. Anyway, unlikely Bank lingkup, if Bank lingkup means whole country shit hole and RM already toilet paper. Put what protection also no use. Bank Pertanian not AgroBank now? 😏 btw if not mistaken... They also have FD.... But not popular 😃 |

|

|

|

|

|

nexona88

|

Sep 16 2022, 09:48 PM Sep 16 2022, 09:48 PM

|

|

QUOTE(15cm @ Sep 16 2022, 09:43 PM) i have some money at 2.1 % for 5 years placed last year worth liquidating it and take on higher rates? Mind asking what make you to take up that 5 year FD placement 🤔 Normally people take 1 year or 15months like that... Anyway... Unless u get some $$$ by breaking... Good to go... If break & gets nothing... Don't take risk This post has been edited by nexona88: Sep 16 2022, 09:49 PM |

|

|

|

|

|

nexona88

|

Sep 17 2022, 08:15 AM Sep 17 2022, 08:15 AM

|

|

QUOTE(15cm @ Sep 16 2022, 11:51 PM) 5 year more % plus its really spare money i wont be touching most prolly until i buy a house / car or retirement. can afford to stick it there and forget Ooh like that... Was thinking different 😁 QUOTE(15cm @ Sep 16 2022, 11:51 PM) my mode is every month they credit to account. so i think i got the $$ already Good. Monthly is good... So I think can break your FD already... Now got better rate... |

|

|

|

|

|

nexona88

|

Sep 17 2022, 08:42 PM Sep 17 2022, 08:42 PM

|

|

QUOTE(CommodoreAmiga @ Sep 17 2022, 06:33 PM) Maybank kedekut as always... They don't really need the $$$ for FD... Ordinary CASA also good enough for them... Many corporate companies & Gomen agencies / school boards have account with them... |

|

|

|

|

Jul 23 2022, 08:27 PM

Jul 23 2022, 08:27 PM

Quote

Quote

0.0679sec

0.0679sec

0.37

0.37

7 queries

7 queries

GZIP Disabled

GZIP Disabled