Outline ·

[ Standard ] ·

Linear+

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

ikanbilis

|

Jul 15 2022, 11:50 AM Jul 15 2022, 11:50 AM

|

|

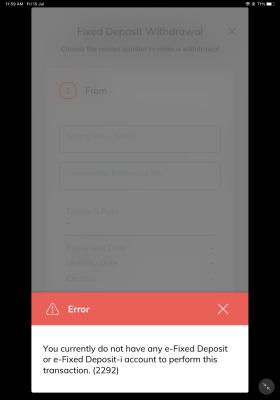

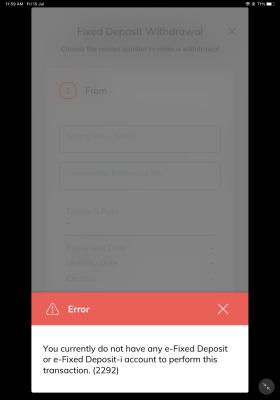

QUOTE(neenee @ Jul 13 2022, 02:43 PM) Hong Leong Bank E FD 6 Months: 2.5% 12 Months: 2.9% Just a reminder to all potential HLB efd customers. I have an efd with HLB for one year and it matured on 7.7.2022. When i tried to withdraw it online it gives an error that i have no efd with the bank. I have sent numerous emails and called them few times. For over a week now they still cannot get a solution for their technical glitch.  This post has been edited by ikanbilis: Jul 15 2022, 12:01 PM

This post has been edited by ikanbilis: Jul 15 2022, 12:01 PM |

|

|

|

|

|

ikanbilis

|

Jul 15 2022, 12:44 PM Jul 15 2022, 12:44 PM

|

|

QUOTE(oldkiasu @ Jul 15 2022, 12:05 PM) Maybe can check whether CASA creditted for non-renewal or FD auto-renewed. The principal may have increased with added on interest, but new maturity date instead to 7.7.2023. The total number of live FD should still be the same if existing FD is replaced with renewed FD. If it is not like this, then really problem. In general, the FD auto-renewal feature is something that needs to be understood by FD depositors. CASA never credited with the interest. The interest is added on to the principal which is renewed for another year. One month before maturity i asked if they could change the instruction to withdraw the principal+interest to CASA. They say cannot but i could withdraw all on maturity date. Unfortunately this has not been the case and my money has stuck there for more than a week. |

|

|

|

|

|

ikanbilis

|

Jul 15 2022, 02:52 PM Jul 15 2022, 02:52 PM

|

|

QUOTE(oldkiasu @ Jul 15 2022, 02:11 PM) So it is just an auto-renew principal and interest for another year at lower board rate. Sorry, but cannot change instruction once made original instruction at any bank. The best thing you can do now, is to premature withdrawal for the renewed eFD as quick as you can since you did not withdraw on 7.7.2022 or 8.7.2022. I don't think BNM complaint will help, since you do not understand how this FD instruction thingy works for all banks. You will not get any new interest for the renewed FD since it is now a premature withdrawal. But still it is better if you take out the money and then place at a better interest rate somewhere. This is what i am trying to do every day for a week now. I just want to premature withdraw the new eFD. I dont want any interest for the new eFD. Problem is the system doesn’t allow me and HLB customer service not able to solve despite the case being elevated to their technical team. |

|

|

|

|

|

ikanbilis

|

Jul 15 2022, 03:01 PM Jul 15 2022, 03:01 PM

|

|

QUOTE(guy3288 @ Jul 15 2022, 02:52 PM) So yours is a case of eFD due, u missed it by a week, it has auto renewed now become non eFD anymore, just go do withdrawal at bank i dont believe bank can prevent you from withdrawal.... not a case bank cheating la, scared us at first glance.... Nope i did not miss it by a week. My eFD mature on 7/7/2022 and i tried to withdraw on the same day. Not able to. I called customer service. They said i could withdraw on 8/7. Tried again 8/7, still cannot. Called them again. They say case elevated to their technical dept. since then the technical dept still cannot solve their system problem. I did not say the bank tries to cheat, but just want to highlight that HLB bank system does have a problem regarding the eFD withdrawal. Regarding withdrawal at bank, their customer service said since it is an eFD, i cannot withdraw at bank. Else i would have gone to their branch for withdrawal. This post has been edited by ikanbilis: Jul 15 2022, 03:09 PM |

|

|

|

|

|

ikanbilis

|

Jul 15 2022, 03:48 PM Jul 15 2022, 03:48 PM

|

|

QUOTE(wayton @ Jul 15 2022, 03:36 PM) It means the efd still appear in your system just you can't withdraw? Have you activated the new app authorise feature? Q1 yes correct Q2 yes activated |

|

|

|

|

|

ikanbilis

|

Jul 15 2022, 03:58 PM Jul 15 2022, 03:58 PM

|

|

QUOTE(wayton @ Jul 15 2022, 03:50 PM) Do you have the Withdraw button on the back of the eFD? Have you tried to use PC to withdraw? Q1 yes have withdrawal button Q2 yes tried PC web, ios app and android app. All same error msg i do not have eFD with the bank when i try to withdraw |

|

|

|

|

|

ikanbilis

|

Jul 16 2022, 09:36 AM Jul 16 2022, 09:36 AM

|

|

QUOTE(aeiou228 @ Jul 16 2022, 08:04 AM) This is worrying. While waiting for hq investigation. I'd suggest you go to your HLB home branch and report it to the branch manager or RM. More ppl follow up to expedite your case. Please update the forum. I have reported the case to BNM. Will update the forum if any progress next week. |

|

|

|

|

|

ikanbilis

|

Jul 19 2022, 05:21 PM Jul 19 2022, 05:21 PM

|

|

QUOTE(aeiou228 @ Jul 16 2022, 08:04 AM) This is worrying. While waiting for hq investigation. I'd suggest you go to your HLB home branch and report it to the branch manager or RM. More ppl follow up to expedite your case. Please update the forum. Update : After reporting to BNM, HLB solve the issue really fast. They called me this morning and solve the issue. My eFD has been withdrawn to my CASA. |

|

|

|

|

|

ikanbilis

|

Sep 18 2022, 03:25 PM Sep 18 2022, 03:25 PM

|

|

Today manage to open ambank account online and place the eFD 12-month 3.5%

No need visit bank branch for account opening.

This post has been edited by ikanbilis: Sep 18 2022, 03:30 PM

|

|

|

|

|

|

ikanbilis

|

Sep 18 2022, 05:21 PM Sep 18 2022, 05:21 PM

|

|

QUOTE(adele123 @ Sep 18 2022, 04:08 PM) What is the minimum you put in your ambank savings account? Will try again after seeing your post. I failed many months ago and lazy to retry after that. I put in rm300 true savers account though the minimum is rm100. Think got promotion put in rm300 can get rm10 cashback but not very sure coz i have not seen the rm10 credited. Maybe the quota has been reached. https://www.ambank.com.my/eng/promotions-pa...Online-CashbackThis post has been edited by ikanbilis: Sep 18 2022, 05:31 PM |

|

|

|

|

|

ikanbilis

|

Sep 19 2022, 01:31 AM Sep 19 2022, 01:31 AM

|

|

QUOTE(cybpsych @ Sep 18 2022, 06:25 PM) which bank account type? I tried looking for bsa without fee, doesn't seem available for online account opening (via amonline app) seems got 3 account type jek I choose the true savers savings acc as it mention free for life. But i dont know if they will charge me any annual fee for the debit card. |

|

|

|

|

|

ikanbilis

|

Sep 19 2022, 12:25 PM Sep 19 2022, 12:25 PM

|

|

QUOTE(!@#$%^ @ Sep 18 2022, 06:30 PM) get debit card? got annual fee? Today check my ambank online account kena charge RM12 debit card issuance fee.  |

|

|

|

|

|

ikanbilis

|

Nov 9 2022, 08:09 PM Nov 9 2022, 08:09 PM

|

|

QUOTE(don123 @ Nov 9 2022, 08:00 PM) I went to CIMB to check for the 4.05%. The bank said is a TIA term investment account. She said is the same as per FD. But I don't believe. All sifu here, may tell me what is the TIA about? is it really the same as per FD? TIA has no PIDM protection. Although the risk is very small, but if their investment really screw up, you may lose your money. |

|

|

|

|

|

ikanbilis

|

Nov 10 2022, 12:01 PM Nov 10 2022, 12:01 PM

|

|

QUOTE(woowoo1 @ Nov 10 2022, 10:44 AM) BTW this can be done online fpx by choosing term deposit-i promo. For those lazy to go bank counter Solved. Need to open the term-deposit i. This post has been edited by ikanbilis: Nov 10 2022, 12:10 PM |

|

|

|

|

|

ikanbilis

|

Nov 10 2022, 01:03 PM Nov 10 2022, 01:03 PM

|

|

[quote=elea88,Nov 10 2022, 12:19 PM] [quote=woowoo1,Nov 10 2022, 10:44 AM] BTW this can be done online fpx by choosing term deposit-i promo. For those lazy to go bank counter [/qu wah so this is the best so far [/quote] I compare 18-month BI 4.4% vs PB TD-i 4.2%. For every RM50k the difference is RM150. I am willing to forgo this RM150 to have the convenience of placing online over the hassle of going to BI OTC placement. |

|

|

|

|

|

ikanbilis

|

Nov 10 2022, 11:04 PM Nov 10 2022, 11:04 PM

|

|

QUOTE(cybpsych @ Nov 10 2022, 08:15 PM) bank Islam or bank rakyat which one has good experience in opening account? I know BIMB is asking extra documents. BI officer told me they only need MyKad and driving license. If no driving license then only they need extra document like utility bill. |

|

|

|

|

|

ikanbilis

|

Nov 16 2022, 12:22 PM Nov 16 2022, 12:22 PM

|

|

QUOTE(cclim2011 @ Nov 16 2022, 12:15 PM) far lo 21 min drive from me. haha. the uplift also can do online? what's maximum daily transfer? got basic savubg acct wothout fee? 😁 too little branch la this mbsb. less than bank islam i think I tried opening mbsb account online through KYC yesterday without going to branch. Now waiting for approval. Previously i open Ambank account online and i was given account number immediately. |

|

|

|

|

|

ikanbilis

|

Nov 23 2022, 09:34 AM Nov 23 2022, 09:34 AM

|

|

QUOTE(elea88 @ Nov 23 2022, 08:58 AM) hmmm.. i was hoping it will be automated. o.k later i call and update here if can do everything online. I applied mbsb online account and no news from them for a week now. Yesterday i called mbsb HQ and they told me they would follow up with the branch i chose. Two hours later the branch called me they would send me the account number through sms. Wait whole day no sms sent. Seems like i chose a branch that is totally inefficient. This post has been edited by ikanbilis: Nov 23 2022, 09:37 AM |

|

|

|

|

|

ikanbilis

|

Nov 23 2022, 10:54 AM Nov 23 2022, 10:54 AM

|

|

QUOTE(elea88 @ Nov 23 2022, 10:37 AM) i just called branch. yes she say.. receive application. tunggu ac number via sms... then i tell her Saya minat nak 6mths fd 4%.. she reply:... Eh tak boleh tu.. kena datang branch. then i say. kalau datang branch i tak minat la nak buka account... buang masa.. Website tulis boleh online.. well.. the reply is Saya tak pasti la. lepas ac buka you cubala. tapi datang branch rate best lagi oh well.. lets see how. Just received mbsb sms giving me account number. Let me try if can put eFD after activating the account. |

|

|

|

|

|

ikanbilis

|

Nov 24 2022, 08:31 AM Nov 24 2022, 08:31 AM

|

|

QUOTE(wilson7847 @ Nov 24 2022, 08:16 AM) For MBSB, can we place eFD after open saving acc online? If yes, which saving acc is prefer, PrimeWin or Wise Saver? After getting acc no. by sms yesterday, today i am able to open online account and then manage to place eFD with TD-i Booster 6 months 4%. My acc is PrimeWin. Everything is done without the need of going to mbsb branch. This post has been edited by ikanbilis: Nov 24 2022, 08:54 AM |

|

|

|

|

Jul 15 2022, 11:50 AM

Jul 15 2022, 11:50 AM

Quote

Quote 0.0609sec

0.0609sec

0.30

0.30

7 queries

7 queries

GZIP Disabled

GZIP Disabled