Outline ·

[ Standard ] ·

Linear+

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

contestchris

|

Mar 18 2023, 10:00 AM Mar 18 2023, 10:00 AM

|

|

QUOTE(AVFAN @ Mar 18 2023, 09:17 AM) it does get confusing with all these banks offering all kinds of deposits and investments with all kinds of names and conditions. they even use terms like "unfixed deposit"! as a cimb customer for a long time, i also sometimes can't fully understand when they come up with something new. and becos some of these products are offered exclusively via conventional, islamic, preferred, OTC, online etc... it adds to the confusion. but generally speaking: efd/efriai = online FD; PIDM protected; need to use desktop, not mobile; no diff if u do OTC; promo rates always higher than normal. https://www.cimb.com.my/en/personal/promoti...fd-efria-i.htmlTIA = term inv account, it's "inv", subject to final outcome; not protected by PIDM. https://www.cimb.com.my/en/personal/day-to-...-account-i.htmlBundled offers = friai bundled with gold, unit trusts, insurance. https://www.cimbpreferred.com.my/en/preferr...paign-2023.htmlif in doubt, do check with bank manager. Some like RHB also usr the term "term deposit". I'm surprised the product has not been standardised by BNM. |

|

|

|

|

|

contestchris

|

Mar 20 2023, 01:18 PM Mar 20 2023, 01:18 PM

|

|

QUOTE(virtualgay @ Mar 20 2023, 01:07 PM) do you think bank in Malaysia will increase FD interest to be more liquid so BANK RUN wont happened to them? or Malaysia bank is very liquid and there is nothing to worry? Our banks have very strong capital and liquidity positions. The BNM requirements for our banks is even more onerous than the regulations for banks in the USA. |

|

|

|

|

|

contestchris

|

Mar 20 2023, 09:55 PM Mar 20 2023, 09:55 PM

|

|

QUOTE(virtualgay @ Mar 20 2023, 03:47 PM) i believe most of us who ride on AMBANK 4% FD for 2 months is maturing. for me i am moving it over to RHB to get 4.05% for 3 months as i still believe that next MPC Meeting should have some positive news for most of us here. OPR chances of going down is close to zero. maintain or up saja... next MPC Meeting - 02 & 03 May 2023 (Tuesday & Wednesday) What folly, have you learned nothing for the past 2 or 3 years? "OPR chances of going down is close to zero. maintain or up saja..."

|

|

|

|

|

|

contestchris

|

Mar 25 2023, 08:09 PM Mar 25 2023, 08:09 PM

|

|

All things said, Malaysian banks are subject to far more stringent solvency/liquidity requirements as compared to US regional banks (and maybe even US tier 1 banks). On top of that, Malaysian banks are not known to make speculative plays, plus our OPR never went down to near zero.

It's unlikely the bank runs we're seeing on the US regionals and European banks will spread to Malaysia, those guys have been pretty reckless (see Credit Suisse and Deustche Bank) or subject to less stringent oversight (US regionals such as SVB).

Still, we will be subject to systemic risk, and in that case, everyone everywhere will be fcked.

|

|

|

|

|

|

contestchris

|

Apr 2 2023, 10:48 PM Apr 2 2023, 10:48 PM

|

|

What's the best 3m/4m eFD promo (preferably MBB, RHB, Affin), my current 4m eFD just matured today.

|

|

|

|

|

|

contestchris

|

Apr 26 2023, 01:54 PM Apr 26 2023, 01:54 PM

|

|

100k units are reserved or must fight?

|

|

|

|

|

|

contestchris

|

May 19 2023, 03:42 PM May 19 2023, 03:42 PM

|

|

Banks have too much liquidity already now, not so hungry for funds anymore

|

|

|

|

|

|

contestchris

|

May 24 2023, 11:12 AM May 24 2023, 11:12 AM

|

|

QUOTE(cclim2011 @ May 24 2023, 10:46 AM) the only one that openly rejected my request for non-fee BSA is ambank so far 🙄 i have non fee bsa witb atm card with cimb, pbe, bi, rhb All must provide, you should threaten AmBank, you will be surprised they will give you a zero fees account before you know it all of a sudden. |

|

|

|

|

|

contestchris

|

May 24 2023, 03:45 PM May 24 2023, 03:45 PM

|

|

QUOTE(voc8888 @ May 24 2023, 03:24 PM) You have succeeded?  Not Ambank but with other banks. Foreign banks are exempt, local banks are not. |

|

|

|

|

|

contestchris

|

May 31 2023, 11:14 PM May 31 2023, 11:14 PM

|

|

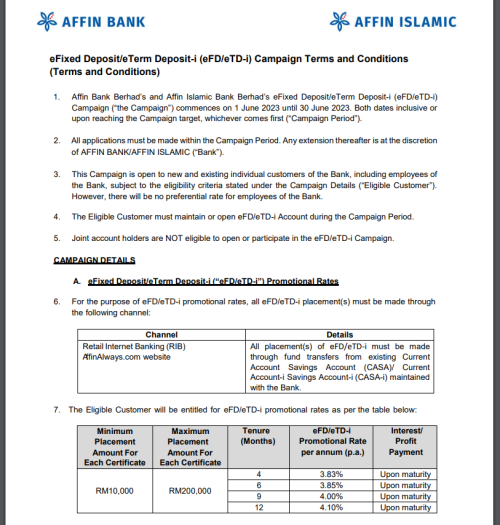

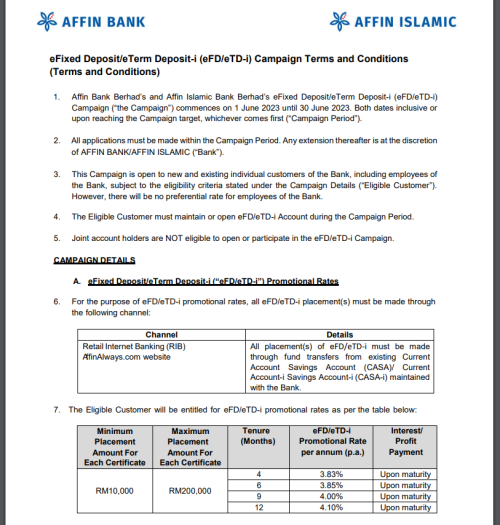

Affin still 4.0% for 9m and 4.1% for 12m. I've placed with them before, quite okay and the best part is at maturity it will auto send principal + interest into your savings account.  |

|

|

|

|

|

contestchris

|

Jun 20 2023, 11:43 AM Jun 20 2023, 11:43 AM

|

|

QUOTE(BWassup @ Jun 20 2023, 11:31 AM) Just a note: BR is not under PIDM Really?? |

|

|

|

|

|

contestchris

|

Sep 16 2023, 01:45 PM Sep 16 2023, 01:45 PM

|

|

QUOTE(fabu8238 @ Sep 16 2023, 08:19 AM) The table which shows the OPR of various countries - all I want to say is high OPR does not mean high FD rates. Th e author should also provide a column to show the average FD rates. Strongly correlated. Last year FD were running ahead cause banks were expecting higher future OPR levels due to the escalating inflation, now that this is no longer a concern banks are dialling back their FD rates. |

|

|

|

|

|

contestchris

|

Sep 20 2023, 10:50 AM Sep 20 2023, 10:50 AM

|

|

My RHB eFD matures today, but when I click on withdraw, it seems like only the principle is being withdrawn....can anyone confirm?

|

|

|

|

|

|

contestchris

|

Sep 20 2023, 11:23 AM Sep 20 2023, 11:23 AM

|

|

QUOTE(poweredbydiscuz @ Sep 20 2023, 10:53 AM) Try proceed until the final approval/authorize screen on your phone app, it should show the included interest amount there. Okay nvm, the interest was already credited into my CASA. Very odd method they have. |

|

|

|

|

|

contestchris

|

Sep 24 2023, 06:58 PM Sep 24 2023, 06:58 PM

|

|

QUOTE(ManutdGiggs @ Sep 24 2023, 06:04 PM) It's all bout what's the sentiment during the end of the fd tenure. Most of the time it's not only a decision made on current sentiment. Not only sentiment, but banks funding needs. If they're hungry for funding, they don't mind paying a bit more. Deposits are still the cheapest source of funding for banks. If they're holding excess liquidity, they will not bother. |

|

|

|

|

|

contestchris

|

Sep 29 2023, 10:31 PM Sep 29 2023, 10:31 PM

|

|

QUOTE(BrookLes @ Sep 29 2023, 02:38 PM) No need to go bank to cancel. Can just call them up and cancel. And at the same time ask if your internet banking can still be used or not. Yes can call to cancel but if need to reset Internet banking stuff then becomes issue. Better way is just switch to rm0 debit card. All banks have it. I have rm0 card for Maybank, RHB and Affin. |

|

|

|

|

|

contestchris

|

Sep 30 2023, 05:13 PM Sep 30 2023, 05:13 PM

|

|

QUOTE(ericlaiys @ Sep 30 2023, 03:40 PM) too basic saving account without any benefit. Yes but you can then have a second account with no debit card with nonissues accessing or resetting online banking. I have this for RHB. In fact even managed to tag the RM0 debit card to the Smart Account |

|

|

|

|

|

contestchris

|

Sep 30 2023, 05:36 PM Sep 30 2023, 05:36 PM

|

|

QUOTE(Matchy @ Sep 30 2023, 02:27 PM) Normally those RM0 debit card is only for basic saving account. (BNM requirement?) Actually I think this is untrue. I have an old Wadiah Savings Account at Maybank. Its not the Basic Savings Account. Yet I managed to walk in to the branch and get then to change it to the RM0 version. |

|

|

|

|

Mar 18 2023, 10:00 AM

Mar 18 2023, 10:00 AM

Quote

Quote

0.0781sec

0.0781sec

0.82

0.82

7 queries

7 queries

GZIP Disabled

GZIP Disabled