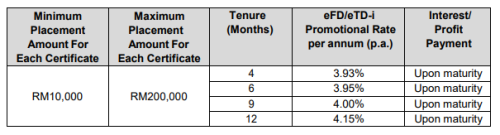

Nvm, I found the RHB offer. Need to log in to see.

One question to all sifus:

"Upon maturity, the e-CMDi/e-FD placement amount together with the profit/ interest earned shall be automatically renewed to an ordinary Comodity Murabahah Deposit-i (“CMD-i”) / Fixed Deposit (“FD”) with the same tenure at the prevailing board rate as per published in RHB Group website."

Unlike my experience with MBB and Affin which clearly state that at maturity the principal and interest earned will be deposited back into my savings account, how will it work in this case? I must manually "cancel" the FD placement is it? If so, any troubles with that? I'd have much preferred if it was auto, but if manual, anything to be aware of? If it starts renewing to another term, will I incur any penalty for "cancelling" it?

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

Jan 19 2023, 07:39 PM

Jan 19 2023, 07:39 PM

Quote

Quote

0.0726sec

0.0726sec

0.88

0.88

7 queries

7 queries

GZIP Disabled

GZIP Disabled