QUOTE(bbgoat @ Oct 31 2023, 08:29 AM)

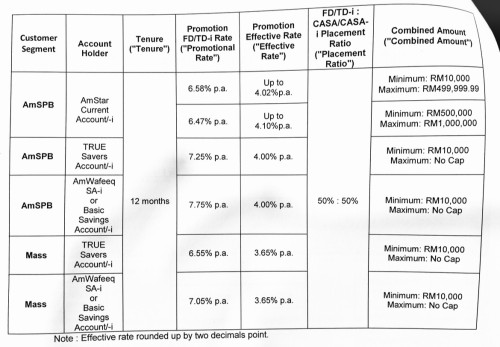

I tired to read the T n C of the True Saver/FD combo. So long as the True Saver 50% (MAB monthly average balance) amount is counted in the bonus interest, should be OK to achieve higher than the non bonus of 4.0%. Also fulfilling the other requirements listed like 3k bank in, spending/usage of credit cards etc.

However the 18 month 4.1% is good that in case the OPR drops then we can enjoy longer period of higher interest vs the above 12 months.

Add Thurs OPR meeting announcement. Today got FD matured. Haha.

Wait for OPR outcome before placing FD? Who knows, BNM might have to raise rates to stabilise the ringgit, tho analysts' consensus is no hike.However the 18 month 4.1% is good that in case the OPR drops then we can enjoy longer period of higher interest vs the above 12 months.

Add Thurs OPR meeting announcement. Today got FD matured. Haha.

Oct 31 2023, 10:59 AM

Oct 31 2023, 10:59 AM

Quote

Quote

0.0572sec

0.0572sec

0.66

0.66

7 queries

7 queries

GZIP Disabled

GZIP Disabled