Malaysia's central bank seen cutting key rate as coronavirus forces fresh lockdownsKUALA LUMPUR (Jan 18): Malaysia's central bank is expected to cut key interest rates to historic lows on Wednesday, according to a Reuters poll, after surging coronavirus infections led the government to impose fresh lockdowns, further curbing economic activity.

Nine out of 15 economists expected Bank Negara Malaysia (BNM) to cut its overnight policy rate to a record low of 1.50%, according to the poll on Monday, with another analyst betting on a bigger 50 basis point cut.

The remaining five expected the central bank to stay put.

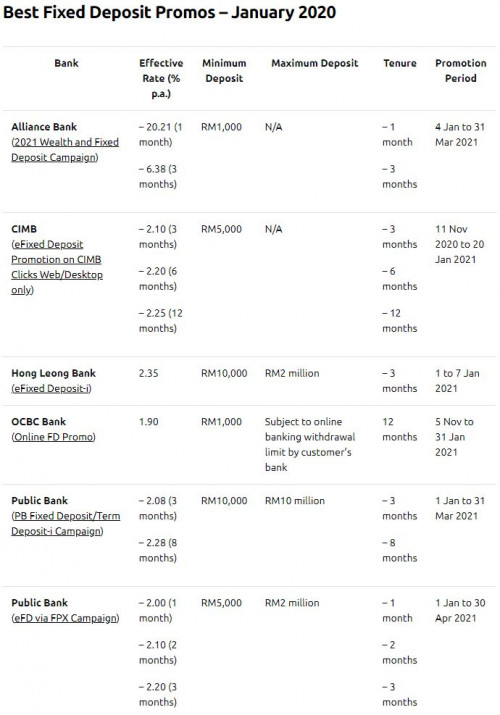

https://www.theedgemarkets.com/article/mala...fresh-lockdownsLet’s see after wed who will have the best fd promo ....

Tough decision ahead for Bank Negara on OPRPETALING JAYA: Malaysia’s overnight policy rate (OPR) has been at its all-time low at 1.75% since July last year as Bank Negara’s Monetary Policy Committee (MPC) sought to accelerate economic recovery post movement control order (MCO).

Ahead of the MPC's first two-day meeting this year starting on Wednesday, economists are quite divided this time around as Malaysia is placed under a second round of MCO, with both sides of the fence having strong views on why the central bank should maintain or cut the OPR.

A Bloomberg poll of 24 economists was equally divided between a retention of 1.75% and a reduction to a new low of 1.5%.

Reuters’ polled a more pessimistic view with nine out of 15 economists expecting a cut to 1.5%, five expecting the rate to be maintained while another expected a 50 basis points (bps) cut to 1.25%.

UOB Malaysia senior economist Julia Goh was one of them who projected a 25bps cut to 1.50% in view of the worsening pandemic, tighter containment measures and weaker growth outlook.

https://www.thestar.com.my/business/busines...k-negara-on-opr

Feb 13 2019, 09:05 AM

Feb 13 2019, 09:05 AM

Quote

Quote

0.0695sec

0.0695sec

0.57

0.57

7 queries

7 queries

GZIP Disabled

GZIP Disabled