Outline ·

[ Standard ] ·

Linear+

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

SUSBrookLes

|

Apr 4 2023, 09:12 AM Apr 4 2023, 09:12 AM

|

|

QUOTE(AVFAN @ Apr 4 2023, 09:08 AM) if a bank gives too high interest rate for deposits, they need to loan them out at even higher rates to make a decent spread. often, that leads to riskier loans, unqualified loans. and that, is one major reason some banks come under stress when the crunch comes, will even fail if there's a run on it. our local banks are generally conservative which is good, the most conservative ones being public bank n maybank. that's why they r the strongest n most resilient. Reason why I wrote that is because. No point giving "up to4 .25%" when a few banks can give that rate anyway. What I was implying is. Still give 4.25% but when rates rises, then give up to 4.5%. |

|

|

|

|

|

SUSBrookLes

|

Apr 12 2023, 12:35 PM Apr 12 2023, 12:35 PM

|

|

QUOTE(joice11 @ Apr 12 2023, 10:03 AM) promo rate only apply to 3 month and above, any promo rate for 1 or 2 month? 1 or 2 months just put at versa for first 30k and the rest at kdi |

|

|

|

|

|

SUSBrookLes

|

Apr 12 2023, 12:37 PM Apr 12 2023, 12:37 PM

|

|

QUOTE(joeblow @ Apr 11 2023, 11:34 PM) Which bank now gives 4.35% for 12 months? Anyway my rhb Branch manager seems to be clueless about this 4.3% 12 months... Fed up. Ppl are getting more and more incompetent these days And they are not hiding it. In the past, they would have at least hide their incompetence by calling up their hq or something. Sure you would not have posted here if they did that |

|

|

|

|

|

SUSBrookLes

|

Apr 19 2023, 01:29 PM Apr 19 2023, 01:29 PM

|

|

QUOTE(BoomChaCha @ Apr 19 2023, 01:28 PM) MBSB Latest Promo - No Monthly Interest[attachmentid=11465694] Thx for sharing. |

|

|

|

|

|

SUSBrookLes

|

Apr 20 2023, 03:29 PM Apr 20 2023, 03:29 PM

|

|

QUOTE(woowoo1 @ Apr 20 2023, 09:14 AM) Look carefully at mbsb 4.35% rate promotion period is 20 April 2022 to end of May 2022. It is not 2023 If they give this kind of promotion last year, everyone will take it without closing an eye. |

|

|

|

|

|

SUSBrookLes

|

May 20 2023, 02:46 PM May 20 2023, 02:46 PM

|

|

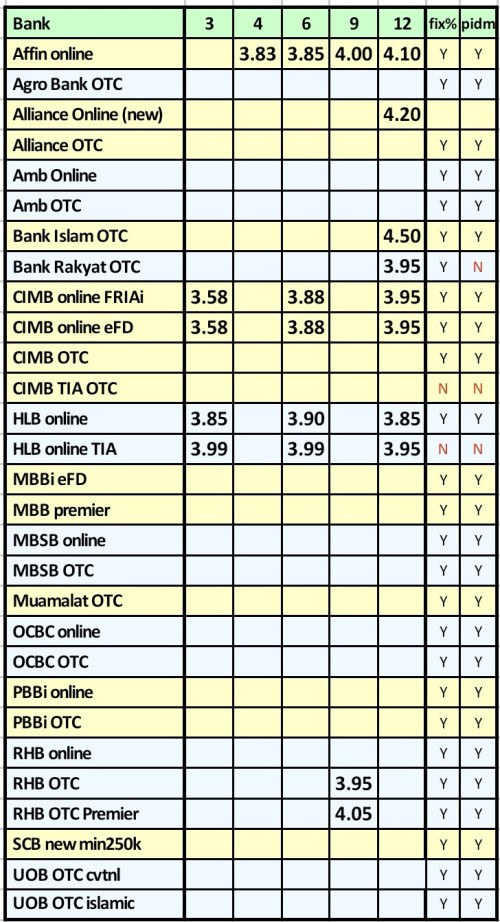

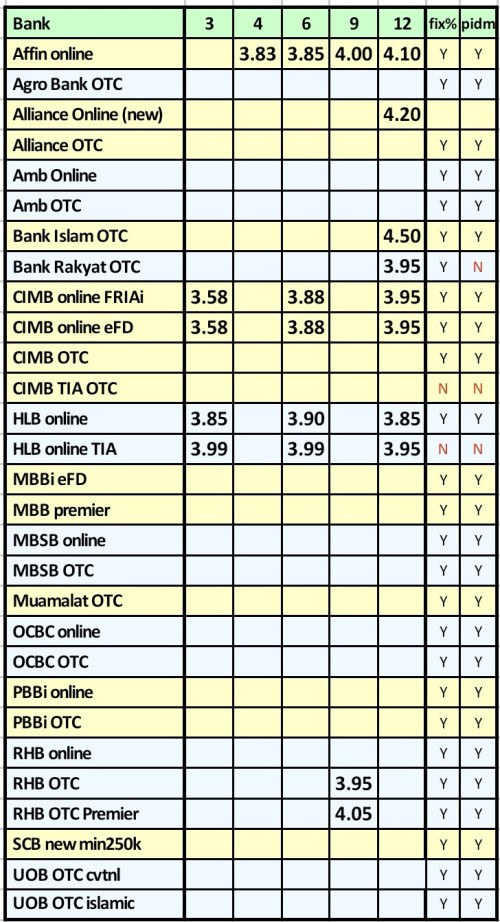

QUOTE(cclim2011 @ May 18 2023, 11:19 PM) thanks for the input ya. updated as below. let's promote bank islam 4.5 haha none of the cimb officers in the branch knew about this 4.5%  Thanks. Really appreciate this. |

|

|

|

|

|

SUSBrookLes

|

Jun 28 2023, 02:57 PM Jun 28 2023, 02:57 PM

|

|

QUOTE(Human Nature @ Jun 28 2023, 07:31 AM) Correct. For example, BR limit is RM50k Dun think 50k is the limit for br. Just that you cannot uplift in other branches if your cert is more then 50k. But if you have say 3 20k certs you can uplift. Really stupid system if you ask me. |

|

|

|

|

|

SUSBrookLes

|

Jun 28 2023, 08:50 PM Jun 28 2023, 08:50 PM

|

|

QUOTE(reversependulum @ Jun 28 2023, 02:10 PM) Bank NPL goes up so need to reduce FD rate to earn back. Wrong logic actually. It depends if banks need more money. If yes, they have to increase FD. Also if there is another large entity willing to borrow money from the bank This post has been edited by BrookLes: Jun 28 2023, 08:50 PM |

|

|

|

|

|

SUSBrookLes

|

Jul 4 2023, 05:36 PM Jul 4 2023, 05:36 PM

|

|

QUOTE(LoTek @ Jul 4 2023, 05:15 PM) I feel you, this is the time where flexi loan accounts really shine. Why? Flexi loan only allows you to pay back your loans a bit earlier right? |

|

|

|

|

|

SUSBrookLes

|

Jul 4 2023, 05:38 PM Jul 4 2023, 05:38 PM

|

|

QUOTE(ikanbilis @ Jul 4 2023, 04:06 PM) Finally went to BI for the 4.5% FD. Seems very old school and said my FD cert would only be given after my bankers check cleared. Must open savings account so the interest could be credited upon maturity. It has been a long time since i last saw a savings passbook. [attachmentid=11472159] I went there 2 weeks ago. They just gave me a FD cert after I gave them my banker cheque |

|

|

|

|

|

SUSBrookLes

|

Jul 4 2023, 05:39 PM Jul 4 2023, 05:39 PM

|

|

QUOTE(Micky78 @ Jul 4 2023, 04:01 PM) what i worry and sad the most is when OPR increased... bank loan interest increase but FD remain the same.. noted my loan statement.. every mth extra few hundred is interest portion... Actually this make sense. When opr increase, there will be less loan demands. Naturally the banks has no obligation to increase their promo rates. I would take advantage of the bank Islam promo as much as possible right now. |

|

|

|

|

|

SUSBrookLes

|

Jul 4 2023, 05:41 PM Jul 4 2023, 05:41 PM

|

|

QUOTE(AVFAN @ Jul 4 2023, 02:20 PM) there is a split, no consensus among banks on coming BNM Jul 6 meeting. but given that BNM been intervening in the FX market lately to "peg" RM to 4.666 per $, and they dun like that... my bet is a 25bps raise is coming. more so when u consider fed having said there will be "2 more hikes this year". I think there will be an increase. Cannot just let the ringgit go down. I dun think voters will be happy if that happens. |

|

|

|

|

|

SUSBrookLes

|

Jul 4 2023, 05:57 PM Jul 4 2023, 05:57 PM

|

|

QUOTE(HolyCooler @ Jul 4 2023, 05:54 PM) Flexi loan allows u to save lots of interests paid to the bank. Let's say you buy a house with rm 1million, you can make advanced payment rm 990K, bank will only calculate the interest based on the remaining 10K. And if you need money, you can withdraw from the advanced payment any time. Let's say if you withdraw 90K, now you owes the bank 100k, interest rate will be charged based on the 100k. Ok thx |

|

|

|

|

|

SUSBrookLes

|

Jul 5 2023, 07:05 PM Jul 5 2023, 07:05 PM

|

|

QUOTE(AVFAN @ Jul 5 2023, 06:08 PM) very true... more so when u hv 1.5 tril and rising debt hanging on yr neck, u dun hv many tools to fight. as it happened, today's announcement of state elections on aug 12 may preempt BNM decision tmr. u dun do a suicide stunt like announce elections and then announce interest rate hike!  now, more likely no change for now, hold till sep 7. I dunno. I mean MYR drop also make ppl no happy right? |

|

|

|

|

|

SUSBrookLes

|

Jul 5 2023, 07:06 PM Jul 5 2023, 07:06 PM

|

|

QUOTE(CommodoreAmiga @ Jul 5 2023, 06:50 PM) I can guarantee tomorrow no hike, or my name is BBC Micro! And their announcement will determine what is MYR value tomorrow. |

|

|

|

|

|

SUSBrookLes

|

Jul 7 2023, 03:43 PM Jul 7 2023, 03:43 PM

|

|

QUOTE(HolyCooler @ Jul 6 2023, 04:41 PM) Is this RIZE suitable for saving > rm 200k? Any protection similar to PIDM? Thanks. Would not put too much money on a digital bank where there is not many brick and mortar branches. |

|

|

|

|

|

SUSBrookLes

|

Jul 7 2023, 07:29 PM Jul 7 2023, 07:29 PM

|

|

Got a few post deleted over here even though I replied appropriately.

Seems like got a few insecure ppl around.

|

|

|

|

|

|

SUSBrookLes

|

Jul 7 2023, 10:07 PM Jul 7 2023, 10:07 PM

|

|

QUOTE(nexona88 @ Jul 7 2023, 09:53 PM) Strictly only FD discussion... If not, expect multiple reports on off topic discussion & posting / replies Welcome to the club   Pm you. |

|

|

|

|

|

SUSBrookLes

|

Jul 22 2023, 03:59 AM Jul 22 2023, 03:59 AM

|

|

QUOTE(nexona88 @ Jul 21 2023, 11:20 PM) Seriously... Probably already have endless $$$ in hand now 😁 too much liquidity... Good things always needs to come end.... Need to look others places like BR or BSN... If they got good rate (I think it's around 4.3% like that).... So which is the best promo now? Now I regret. Maybe should have just took our Versa money and put inside. At least secure this 4.5 for 1 year. This post has been edited by BrookLes: Jul 22 2023, 04:06 AM |

|

|

|

|

|

SUSBrookLes

|

Jul 22 2023, 04:01 AM Jul 22 2023, 04:01 AM

|

|

QUOTE(joeblow @ Jul 21 2023, 07:52 PM) Branch manager sent me info on this. I thought the promo until end of the year? Wow they just stop like this? This post has been edited by BrookLes: Jul 22 2023, 04:09 AM |

|

|

|

|

Apr 4 2023, 09:12 AM

Apr 4 2023, 09:12 AM

Quote

Quote

0.0588sec

0.0588sec

0.38

0.38

7 queries

7 queries

GZIP Disabled

GZIP Disabled