FOR THOSE INTERESTED IN THE TECHNICAL DETAILS-

The mistake is that you have 2 wrong ideas about FD which is commonly held by many people - until they start calculating and realise what is wrong.

It does not seem to be right because you do not understand the basic fact that compound interest calculation formula in FD calculations is normally not valid in Malaysia. All FD calculations are actually Simple Interest calculations. In Malaysia, almost all banks use calculation based on the numebr of days involved (except Alliance formerly - don't know whether they had conformed now) and a year of 365 days regardless of leap year (except Maybank) based on actual interests given over the last few years.

Most financial writings will use the word "compounding" or "magic of compound interest". But this was applicable to a time in the past in Malaysia when interest was calculated on a monthly basis, or a yearly basis (difficulty without calculators and computers). But the fact is both cases were replaced by days basis. However, all these obsolete ideas have not been taught as obsolete as people seem to have the idea that arithmetic is always right and static and same, not realising it is no longer applicable/correct anymore as in the school, books, references and previous financial training or previous experience on interest collected. Hence, we need to stress the importance of an attitude to lifelong learning and adaptation to changes/improvements as the real lesson of education. What is learnt is not as important as adapting/innovating to different situation or improving the situation.

The FD interest is creditted to your saving account every 6 months. It is wrong and misleading to use the word "compound" to trick gullible customers into associating this as increasing the principal (RM 130,000). Technically FD never can increase their principal during the agreed tenure. An add on of the interest can only happen after the FD matures and a new FD comes into force (after 18 months in this case).

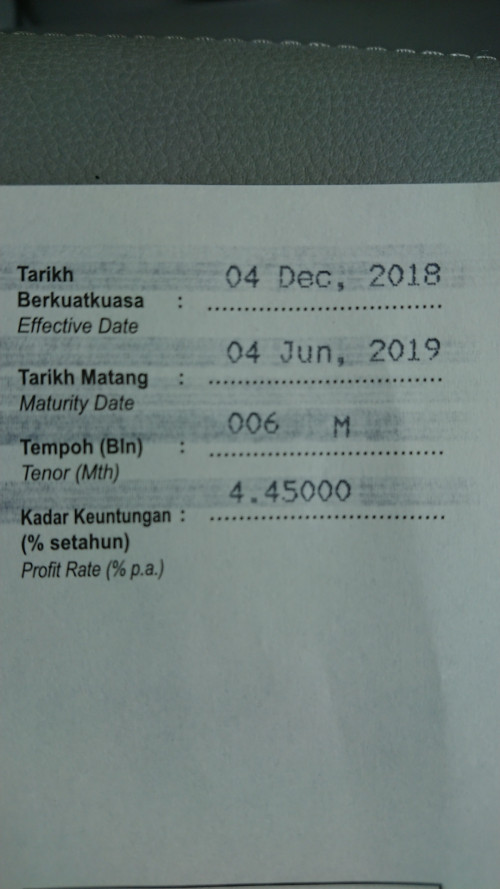

The calculation of your FD placement can be explained as follows:-

Say placement, Effective Day (or Value Day etc) is Thursday 31 January 2019.

Maturity Day (or date you can go to the bank to take out the principal) is then Friday 31 July 2020.

Number of days (Interest Bearing Days IBD) = Maturity Date - Effective Date = 547 IBD.

Profit Due (Interest, Dividend etc) = Principal x rate p.a. x IBD / 365 = 130,000 x 4.49 /100 x 547/365 = 130,000 x 4.49 x 547 / 36500 =8747.5041...

Some banks will simply round to nearest, but some will round down to sen (can't give you money bank did not get kind of idea, and also to ensure never overpay). But in this case, no question should be 8747.50. Thus in the end the total amount or Selling Price 130,000+8747.50 = 138,747.50 is correct.

You should note that you will not get this Selling Price on Maturity Date because two 6 month profit payments were already paid into your savings account. You will only get 130,000 + (8747.50 - 2 payments paid).

Note that 2020 is a leap year of 366 days, but the calculation divisor remains at 365.

If you had placed on Friday 1 February 2019, you should know that exactly 18 months later is actually Saturday 1 August 2020. For over the counter (OTC) FD, you may be given extra interest for Sunday 2 August if you show up on Monday 3 August 2020.

You should always check with calendar on planned Effective Date and the day of Maturity Date and the first applicable Bank Working Day after weekends, scheduled holidays or semi-annual or annual adjustments (only for some banks) and whenever you place between 29-31 of the month. All these affect the IBD calculation and hence interest and cash flow and when you should go to the bank. Some banks will adjust the Maturity Date at placement, but some will maintain even if it a weekend or scheduled Public Holiday. In the latter style, the extra interest may be given automatically, or on application only, or not at all depending on the bank and you.

.

Dec 5 2018, 03:21 PM

Dec 5 2018, 03:21 PM

Quote

Quote

0.0520sec

0.0520sec

0.87

0.87

7 queries

7 queries

GZIP Disabled

GZIP Disabled