$ index 103.10

euro 1.04

yen 118.5

rm still at 4.46, nice of bnm!

USD/MYR v5

|

|

Dec 15 2016, 07:46 PM Dec 15 2016, 07:46 PM

Return to original view | Post

#41

|

All Stars

24,455 posts Joined: Nov 2010 |

ooo....

$ index 103.10 euro 1.04 yen 118.5 rm still at 4.46, nice of bnm! |

|

|

|

|

|

Dec 16 2016, 10:27 AM Dec 16 2016, 10:27 AM

Return to original view | Post

#42

|

All Stars

24,455 posts Joined: Nov 2010 |

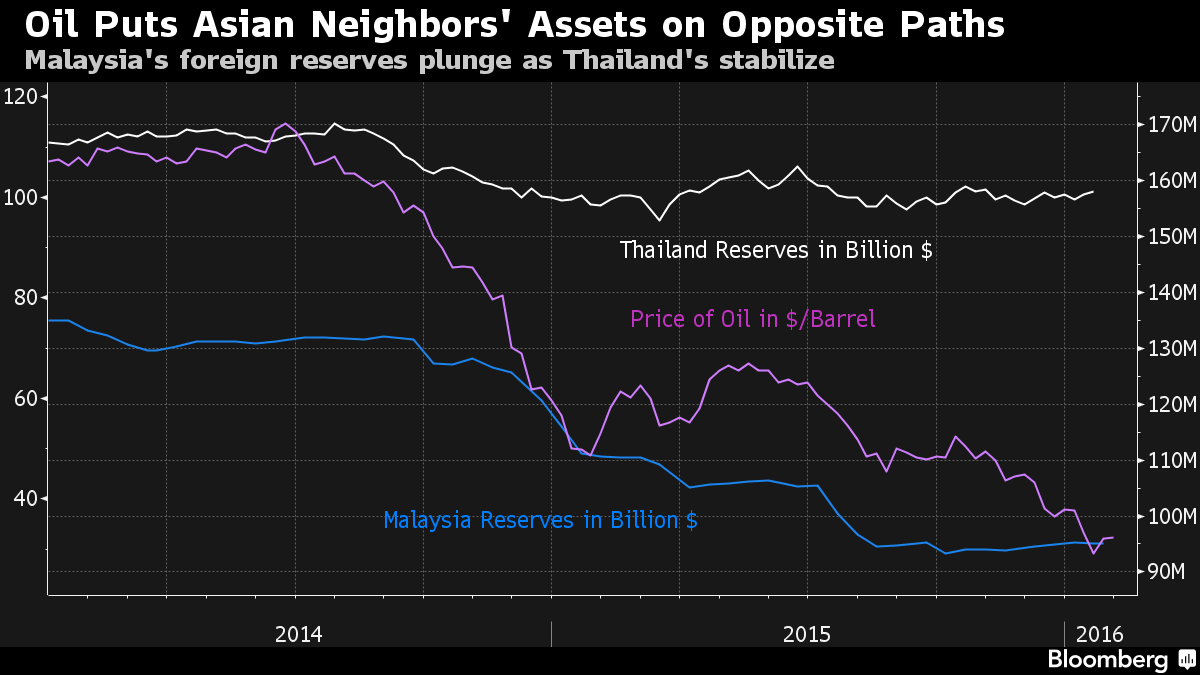

QUOTE(the99percent1 @ Dec 16 2016, 08:57 AM) think it was 1.9 bil.but yes, little doubt more reserves now being burned to keep it <4.50. imo, it won't hold for long. even the SGD is expected to slide to 1.50 with USD next year. https://www.bloomberg.com/news/articles/201...low-amid-easing |

|

|

Dec 16 2016, 12:15 PM Dec 16 2016, 12:15 PM

Return to original view | Post

#43

|

All Stars

24,455 posts Joined: Nov 2010 |

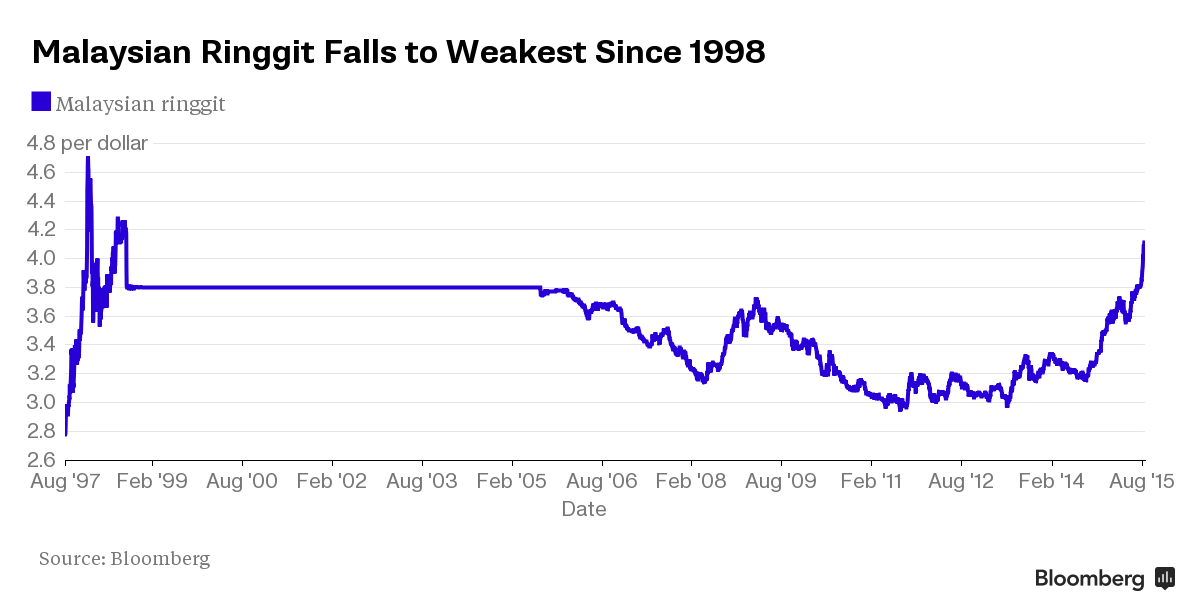

QUOTE(nexona88 @ Dec 16 2016, 12:04 PM) Hong Leong IB expect the ringgit to move around 4.20 - 4.50 range next week.. clever prediction! And 4.10 - 4.40 range next year.. if u go to HLB or Ambank or CIMB now, you will pay >4.50 for $1. already saw that in Ambank 2 days ago. latest report... QUOTE Malaysia is reportedly one of Asia’s worst-hit economies in the face of rising US interest rates and the dollar. According to Wall Street Journal today, foreign investors sold US$5.3 billion of Malaysian stocks and bonds in November, the largest monthly outflow since September 2011, according to ANZ Bank. "That is almost a quarter of the US$22.1 billion pulled from emerging markets in the region, excluding China," wrote WSJ. The bulk of this, it said, was US$4.5 billion of bonds, the biggest monthly debt outflow on record, according to ANZ. This comes as the ringgit continues to slide amidst a loss of market confidence in the country's financial standing, of which the growing 1MDB scandal is one of the contributing factors. "Despite the government’s various attempts to support the currency, the ringgit has lost 6.5% of its value against the greenback since the US election, hitting a nearly 19-year low on Nov 30. "On Thursday, the currency weakened 0.9%, following the Federal Reserve’s announcement of its first rate increase in 2016," wrote WSJ. "Malaysia’s Achilles' heel is the high level of foreign ownership of its government bonds. "Foreign money is flighty, a factor that can accelerate a liquidity crunch during times of stress," the financial daily reported. Read more: https://www.malaysiakini.com/news/366301#ixzz4SyHxLmOA This post has been edited by AVFAN: Dec 16 2016, 12:20 PM |

|

|

Dec 16 2016, 01:59 PM Dec 16 2016, 01:59 PM

Return to original view | Post

#44

|

All Stars

24,455 posts Joined: Nov 2010 |

QUOTE(kit2 @ Dec 16 2016, 09:15 AM) why cant they make all exporters convert 100% of their usd proceeds into myr? better let the exporters defend the ringgit. QUOTE BNM ruling impeding growth, says Top Glove FMT Reporters | December 16, 2016 World’s largest glove manufacturer unhappy with directive requiring exporters to convert 75% of their proceeds into ringgit, as it reports a 43% decline in quarter one profits. http://www.freemalaysiatoday.com/category/...says-top-glove/ |

|

|

Dec 16 2016, 06:02 PM Dec 16 2016, 06:02 PM

Return to original view | Post

#45

|

All Stars

24,455 posts Joined: Nov 2010 |

|

|

|

Dec 16 2016, 06:39 PM Dec 16 2016, 06:39 PM

Return to original view | Post

#46

|

All Stars

24,455 posts Joined: Nov 2010 |

QUOTE(Hansel @ Dec 16 2016, 06:16 PM) Yeah,... I think xpmm has a point there,... But there is no hurry to convert, right ?? Since our central bank is going to hold this rate and defend the MYR, we can convert anytime, as long as they have the power to defend the currency,.... u saw that too earlier when u commented "how come other em currencies...?". if one cannot see that, it will be hard to foresee what comes next. intervention... long how, how much fx reserves, what controls next... good point. the trouble is our major economic policies are largely dictated by politicians... u know... they may do something "extraordinary" or just let go. so, we will just have to see what we will see. This post has been edited by AVFAN: Dec 16 2016, 07:15 PM |

|

|

|

|

|

Dec 17 2016, 05:22 PM Dec 17 2016, 05:22 PM

Return to original view | Post

#47

|

All Stars

24,455 posts Joined: Nov 2010 |

QUOTE(Hansel @ Dec 17 2016, 04:33 PM) Going back to the points in the above,... I discovered the following :- u mean to get same AUD, u spend less RM doing RM->AUD than RM->USD->AUD?I calculated if I am to use the current exchange rates to convert directly from the RM into the AUD, compared against if I am to convert from the RM into the USD first, then after that into the AUD at about the same time, I will spend RM10 less for RM100 to buy the same amount of AUD worth of conversions. Hence, yes, I believed the actual value f the RM right now is actually more that 4.47,... perhaps even touching as high as RM5 per USD. But because of help from our central bank, we can 'enjoy' a lower USD. Yeah,......... ....... I await further comments,........ if so, that is only normal. if u mean cheaper the other way round, that will be something interesting... arbitrage opportunity? This post has been edited by AVFAN: Dec 17 2016, 08:39 PM |

|

|

Dec 17 2016, 05:37 PM Dec 17 2016, 05:37 PM

Return to original view | Post

#48

|

All Stars

24,455 posts Joined: Nov 2010 |

this big gun say weak RM is great!

QUOTE Weakening ringgit good for trade, says Vincent Tan http://www.freemalaysiatoday.com/category/...ys-vincent-tan/ but this other big gun disagree. QUOTE Matrade: Weak ringgit won’t result in higher trade surplus http://www.freemalaysiatoday.com/category/...-trade-surplus/ weak RM cannot be good overall. it's BS to say it is good. if it's really good, just devalue to 7.0 or even 8.0, all is good then. so easily done. try getting it back to 4.0, u can only get defensive responses like "all external, can't control, not too bad". of course, the ever wise statement is "too strong no good, too weak also no good, just right is good." so, the big question now, given: .. the continued strength of the $. .. USD/RMB going >7.0 soon. .. our debt levels and addiction to debt. .. gomen priority for gdp growth (and hence reluctance to raise int rates), which is primarily driven by consumption and construction that bring no fx. .. our budget deficit, br1m, subsidies, leakage, wastage, graft. what is the "right" no. for RM? 5.0 by 2018 sounds about right, no? This post has been edited by AVFAN: Dec 17 2016, 05:48 PM |

|

|

Dec 18 2016, 01:03 AM Dec 18 2016, 01:03 AM

Return to original view | Post

#49

|

All Stars

24,455 posts Joined: Nov 2010 |

for everyone's reference...

QUOTE       |

|

|

Dec 18 2016, 01:30 AM Dec 18 2016, 01:30 AM

Return to original view | Post

#50

|

All Stars

24,455 posts Joined: Nov 2010 |

QUOTE(Hansel @ Dec 18 2016, 12:48 AM) I think the exporters are no more enjoying themselves as they used to after BNM forced them to convert 75% of their proceeds back to the RM ! the bigger question is with this 75% thingy, who will put big money into exports biz?I believed nobody would want to convert into 'a lot of a currency' that CONTINUES TO WEAKEN ! |

|

|

Dec 18 2016, 09:18 AM Dec 18 2016, 09:18 AM

Return to original view | Post

#51

|

All Stars

24,455 posts Joined: Nov 2010 |

|

|

|

Dec 18 2016, 10:54 AM Dec 18 2016, 10:54 AM

Return to original view | Post

#52

|

All Stars

24,455 posts Joined: Nov 2010 |

QUOTE(Hansel @ Dec 18 2016, 10:15 AM) Bro,... for myself, I think it's great that AV can furnish us news. He put in great effort to find and post. I wouldn't ask more of him if he is not ready to comment. The great thing abt this thread is we all scour and post what we find from the net. QUOTE(Avangelice @ Dec 18 2016, 10:26 AM) wow didn't realize there's an douche bag in every thread. I feel you AV as I always post stuff on the fsm group and there's one guy who never gives anything in the conversation and will pop up for no where and start complaining. keep up the good job AV news articles help a lot when making a decision on what to invest and where to invest well, if one has hung around any thread LYN or any forum for a while, one surely knows - there are all kinds.one liners, trolls, "feed me's", post for post sake, stalkers, hijackers, derailers, troopers... it is true not everyone can keep up with a dynamic and complex subject and hence get lost in the middle. more so when one is lazy and does not want to read or think a bit. and that causes frustration on one side and exasperation on the other. however, one can also find value in some others' posts. it is for this reason i only go to a handful of threads where i know there are good contributors to share with and brains to pick. |

|

|

Dec 18 2016, 11:38 AM Dec 18 2016, 11:38 AM

Return to original view | Post

#53

|

All Stars

24,455 posts Joined: Nov 2010 |

QUOTE(spiderman17 @ Dec 18 2016, 04:47 AM) I believe businessman made most money from the trade margin. The Forex gain from sitting on usd pile is just bonus. Nobody likes their bonus being taken away, but that doesn't mean they will just quit/walkaway from their money-making trades. QUOTE(icemanfx @ Dec 18 2016, 04:18 AM) the actual impact of that 75% thingy has yet to be seen.however, the comments from topglove already give a clue - it will stifle export industries' growth, i.e. new investments for export biz will think very hard about whether to go ahead or not. what sectors are we talking about when we say "export biz" or anything that earn FX? that should be largely manufacturing. this new report says mfg investment approved (not actual) is down by 39%. not much details about foreign or domestic; the nos. are for jan-sep, before the trump win, before the 75% thingy. i doubt the 75% thingy is going to help the RM overall over time. QUOTE On the manufacturing sector, he said approved investments for the sector dropped 39% for the January-September period from the corresponding period last year. He said the total investments approved in the manufacturing sector were mainly in petroleum products, including petrochemicals (RM9.4 billion), electronics and electrical products (RM7.3 billion), natural gas (RM3.7 billion) and food manufacturing (RM3.3 billion). http://www.freemalaysiatoday.com/category/...ed-since-jan-1/ This post has been edited by AVFAN: Dec 18 2016, 11:45 AM |

|

|

|

|

|

Dec 18 2016, 01:18 PM Dec 18 2016, 01:18 PM

Return to original view | Post

#54

|

All Stars

24,455 posts Joined: Nov 2010 |

QUOTE(icemanfx @ Dec 18 2016, 11:49 AM) Besides u.s fed rate, with China as the largest trading partner, economic downturn e.g property bubble burst in China, RMB breached 7.0 will have impact on Myr forex rate. i am starting to wonder if bnm is intervening to keep RM closer to RMB rather than USD.since there is so much hype about RM144 bil investment to come from china. QUOTE(Hansel @ Dec 18 2016, 01:01 PM) Bro,... pls help me to confirm,... I discovered an arbitrage opportunity here ! AUD will be weakening these 2 to 3 days, but after it 're-strengthened', pls allocate a few minutes to help me cfm,... so, u mean it is better to do RM->USD->AUD than RM->AUD?in another thread, i mentioned i was checking if SGD->USD->RM is better than SGD->RM due to the ridiculous RM/SGD spread with the local banks. i will post what i find tmrw. |

|

|

Dec 18 2016, 09:37 PM Dec 18 2016, 09:37 PM

Return to original view | Post

#55

|

All Stars

24,455 posts Joined: Nov 2010 |

|

|

|

Dec 19 2016, 11:03 AM Dec 19 2016, 11:03 AM

Return to original view | Post

#56

|

All Stars

24,455 posts Joined: Nov 2010 |

$ index down to 102.6x, profit taking.

RM still just under 4.48. banks should be selling USD at >4.50 now. money changer...? |

|

|

Dec 19 2016, 11:15 AM Dec 19 2016, 11:15 AM

Return to original view | Post

#57

|

All Stars

24,455 posts Joined: Nov 2010 |

ah, well...

$ index up or down, RM same... ok, we will live say 4.5 for now. i see many prices at the stores already up, can expect more to come. how to have happy festive holidays? some more water cut for a week... |

|

|

Dec 19 2016, 12:33 PM Dec 19 2016, 12:33 PM

Return to original view | Post

#58

|

All Stars

24,455 posts Joined: Nov 2010 |

QUOTE(ZZMsia @ Dec 19 2016, 12:22 PM) https://www.bloomberg.com/news/articles/201...inancial-crisis bolded part says it all.“It is a confluence of the relative decline in cash metric, high foreign holding of bonds sold off, investors’ trepidation about FX controls and the underlying political or headline risks,” said Vishnu Varathan, a senior economist at Mizuho Bank Ltd. in Singapore. investors’ trepidation about FX controls and the underlying political or headline risks = high fear, low confidence. our local banks, analysts and "experts" will only say... "speculators" or "oversold", "will return to 4.0". the root causes and what needs to be rectified are never mentioned. This post has been edited by AVFAN: Dec 19 2016, 12:39 PM |

|

|

Dec 19 2016, 04:22 PM Dec 19 2016, 04:22 PM

Return to original view | Post

#59

|

All Stars

24,455 posts Joined: Nov 2010 |

QUOTE(Hansel @ Dec 19 2016, 02:24 PM) no more? that will be like burkina faso and zimbabwe. i think the intervention will continue for a while. but the time may come it may have to let go if the RMB shoots >7.0. china is having big problems with capital outflows. what next? raise int rate will reduce gdp growth further, can't do. cut int rate will push rm down further, can't do. cut budget spending is surely no-no. i see only one thing that will be done - raise GST and other taxes to shore up revenues to reduce new borrowings. latest reads: QUOTE Asian currencies on defensive; ringgit matches post-1998 lows http://www.thestar.com.my/business/busines...post-1998-lows/ Goldman Warns China Outflows Rising in Both Yuan Payments, Forex https://www.bloomberg.com/news/articles/201...-payments-forex Don't panic, ringgit will bounce back, says minister http://www.malaysiakini.com/news/366591 |

|

|

Dec 19 2016, 04:47 PM Dec 19 2016, 04:47 PM

Return to original view | Post

#60

|

All Stars

24,455 posts Joined: Nov 2010 |

QUOTE(TOMEI-R @ Dec 19 2016, 04:22 PM) Ringgit will not crash. these "experts" are just selling snake oil with the idea, "what comes down will go up" - automatically, by itself, no need to do anything.An analysis of the ringgit pattern during every last quarter of the year exemplifies that even though the currency remains volatile and people become jittery, it is not going to crash, and will hardly be traded beyond 4.50 against the US dollar, an economist said. I wonder if these 'experts' have vested interests in making such speculations or they are 'instructed' by higher ups to contain panic among the public? but we know certain things like gravity... "what comes down stays down" or what goes down can go down further" - until new powerful forces come into play. at this time, there is only one new force - BNM intervention with reserves. |

| Change to: |  0.1136sec 0.1136sec

0.56 0.56

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 10th December 2025 - 01:28 PM |