Outline ·

[ Standard ] ·

Linear+

ASX COUNTERS !, Everything related to the Aus Sec Exc !

|

prince_mk

|

Dec 7 2016, 09:10 PM Dec 7 2016, 09:10 PM

|

|

QUOTE(Hansel @ Dec 7 2016, 04:19 PM) This would be a good time to slowly go in again,....low bank interest rates, low economic results,... hence low asset prices. The signs are there,.... which sectors are you going in ? Financial / Industrial / Reits / Materials / Energy / Info Tech etc. I will be using the Std Ctd ASX settlement acc to trade  glad I updated at bank few days ago. any page you can recommend for newbies like me ? http://www.marketindex.com.au/analysis/div...5-december-2016http://www.marketindex.com.au/how-to-buy-sharesThis post has been edited by prince_mk: Dec 7 2016, 09:42 PM |

|

|

|

|

|

prince_mk

|

Dec 7 2016, 10:46 PM Dec 7 2016, 10:46 PM

|

|

Taxation : At tax-time you must calculate the tax payable from your share trading by tallying up your profits, losses and dividends. An added benefit of owning shares as an individual is that when you hold a share for more than a year then you only pay Capital Gains Tax (CGT) on 50% of your profit.

|

|

|

|

|

|

prince_mk

|

Dec 8 2016, 07:45 AM Dec 8 2016, 07:45 AM

|

|

QUOTE(Hansel @ Dec 8 2016, 06:49 AM) Then dont keep more than 1 yr ? If more than 1 yr, 50% on profit? How then ? Applicable for Malaysian ? This post has been edited by prince_mk: Dec 8 2016, 07:47 AM |

|

|

|

|

|

prince_mk

|

Dec 8 2016, 09:31 AM Dec 8 2016, 09:31 AM

|

|

QUOTE(Hansel @ Dec 8 2016, 07:49 AM) No bro,.. if you keep more than one year, the taxable component is ONLY 50% of your profit earned. If you keep less than one year, the taxable component is 100% of your profit earned. 1 Jan 2016 bought 1000 units at $1, paid $1000 1 Feb 2017 sold 1000 units at $2, gross amount $2000 Profit = $1000 Tax = 50% x $1000 = $500 ?? This post has been edited by prince_mk: Dec 8 2016, 09:34 AM |

|

|

|

|

|

prince_mk

|

Dec 8 2016, 10:20 AM Dec 8 2016, 10:20 AM

|

|

QUOTE(Hansel @ Dec 8 2016, 10:14 AM) $500 is the Taxable Amount. This Taxable Amount will be added into the other taxable amts generated from employment, other incomes, etc, and then to calculate from there,...... the tax bracket that an individual falls into. Oic. We are Msian. Does this impact us ? Or this only impact the Aussies citizen only ? |

|

|

|

|

|

prince_mk

|

Dec 14 2016, 08:24 PM Dec 14 2016, 08:24 PM

|

|

QUOTE(Hansel @ Dec 14 2016, 01:11 PM) Yeah,... but even better if we can dip our fingers directly into Australian assets ourselves,... Need not remain behind these proxy SG REIT managers,....  Edited to make my points clearer.    I m still bit blur on ASX market. slowly following you and reading abt Australian assets I agreed with you too. we invest directly in ASX market and remove the proxy Sg reits managers. Good idea. but must see the initial amt to invest in ASX market too coz I got limited bullets and started with Sg reits 1 yr ago.  This post has been edited by prince_mk: Dec 14 2016, 08:34 PM This post has been edited by prince_mk: Dec 14 2016, 08:34 PM |

|

|

|

|

|

prince_mk

|

Dec 16 2016, 09:38 PM Dec 16 2016, 09:38 PM

|

|

Just curious. Let say I have some AUD in the dbs MCA acc.

can I transfer from the AUD in the MCA acc to Std Ctd AUD settlement acc ? doable ?

|

|

|

|

|

|

prince_mk

|

Dec 16 2016, 09:55 PM Dec 16 2016, 09:55 PM

|

|

|

|

|

|

|

|

prince_mk

|

Dec 20 2016, 09:05 PM Dec 20 2016, 09:05 PM

|

|

QUOTE(Hansel @ Dec 18 2016, 12:53 PM) OK,....  what is the min units for every purchase ? same like Sgx 100 units ? This post has been edited by prince_mk: Dec 20 2016, 09:06 PM |

|

|

|

|

|

prince_mk

|

Dec 20 2016, 09:20 PM Dec 20 2016, 09:20 PM

|

|

QUOTE(Hansel @ Dec 20 2016, 09:16 PM) They don't go by number of minimum units. It depends on the brokerage that you use, the brokerage instils a minimum value of purchase, eg AUD500, etc,... any idea for Sg Std Ctd boss ? |

|

|

|

|

|

prince_mk

|

Dec 20 2016, 09:30 PM Dec 20 2016, 09:30 PM

|

|

QUOTE(Hansel @ Dec 20 2016, 09:28 PM) ok, will write them an email. I thought it applies for all currency. Now only I know different currency got different requirement. will update you all later. |

|

|

|

|

|

prince_mk

|

Jan 19 2017, 08:46 PM Jan 19 2017, 08:46 PM

|

|

QUOTE(Ramjade @ Jan 13 2017, 01:02 PM) Moving to AU = buying a property for future stay. Takkan want to rent. too early to foresee so far. I guess u better get yourself a job. then u may consider after 5 yrs from now. |

|

|

|

|

|

prince_mk

|

Jan 19 2017, 08:48 PM Jan 19 2017, 08:48 PM

|

|

QUOTE(Hansel @ Jan 13 2017, 12:29 PM) I suggest not within Msia,.. go out,... DBS comm is high, but if there is no choice, then must go with it. I would suggest opening an account with Stanchart Sgp, if you can,... only AUD10 per trade,.... what shares can we consider at the moment for a start ? for a newbie like me ? I have Stanchart SGP. |

|

|

|

|

|

prince_mk

|

Jan 19 2017, 09:10 PM Jan 19 2017, 09:10 PM

|

|

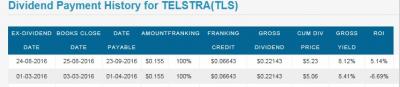

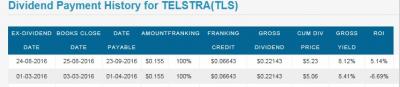

Let say I bought 1000 units on 2 Jan 2016 at AUD5. Annual dividend : 0.31 Purchase on 2 Jan 2016 = 1000 units x AUD5 = AUD5000 1000 units will get dividend = 1000 units x 0.31 = AUD310 How about the franking credit of $0.06643 ? Mind if you show me the calculation for each dividend declared. I m still thinking how much would I get for purchase of 1000 units. This post has been edited by prince_mk: Jan 19 2017, 09:21 PM Attached thumbnail(s)

|

|

|

|

|

|

prince_mk

|

Jan 19 2017, 09:14 PM Jan 19 2017, 09:14 PM

|

|

Australian companies are known as having some of the most generous dividends across the world. This approach by Australian businesses may result in slower growth, but it does reward shareholders with the assured rewards of dividends.

Dividends are great because they are paid to shareholders like clockwork, whereas trying to know when to buy and sell shares makes it harder to know when to push the trade button and you also have to factor in brokerage costs.

So which stocks are the best ones to buy for dividends? It’s generally thought that large blue chips are the biggest dividend payers and most reliable, so here are three dividend stocks that could make solid additions to your portfolio:

a) Crown Resorts Ltd (ASX: CWN)

b) Medibank Private Ltd (ASX: MPL)

|

|

|

|

|

|

prince_mk

|

Jan 19 2017, 10:30 PM Jan 19 2017, 10:30 PM

|

|

QUOTE(Hansel @ Jan 19 2017, 10:15 PM) Try CUP ! Bro,.. if you are not a resident of Australia, don't worry abt the franking part ! LIke I said previously, only if you're ready to stay in Australia do you think abt the franking credits. Ok thanks sifu. Then pass. No intention to stay there. Let me do some research on the dividend.au first. It seems u have started much earlier than I thought. Thanks for leading us. This post has been edited by prince_mk: Jan 19 2017, 10:31 PM |

|

|

|

|

|

prince_mk

|

Jan 20 2017, 11:15 AM Jan 20 2017, 11:15 AM

|

|

QUOTE(Hansel @ Jan 20 2017, 08:42 AM)  ... When mind is made up and the target is there, must chase,... if just to talk only, then can never get done. Try NAB ! I never talk empty. Sure will follow your lead. U see Sg reits after u leaded me 1 yr ago. Now I m harvesting d dividend. |

|

|

|

|

|

prince_mk

|

Jan 20 2017, 11:18 AM Jan 20 2017, 11:18 AM

|

|

QUOTE(Hansel @ Jan 20 2017, 09:10 AM) Bro,.. what is the source of your article in the above ? Sifu, http://www.fool.com.au |

|

|

|

|

|

prince_mk

|

Jan 21 2017, 09:54 PM Jan 21 2017, 09:54 PM

|

|

QUOTE(Hansel @ Jan 20 2017, 08:42 AM)  ... When mind is made up and the target is there, must chase,... if just to talk only, then can never get done. Try NAB ! Wonder should I go in or look into others ? |

|

|

|

|

|

prince_mk

|

Jan 21 2017, 09:58 PM Jan 21 2017, 09:58 PM

|

|

Countplus. CUP

Countplus is an accounting and financial services aggregator with a 5.04% stake (or 5,882,540 shares as at 31 December 2015) in listed cloud based SMSF administration software provider Class Limited (ASX: CL1).

The equity stake in Class provides Countplus’ shares with the impetus to grow in value, as the underlying investment in Class swells day-by-day. Accordingly, investors in Countplus benefit from both companies’ growth.

The yield

Countplus pays (and has paid since listing) a quarterly dividend of 2 cents per share, providing it with a robust trailing yield of 9.1% before tax at current prices. Importantly, this dividend is fully-franked, meaning the yield surges to almost 13% after tax.

|

|

|

|

|

Dec 7 2016, 09:10 PM

Dec 7 2016, 09:10 PM

Quote

Quote

0.0517sec

0.0517sec

0.78

0.78

7 queries

7 queries

GZIP Disabled

GZIP Disabled