QUOTE(mamamia @ Nov 17 2018, 04:27 PM)

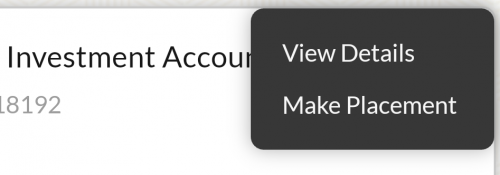

GIA 1 month interest only 2.75% now? Just place 5k just now n notice only 2.75%, lower than normal FD, tomorrow need to uplift

better jor, it was 2.50% last monthp/s: just placed egia 1mth @ min rm5k. m2u shows 2.50% rate.

This post has been edited by cybpsych: Nov 17 2018, 07:13 PM

Nov 17 2018, 07:06 PM

Nov 17 2018, 07:06 PM

Quote

Quote

0.0283sec

0.0283sec

0.34

0.34

7 queries

7 queries

GZIP Disabled

GZIP Disabled