QUOTE(Avangelice @ Oct 6 2016, 08:22 PM)

Yes Because it is almost as liquid as saving accounts with almost unconditional FD return

Fundsupermart.com v15, 基金超市第十五章 - Rise the Dragon

|

|

Oct 6 2016, 08:26 PM Oct 6 2016, 08:26 PM

Return to original view | Post

#41

|

Senior Member

1,166 posts Joined: Jul 2016 |

|

|

|

|

|

|

Oct 6 2016, 08:29 PM Oct 6 2016, 08:29 PM

Return to original view | Post

#42

|

Senior Member

1,166 posts Joined: Jul 2016 |

|

|

|

Oct 6 2016, 08:50 PM Oct 6 2016, 08:50 PM

Return to original view | Post

#43

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(Ramjade @ Oct 6 2016, 08:45 PM) See the reply below. For me, whenever I need the money, just uplift it without penalty transfer to SA and go to atm/IBG/IBFT out. Who needs SA/CMF when eGIA-i exist. erm, when OPR increase to the extend that bond yield falls below FD rate, you will go back to fd Actually I am asking about if I use libra asnita to buy fund A (switch buy), will it be instant like FPX or do we need to wait a few days if we do the transaction before 3pm of that day. Switch sell is instant the same way as you use CMF to invest in other funds, just also take 4 days to show your holdings |

|

|

Oct 6 2016, 09:44 PM Oct 6 2016, 09:44 PM

Return to original view | Post

#44

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(Ramjade @ Oct 6 2016, 09:37 PM) Er, if FD is 15% p.a, I withdraw all from UT lo. You gotta wait for high official inflation for that to happen, hint hint brazil No delay in few days for FM to liqudate my funds first? this is from FSM FAQ: Q: HOW LONG WILL THE WHOLE INTRA SWITCH PROCESS TAKE? A: Cash investments The switch-sell and switch-buy orders will be transacted on the same business day the order is received before 3pm. Otherwise it will be transacted on the next business day. However, please note that there are 2 business days lag time should you switch buy into RHB Money Market Fund, RHB Income Fund 2, RHB Institutional Islamic Money Market Fund and 1 business days lag time if you switch buy into CIMB-Principal Equity Growth & Income Fund, CIMB-Principal Greater China Equity Fund, CIMB-Principal Income Plus Balanced Fund, CIMB-Principal Global Titans Fund, CIMB-Principal Australian Equity Fund, CIMB-Principal Strategic Bond Fund, CIMB-Principal Asia Pacific Dynamic Income Fund, AmSchroder European Equity Alpha Fund and Kenanga Asia Pacific Total Return Fund. From the above, seems like if you do switch sell and switch buy before 3pm, you will sell libra asnita at today price and buy example EI small cap at today price too do take note some switching will charge switching fee depending on funds p/s: why so many popular cimb funds have 1 day lag pps: sorry for yet another irrelevant explanation This post has been edited by AIYH: Oct 7 2016, 07:43 AM |

|

|

Oct 7 2016, 07:50 AM Oct 7 2016, 07:50 AM

Return to original view | Post

#45

|

Senior Member

1,166 posts Joined: Jul 2016 |

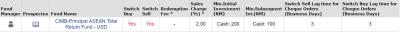

QUOTE(puchongite @ Oct 7 2016, 07:34 AM) The above is for intra switch. For inter switch, have to read the next section. From what I read, the locked in price for a switch buy will normally have a lag of 2 business days or more, after the switch sell transaction. Oh my I see it wrong again Thanks for the guidance Attached is the switch sell lag time for libra asnita Means that FSM will transact the switch sell and liquidate libra asnita today based on today's price provided before 3pm However, the fund you switch buy will be transact 2 days later and based on the price on 2 days later @puchongite really appreciate your correction as I am going to switch sell from libra soon Otherwise I would be confuse on that Any missing point please guide us p/s: maybe I should ask FSM to confirm on this This post has been edited by AIYH: Oct 7 2016, 08:01 AM Attached thumbnail(s)

|

|

|

Oct 7 2016, 08:17 PM Oct 7 2016, 08:17 PM

Return to original view | Post

#46

|

Senior Member

1,166 posts Joined: Jul 2016 |

testing tag Avangelice Ramjade puchongite

edit: how to tag people post edit: testing yeah This post has been edited by AIYH: Oct 7 2016, 08:39 PM |

|

|

|

|

|

Oct 7 2016, 09:03 PM Oct 7 2016, 09:03 PM

Return to original view | Post

#47

|

Senior Member

1,166 posts Joined: Jul 2016 |

Avangelice Ramjade puchongite

I asked FSM about the switch sell and siwtch buy time frame I will take these 2 funds and some variables to illustrate it as well as the attachment for both funds for reference. a) Switch Sell Fund : Affin Hwang AIIMAN Asia (Ex Japan) Growth Fund - MYR b) Switch Buy Fund : CIMB-Principal ASEAN Total Return Fund - USD c) Switch Sell Lag time for Cheque Orders (Business Days) : X (Affin switch sell days) d) Switch Buy Lag time for Cheque Orders (Business Days) : Y (CIMB switch buy days) Take this scenario: I switch sell from Affin fund on T (Monday 10/10 10:10), so it will transact on the day itself and priced on T (MOnday 10/10). They will receive the sales proceed from Affin on T+X, in this case, X = 5 days, so is T+5 (Monday 17/10). Then They will switch buy CIMB fund and priced on T+X+Y, in this case, Y = 3 days, so is T+5+3 = T+8 (Thursday 20/10). Finally, FSM will take 4 more days to show your holdings, so in total you gotta wait T+X+Y+4 = T+12 ( Wednesday 26/10). ***In summary, your switch sell price will be based on T and switch buy price will be based on T+X+Y Using the concept above, will take Ramjade case for, say switch sell Libra Asnita and switch buy kenanga growth fund. Switch sell Libra Asnita will priced at T and switch buy KGF will priced at T+2, and holding will be shown on T+6. Hope this make switch sell and switch buy understandable to those who want to know. Edit: Avangelice I made some correction to it, ps This post has been edited by AIYH: Oct 7 2016, 09:14 PM Attached thumbnail(s)

|

|

|

Oct 7 2016, 09:22 PM Oct 7 2016, 09:22 PM

Return to original view | Post

#48

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(puchongite @ Oct 7 2016, 09:16 PM) This will mean FSM needs to correct their footnote document which generalized all switch-buy to be transacted on T+2 :- I think the footnote is illustrating an example similar to my one For example :- https://www.fundsupermart.com.my/main/buyse...do?code=MYHWDBS The footnote says T+2 for switch-buy. Which is wrong. T+2 will be common but not applicable to all. |

|

|

Oct 7 2016, 09:51 PM Oct 7 2016, 09:51 PM

Return to original view | Post

#49

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(Ramjade @ Oct 7 2016, 09:39 PM) If you want parking for money, just directly invest via fpx and wait until few days before you need the money then you sell, that will just be T+4.After all, it is not for emergency liquidity fund, that belongs to eGIA On the other hand, if you want park for very short term future potential investment, just sell to CMF or directly to ur banking account and reinvest later through either platform will do I think the switch system is still ok for normal transfer between funds but not for dynamic "taking advantage of maket fluctuation" type, you will die just for waiting them to show up after each switch Nope,not to spark any argument on it |

|

|

Oct 7 2016, 10:06 PM Oct 7 2016, 10:06 PM

Return to original view | Post

#50

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(Ramjade @ Oct 7 2016, 10:01 PM) I will never use CMF as long as eGIA-i rates beat it. But if you have some not so emergency fund and can take a bit risk, libra asnita still provide better returns compare to eGIA and ASNBThat's my parkong definition for FSM For now I will use eGIA-i as parking. Diversify some money to it ma, not a replacement of eGIA also I used all of them for different purposes No harm trying it, experience at least once with minimum money, you might have different opinion after trying it This post has been edited by AIYH: Oct 7 2016, 10:09 PM |

|

|

Oct 8 2016, 09:31 AM Oct 8 2016, 09:31 AM

Return to original view | Post

#51

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(Avangelice @ Oct 8 2016, 08:50 AM) looks like I need to really set up an instant liquidity account and also a bridge to fsm while balancing the rates of eGIA-i and fixed income. Depending on which fixed income fund you put as your ammo, you might need to check the difference between their switch sell lag time (transfer fund to fund) and sell off time (transfer to CMF or bank).after seeing AIYH post on down time and lag and ramjade for chiming in I have been neglecting to create a real instant emergency fund. so let me get this straight. rates of eGIA-i > cash management account >savings account three of which are able to liquid cash ASAP. to cut short the switch sell and buy of T12 days which we found out, it is better to sell the fund first then on the same day buy the intended fund with your other savings parked in your eGIA-i? I always thought the fixed income fund will be my ammo storage. guess not. Refer these below to understand more. Switching Fund FAQ Intra Switch Table Inter Switch Table Selling Funds FAQ Depends on your investment amount and how much you reserve in your liquid assets vs fixed income fund. If your planned investment amount is < 10k, then i think the method of selling fixed income fund and investing same day via eGIA is a good method But fixed income fund selling will still need 4 working days (mostly, depend on funds, refer to selling FAQ) to reach CMF/bank, so you might need to ensure your emergency amount will still be sufficient for the following 4 days after you invest with your emergency fund |

|

|

Oct 8 2016, 10:18 AM Oct 8 2016, 10:18 AM

Return to original view | Post

#52

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(puchongite @ Oct 8 2016, 10:00 AM) Inter switch will generally have 2 days lag. But intra switch will generally have zero lag ( there is a list of exceptions ). Sounds workable, but not optimal, the return is about half of what libra asnita can offer, and it can't provide the liquidity eGIA providesSo if I am targeting to invest in cimb equity fund, may be can consider parking into cimb bond fund in the mean time ? LOL. Using cimb bond fund to switch into cimb equity fund will be the very similar to invest directly into cimb equity fund using eGIA/CMF Plus particularly, intra switch into some popular cimb equity fund, like GTF, APDIF just to name a few has a lag of 1 business day QUOTE(T231H @ Oct 8 2016, 10:07 AM) a "friend of mine"...always has a minimum That would be part of the consideration when constructing portfolio, thank you for the idea 1) 1/2 month expenses in CASH lying around the house 2) 1 monthly expenses in Saving a/c of EACH of the 3~4 different banks with ATM cards 3) 3 months of saving in FDs on monthly renewal mode that is "his" 1st pockets of Emergency fund that is to be "VERY" liquid. there is really no right or wrong methods to have in an emergency fund. just that don't be too annalistic in "concerning" too much about the "losses" of some % of interest on this emergency fund....not to the extend of calculating to the precise "lag" time in days of the x% of emergency cash in the said a/c.... concentrate more into how/where to position one funds in the portfolio; be it includes among other things like; Vanguard credit ninja trick, RSP ninja trick, abit of timing (buy lower Every method has pros and cons, just need to evaluate and maximize the particular method for different people Maximizing the fixed income with savings method will also benefit some way for those who rely on it |

|

|

Oct 8 2016, 12:12 PM Oct 8 2016, 12:12 PM

Return to original view | Post

#53

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(xuzen @ Oct 8 2016, 11:16 AM) Good sirs, Chill chill Please allow me to put in some perspective: While you are arguing eGIA-i vs Asnita Bond vs CMF for parking in terms of how best each will give you ROI, you people are being petty, that is, no matter which one you choose, the difference will not be a lot. e-GIAi = 4% p.a Asnita Bond = 6% p.a. CMF = 3.5% p.a. Unless you are talking about parking a million or two ringgit, the end result is insignificant for couple of months placement. The difference cannot even pay for one cup of Starbucks Americano Vente. This is what we called penny wise, pound foolish. While you are arguing about this insignificant thing, India oh my lovely India In one week how much is e-GIAi ROI? 4/52 = 0.077%. In one week how much is CMF ROI? 3.5/52 = 0.067%. In one week how much is Asnita Bond ROI? 6/52 = 0.115%. My point is these instruments are there for a purpose other than for generating ROI. Xuzen Slowly accumulating wealth and slowly shift the priority Give youngsters and beginners who have limited wealth some time to learn and grow ma This post has been edited by AIYH: Oct 8 2016, 12:20 PM |

|

|

|

|

|

Oct 8 2016, 01:01 PM Oct 8 2016, 01:01 PM

Return to original view | Post

#54

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(xuzen @ Oct 8 2016, 12:49 PM) Give some time ma Yes, there is investment amount for wealth accumulation but there are also some money left that are for liquidity and waiting for opportunity aka wealth preservation We try to find a balance to maximize the return for this standing fund while learning and finding other investment opportunity Of course when we earn more from income or investment and have enough to dispose them to investment, the petty method will slowly become insignificant and we start to increase risk appetite maximizing the investment portion of the portfolio Give time to learn ma, sorry sifu |

|

|

Oct 8 2016, 10:01 PM Oct 8 2016, 10:01 PM

Return to original view | Post

#55

|

Senior Member

1,166 posts Joined: Jul 2016 |

Since last discussion about the high correlation between CIMB APDIF and RHB AIF, would it be good if I keep APDIF and drop AIF?

Trying to have a fund for emerging market but the only better one I see is in fixed income sector, namely RHB Emerging market bond fund, which some very correlated with RHB ATR. Seeking for advise on the comparison between the 2 p/s: Do I just need to register morningstar free account to analyze the correlation between 2 funds? |

|

|

Oct 9 2016, 10:41 AM Oct 9 2016, 10:41 AM

Return to original view | Post

#56

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(T231H @ Oct 8 2016, 10:19 PM) Since last discussion about the high correlation between CIMB APDIF and RHB AIF, would it be good if I keep APDIF and drop AIF? Since they are different asset classes, would you recommend that for people like me who RSP every month, to keep CIMB APDIF to take advantage of the larger volatility compared to RHB AIF?just a note: one is a Eq fund the other is a Balanced fund... Trying to have a fund for emerging market but the only better one I see is in fixed income sector, namely RHB Emerging market bond fund, which some very correlated with RHB ATR. just a note: I would go for RHB EM bond...because it invested abt 70% in Govt. securities Seeking for advise on the comparison between the 2 smile.gif p/s: Do I just need to register morningstar free account to analyze the correlation between 2 funds? just a note: yes, you need to register,...but some forummer questioned that the correlation number given is related to USD.......thus the number may be off in relation to RM If I am considering to shift from RHB AIF to RHB EMBF instead of RHB ATR, I can't really understand the region break as there is a lot of others region that neither FSM nor morningstar is helpful in breaking down on that Anyone can kindly enlighten me more on the region breakdown in RHB EMBF (I know is emergin market, but with 67% others, is kinda really hard to understand more p/s: noticed that the target fund of RHB EMBF, united emerging market bond fund, the SGD and USD class performance were similarly to a bond fund. While the RHB counterpart performace similar to equity. Is this due to different currencies' appreciation/depreciation at different time that results in such a different in return and volatility? This post has been edited by AIYH: Oct 9 2016, 11:28 AM |

|

|

Oct 9 2016, 11:18 AM Oct 9 2016, 11:18 AM

Return to original view | Post

#57

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(1tanmee @ Oct 9 2016, 11:12 AM) What are the charges incurred to maintain FSM account? That is the PPA account opening fee (RM10 + GST) charged by PPA (one time charge)fyi, recently registered with FSM, and subscribed to the PRS. Was charged RM10.60 (not sure whether this is one-off, or per annum). What about the other charges? For argument's sake, i am not planning to increase/transfer/switch/decrease anything. For future calendar year, you will be charge fund annual fee (RM8 +GST) for each fund that you invest during the calendar year (meaning if you make contribution for fund A and didnt make contribution for fund B in 2017, fund A will be charge annual fee but fund B won't) For each new PRS fund you invest, their first calendar year will be exempted from annual fee |

|

|

Oct 9 2016, 01:04 PM Oct 9 2016, 01:04 PM

Return to original view | Post

#58

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(1tanmee @ Oct 9 2016, 12:53 PM) Ah, what is this forum without such great help from fellow forumers. Thanks @AIYH! Quote : "The Private Pension Administrator (PPA) is the central administrator for the Private Retirement Schemes (PRS)."Noted on the PPA account opening. But is it based on each PPA provider, or not? I mean, I open an account with Kenanga PPA. Should I open another account with CIMB, do I get charged too? As for the calendar year, you meant 1/1 - 31/12, or the annual date of subscription (e.g. 1/9 - 31/8) ? PPA is like the governing body for all the PRS providers. The PPA account is an account that contains the PRS funds you invest in, kinda like master account that consolidate your PRS funds in one place. So the PPA account will be opened when you invest on your first PRS fund. Afterwards, you don't need aother PPA opening form moving forward. However, you do need to submit a new PRS form for each provider you are new to. Say for first time you submit PPA form and Kenanga PRS form. Next time say you wanna invest in CIMB PRS, you dont need another PPA form as you had the PPA account, but you need to submit the CIMB PRS form as this your first time invest in CIMB PRS. I asked about this before to PPA and they say calendar year, which I assumed is 1/1 to 31/12, if is from the time you start invest, that would be anniversary year, not too sure about it, anyone can kindly verify it? p/s: In case someone bombard me on this, you may ask on the PRS forum here: Private Retirement Fund @ Lowyat Forum |

|

|

Oct 9 2016, 01:57 PM Oct 9 2016, 01:57 PM

Return to original view | Post

#59

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(T231H @ Oct 9 2016, 12:35 PM) QUOTE(puchongite @ Oct 9 2016, 01:19 PM) I don't see much difference among all these funds despite them claiming to be in different market. I only see some differences for 1 year result. The further away the more similar they are. [attachmentid=7725962] QUOTE(MUM @ Oct 9 2016, 01:40 PM) Both had also been "filtered" by FSM as both are also in the recommended fund list.... the noticed able different is the composition in each funds. one is ASIAN focused and the other more diversified.... |

|

|

Oct 9 2016, 02:29 PM Oct 9 2016, 02:29 PM

Return to original view | Post

#60

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(yklooi @ Oct 9 2016, 02:21 PM) Cannot la RSP date is coming soon, not enough ammo to even meet minimum initial investment Gotta sell of AIF next week then repump into EMBF via RSP Rather than wait for the timing, might as well just invest it when decision made with RSP for this month coming soon |

|

Topic ClosedOptions

|

| Change to: |  0.0897sec 0.0897sec

0.31 0.31

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 05:44 PM |