https://sg.finance.yahoo.com/news/amazon-tu...-160736387.htmlAmazon stock plunges 14% in biggest one-day drop since 2006

GOOG

-3.72%

GOOGL

-3.72%

WMT

-2.06%

AMZN

-14.05%

+2

Scroll back up to restore default view.

Yahoo Finance

Amazon stock plunges 14% in biggest one-day drop since 2006

Alexandra Semenova

Alexandra Semenova·Reporter

Sat, 30 April 2022, 4:02 am

In this article:

Even mega-cap tech giant Amazon couldn’t bear up against the macroeconomic headwinds that imperiled Corporate America last quarter.

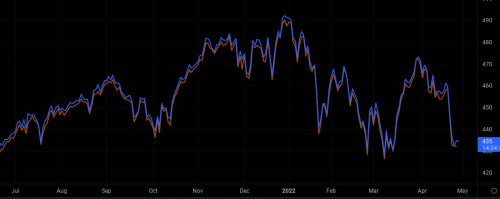

Shares of Amazon (AMZN) plunged 14% on Friday, marking the retail behemoth's biggest intraday drop since July 2006, according to Bloomberg data.

The sell-off comes at the heels of a disappointing earnings report from Amazon that showed a loss of nearly $4 billion in the three months ended March 31 — the company’s first quarterly loss in seven years — attributed largely to its investment in electric-vehicle maker Rivian Automotive (RIVN), which has seen its stock shed more than 75% since going public late last year.

During the same quarter last year, Amazon posted a profit of $8.1 billion as its core retail business benefited from a pandemic-related surge in online shopping.

On the revenue side, Amazon’s net sales logged the slowest pace of growth in about two decades, up 7% to $116.4 billion, compared with a pace of 44% in the same period last year.

“Amazon is still a titan, no one can deny that – $116bn of quarterly sales takes a mighty beast,” Hargreaves Lansdown Lead Equity Analyst Sophie Lund-Yates said in an emailed note. “Sadly though, the market isn’t asleep to the fact that Amazon is suffering badly at the hands of economies of scale.”

Even more concerning for investors was a disappointing outlook for the current quarter that missed analyst estimates. Amazon projected second quarter revenue between $116 billion and $121 billion for the period ending June 30, citing higher transportation expenses associated with persisting supply chain and inflationary pressures and increased labor costs from growing staff to meet higher pandemic demand. Bloomberg analysts were looking for net sales of $125.01 billion, according to consensus data.

The company also warned revenue growth could further wane next quarter to a rate of between 3% and 7%.

Apr 27 2022, 01:24 PM

Apr 27 2022, 01:24 PM

Quote

Quote

0.4453sec

0.4453sec

1.12

1.12

7 queries

7 queries

GZIP Disabled

GZIP Disabled