QUOTE(zacknistelrooy @ Mar 9 2022, 08:50 PM)

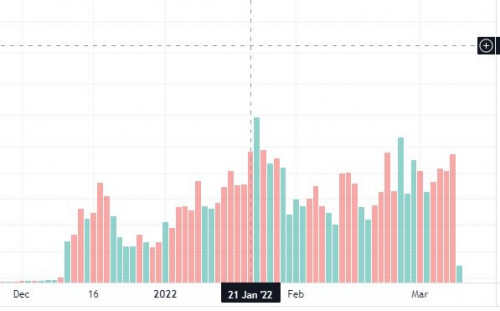

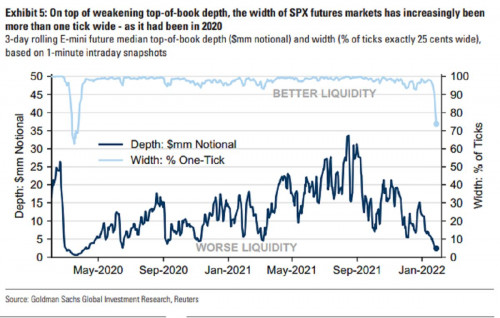

the previous 4 charts are book depths... this chart is volumes... they are different things no?I can only say interests in ES has declined looking at book depths... and vol in MES has plateau... doesn't imply a broken market

I did say a lot of volumes are now in micro minis... implying the micro's order book needs to be filled up as well... assuming no new monies inflow to this futures market.. decreases in mini's should match increases in micro's... but there's also a flaw in this assumption... as ppl probably moved their money to others... like commodities, metals, etc...

just to add... imho market is ok because market structure is intact... after every swing high/low comes a retrace... support and resistance are there... put to call ratios are normal... etc...

the 5 to 10 minutes of London and Ney York open are always a wild ride...

This post has been edited by dwRK: Mar 9 2022, 09:55 PM

Mar 9 2022, 09:30 PM

Mar 9 2022, 09:30 PM

Quote

Quote

0.0561sec

0.0561sec

0.40

0.40

7 queries

7 queries

GZIP Disabled

GZIP Disabled