QUOTE(moosset @ Feb 28 2020, 10:11 PM)

You do not need green. You need red now actually.USA Stock Discussion v8, Brexit: What happens now?

USA Stock Discussion v8, Brexit: What happens now?

|

|

Feb 28 2020, 10:13 PM Feb 28 2020, 10:13 PM

Return to original view | Post

#81

|

All Stars

24,335 posts Joined: Feb 2011 |

|

|

|

|

|

|

Mar 3 2020, 12:01 AM Mar 3 2020, 12:01 AM

Return to original view | Post

#82

|

All Stars

24,335 posts Joined: Feb 2011 |

|

|

|

Mar 3 2020, 12:24 AM Mar 3 2020, 12:24 AM

Return to original view | IPv6 | Post

#83

|

All Stars

24,335 posts Joined: Feb 2011 |

|

|

|

Mar 3 2020, 07:11 AM Mar 3 2020, 07:11 AM

Return to original view | IPv6 | Post

#84

|

All Stars

24,335 posts Joined: Feb 2011 |

|

|

|

Mar 3 2020, 10:32 AM Mar 3 2020, 10:32 AM

Return to original view | IPv6 | Post

#85

|

All Stars

24,335 posts Joined: Feb 2011 |

QUOTE(Yggdrasil @ Mar 3 2020, 10:18 AM) It won't die. It just transition. That's why the oil and gas companies have hand in electric vehicle charging, renewable energies. Don't forget no renewable energy can heat up house in winter completely. Poor countries like south east Asia, India, Africa still relay on oil. |

|

|

Mar 3 2020, 11:31 PM Mar 3 2020, 11:31 PM

Return to original view | IPv6 | Post

#86

|

All Stars

24,335 posts Joined: Feb 2011 |

QUOTE(zacknistelrooy @ Mar 3 2020, 08:57 PM) Good to see you are back If trump mess up the virus stuff he's going to pay big time. Oil for now at least seems to be taking a taking a cue form the equity markets. Was on track for a proper bounce till equities turned lower. I personally took a chance on Kinder Morgan as I feel it has a bit more margin of safety with the upside caped but have stop-loss order in place in case it turns again. Yes oil may not die and demand is suppose to grow but finding incremental buyers is the problem as institutional buyers are focused on ESG and whether that is a fad is a story for another day Oil has only worked as a trade for the past two years That is the reason NextEra Energy which is a utility that is involved in renewable trades at 33 P/E while ExxonMobil trades at 17 P/E. Are both irrational? Probably but in the end of the day we have to setup our portfolio for the best outcome based on our own objectives and price rarely lies in the long run Don't forget it is election year and markets are choppy unless we are sure the incumbent wins and COVID-19 has added uncertainly to that and disrupted what would probably been a sure win QUOTE(oOoproz @ Mar 3 2020, 11:23 PM) 50 pts rate cut from FED, i never expect this much lol, let's see how it goes tonight, bond yield is going low again Feds to the rescue again.This post has been edited by Ramjade: Mar 3 2020, 11:31 PM |

|

|

|

|

|

Mar 3 2020, 11:46 PM Mar 3 2020, 11:46 PM

Return to original view | IPv6 | Post

#87

|

All Stars

24,335 posts Joined: Feb 2011 |

|

|

|

Mar 4 2020, 12:09 AM Mar 4 2020, 12:09 AM

Return to original view | IPv6 | Post

#88

|

All Stars

24,335 posts Joined: Feb 2011 |

|

|

|

Mar 5 2020, 07:18 AM Mar 5 2020, 07:18 AM

Return to original view | IPv6 | Post

#89

|

All Stars

24,335 posts Joined: Feb 2011 |

|

|

|

Mar 7 2020, 02:13 PM Mar 7 2020, 02:13 PM

Return to original view | Post

#90

|

All Stars

24,335 posts Joined: Feb 2011 |

|

|

|

Mar 7 2020, 06:54 PM Mar 7 2020, 06:54 PM

Return to original view | Post

#91

|

All Stars

24,335 posts Joined: Feb 2011 |

|

|

|

Mar 9 2020, 12:38 AM Mar 9 2020, 12:38 AM

Return to original view | Post

#92

|

All Stars

24,335 posts Joined: Feb 2011 |

|

|

|

Mar 9 2020, 10:28 AM Mar 9 2020, 10:28 AM

Return to original view | Post

#93

|

All Stars

24,335 posts Joined: Feb 2011 |

QUOTE(markedestiny @ Mar 9 2020, 09:53 AM) Accumulative 20% drop from the previous high is very possible, but 20% single day drop not so much...but we'll see as can't tell now given the higher volatilities in the market now What I meant is 20% drop from yesterday price over say 1 month period possible? |

|

|

|

|

|

Mar 10 2020, 10:59 PM Mar 10 2020, 10:59 PM

Return to original view | Post

#94

|

All Stars

24,335 posts Joined: Feb 2011 |

|

|

|

Mar 12 2020, 01:07 AM Mar 12 2020, 01:07 AM

Return to original view | Post

#95

|

All Stars

24,335 posts Joined: Feb 2011 |

|

|

|

Mar 13 2020, 06:55 PM Mar 13 2020, 06:55 PM

Return to original view | IPv6 | Post

#96

|

All Stars

24,335 posts Joined: Feb 2011 |

|

|

|

Mar 15 2020, 09:48 AM Mar 15 2020, 09:48 AM

Return to original view | IPv6 | Post

#97

|

All Stars

24,335 posts Joined: Feb 2011 |

QUOTE(moosset @ Mar 15 2020, 09:29 AM) Are we expecting the Fed to cut rates this week? Just change. No need to look at exchange rate. Overtime whatever investment you do will cover back the minimal savings you gain from exchange rate. I want to change some money to SGD but if Fed cuts the rates, then SGD will also weaken, right? So better wait a bit? Last week I broke out my amanah saham and change regardless of exchange rate. Some things too cheap to ignore. Normal times yeah look at exchange rate. I agreed. This post has been edited by Ramjade: Mar 15 2020, 09:51 AM |

|

|

Mar 15 2020, 10:22 AM Mar 15 2020, 10:22 AM

Return to original view | IPv6 | Post

#98

|

All Stars

24,335 posts Joined: Feb 2011 |

QUOTE(moosset @ Mar 15 2020, 09:54 AM) hahaha... same here. I'm about to withdraw money from amanah saham... still quite reluctant though. I already got. Last Friday. Double what amanah saham can give me. Will add some more. Yes, but if I can get a better rate, .... I need to save every penny for investment. After all, we are not in a rush since this crisis will drag for a least a few months. Later will buy Starbucks, mcd, Brookfield and family if they are priced cheaply. |

|

|

Mar 15 2020, 06:04 PM Mar 15 2020, 06:04 PM

Return to original view | Post

#99

|

All Stars

24,335 posts Joined: Feb 2011 |

QUOTE(GloryKnight @ Mar 15 2020, 01:28 PM) Consumer stocks? Im looking at brkb, visa and googl/amazon (have to choose one between the two to buy) OXY as in the O&G company? AAlready cut dividends liao. Buy only BP/shell. nothing else. Tax free both of them.Of course, OXY seems good too. This post has been edited by Ramjade: Mar 15 2020, 06:35 PM |

|

|

Mar 15 2020, 06:36 PM Mar 15 2020, 06:36 PM

Return to original view | IPv6 | Post

#100

|

All Stars

24,335 posts Joined: Feb 2011 |

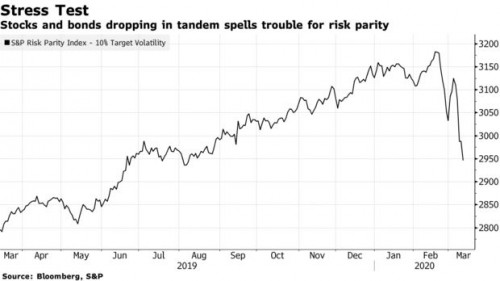

QUOTE(zacknistelrooy @ Mar 15 2020, 06:26 PM) Are you talking about Brookfield (alternative asset management company)? Yes the Brookfield family and the parent. I am not a fund manager so I don't care about their structure.If that is the case any reason why as most of their stocks are structured as partnership which means certain fund can't hold them. KKR and Carlyle Group had the same problem before they switched to C-corp and finally realized their true value. I definitely agree Brookfield has really good assets as I used to own them but due to their structure they lagged their true value Gold generally goes down in a crisis ( same thing happen in 08 before it went to an all time high) Gold is great for insolvency cycle but not illiquidity cycle Also a lot of central banks added gold for the past two years so I would not be surprised if they are selling some Also the risk parity trade got hid badly this week:  Dalio caught flat-footed with big losses at Bridgewater fund Interesting to see even Ray Dalio underestimate the current downturn |

| Change to: |  0.4078sec 0.4078sec

0.48 0.48

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 10:20 AM |