ooo... many moons passed liao....

On the other hand, cannot take whatever investopedia writes as the whole truth la...

Rational policy. The first and utmost rational policy should address the issue of why is the share down so much that one feels the need to average down?

Say.. One buy XXX at 200. Stock is now only 140. The urge of course if to average down.....

However, BEFORE that,

isn't the rational policy is to ask why? Why the stock jatuh la....

1.

Is the stock fundamentals or earnings going down? And the biggest danger to address is did one buy the stock at peak earnings? If peak earning is 60% above it's average yearly earnings, when earnings slide... earnings could slide a lot. When it does, stock price could really plunge to way, way below. So averaging down now, it's suicidal if the stock could even plunge to below 100 (from the above example). And of course, the need to address and ask ownself, if that stock's peak earnings was a once off, like recent glove earnings.

And even before all this... before one buy the stock, did one even address this issue? Address the risk of buying into a growth stock whose earnings might peak? There are literally tons of data showing the grave danger buying into a growth stock whose earnings has peaked, which always results in plunging share prices. That needed to be address before the buying.

and once, the sign of peak earnings is there, get out. That's called admitting to the mistake of buying into a stock with declining earnings/peak earnings.

2. Buying the good stock but at the wrong price.Isn't this what most are seeing now? They bought XXX. It's not that XXX suddenly has gone bad or what not. Fundamentals are sill strong. But... they over paid for it. For example, paying over 200 times earnings for XXX.

When market goes bad... naturally XXX could only fall to below 100 times earnings or even 80 or lower.... which means the stock price could really fall.

Again... addressing this issue from day one is much better than contemplating to average down that earlier mistake.

3. Buying but refusing to admit the stock selection to buy XXX was poor.It was a mistake from day one. XXX was never ever a good company. Just average. And naturally, caught in a bear market, XXX will really plunge.

Yet once more, isn't addressing the issue of whether one has made or not is more important than the idea of simply averaging down and doubling down on the poor initial decision.

4. When the stock falls, it's undervalued?Hey, whatever happen to the initial buy decision? Doesn't this mean that XXX was not undervalued in the first place? Averaging down, again meant doubling down of our initial mistake.

But then, how many admits to their own mistakes? Their stock selection cannot be wrong meh? If fall means, the stock is undervalued?

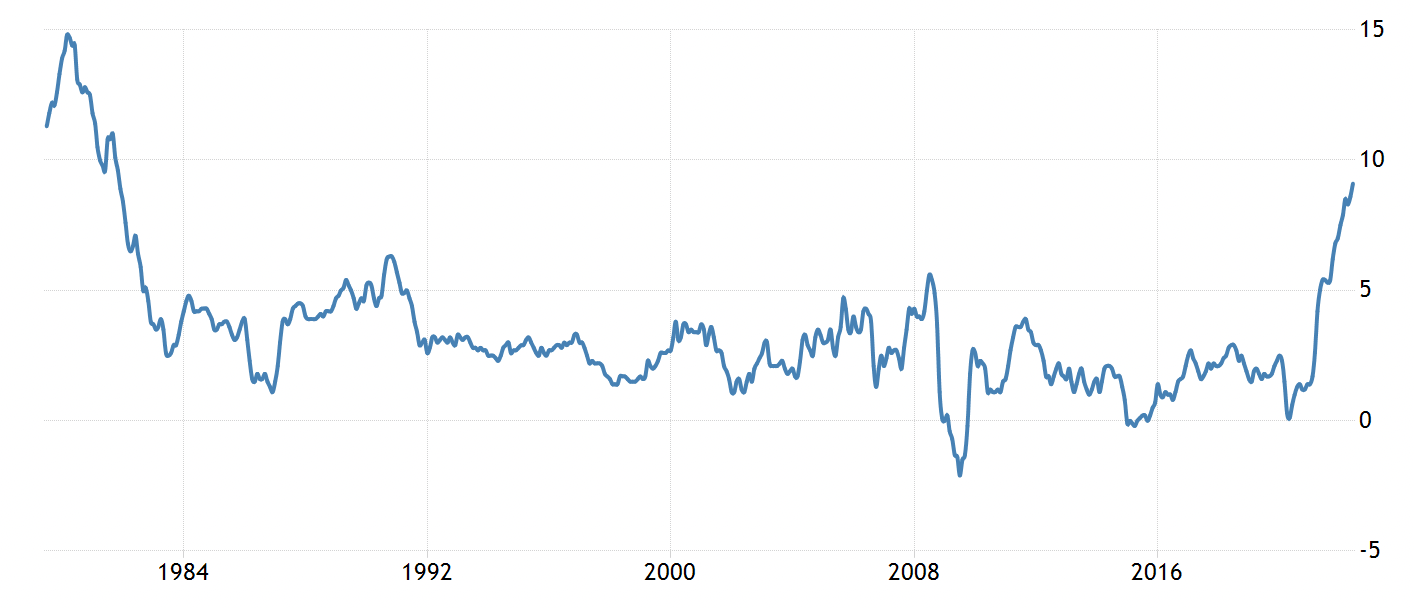

5. Stock was good but was caught in the current bear market?Again... initial decision... did one not consider the inflation risk early this year? Wasn't there signs?

or maybe one bought the stocks way earlier. But if one had bought way earlier, shouldn't there any review of investment and review of whether one should have sold their stocks for a profit?

Paper profits are not profits until we sell.

6. Buy the dip!oh.... lastly ..... recent years.... market was in a hell of bull market la.

Hence, all dips were sapu-ed cow cow. Buy the dip, buy the dip, buy the dip.....

now? market has turned. Some dips, had no bounce at all. Some even turned into big deeper!

Of course, buy the dip, was nothing but a market trend which happens during strong bull markets. To assume and adopt such strategy NOW is so very risky.

Oh...sidetrack.... from a gambling perspective. Haven't we seen this gamblers sitting on the table with piles and piles of chips. Winning streaks. Many a times, they don't understand why it's good to take profit. They keep on riding the luck, hoping the streaks continues. It doesn't. Chips go down in a hurry. Yet they don't take profit. They sit and believe the hot winning streak will come again..... but sadly it doesn't. Hence the earnings turn into losses.

There.... my ... err.... 28*1.1 = 31 sen opinion la....

addressing the stock is more important. Did we make mistake or not? If make mistake and then, don't admit, you think die or no die?

Woi cannot inflate your cents la.

Jun 24 2022, 04:44 PM

Jun 24 2022, 04:44 PM

Quote

Quote

0.0430sec

0.0430sec

0.22

0.22

7 queries

7 queries

GZIP Disabled

GZIP Disabled