Tq for your replies,...

There you go,... brokerages are covering their asses, right ? So they just tax first-lar,... therefore you were wrong when you said "Won't be broker."

I can tell you,... the broker will be the first line to withhold tax,... then subsequently, we will need to go back to The IRS to claim back what the broker took. We need to raise IRS File Numbers, etc,...

For IBKR, will they do withholding taxes onto instruments like PFLT, and if they do, what documentation is needed to get the exemption ? Notes as below for the latest PFLT dividend payout,.....

"PennantPark Floating Rate Capital Ltd. (NYSE: PFLT) has announced its monthly distribution of $0.1025 per share for June 2025, payable on July 1, 2025, to stockholders of record as of June 16, 2025. The distribution will be sourced from taxable net investment income. PFLT operates as a business development company focusing on U.S. middle-market private companies, primarily investing in floating rate senior secured loans. The company is managed by PennantPark Investment Advisers, LLC, a middle market credit platform managing approximately $10 billion of investable capital. The distribution may be exempt from U.S. withholding tax for non-U.S. stockholders when proper documentation is provided, as the company generates qualified interest income and short-term capital gains."

To your second reply : REITs' mandates are to pay out 90% of their net income as dividend to unitholders. Why not fair if these instruments are not taxed against their net income ? Of all people, you shld know this. You invested in REITs too,... or,....... have I misunderstood your question ?

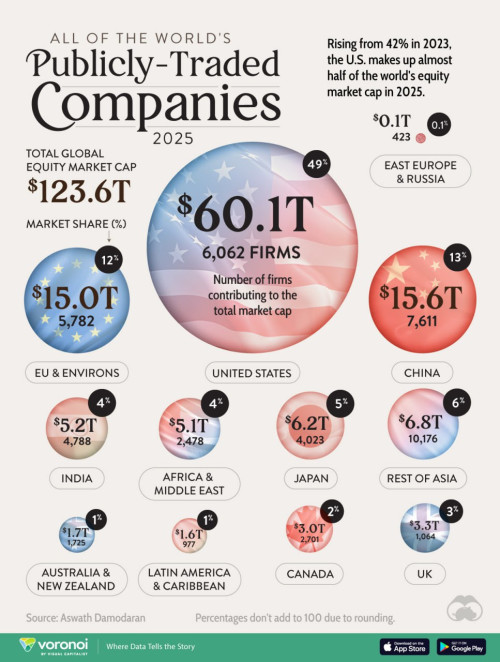

To your third reply,... I invest into the US, SG and into other countries too,... directly into their jurisdictions, ie having accts in a brokerage inside the ctry. I think factors such as 'easy to make money' and liquidity are available everywhere. Just depends on whether you know what to do or not. You are good in Options against US equities, hence, your biasness into the US mkts.

Nothing wrong with that tho',... just like I'm biased with the SG mkts because of its taxfree status, political stability and stable currency. OPenness into the world,.. easy to open accounts, etc,... but emm,... not so easy anymore today.

One more advantage,... but that's just me,... a convenience in attending functions in the companies which we invest into,...

You go invest in PennantPark Floating Rate Capital Ltd. for what? MLP, BDC, Us Reits got all kind of weird tax law. As long as need to with hold IBKR will with hold. But let us see when linde pays me. Will there be any taxes as it's HQ is in LSE and listed on Nasdaq. My research says no.

It's not about options. Please la. i didn't even mention options. Easy here means buy hold and do nothing. Market will take care of itself. Another easy here is lots of high quality companies in US market Vs anywhere else. Even grab doesn't want to list in Singapore despite it being a SG company. Can buy and hold 20-30 high quality companies, don't look at it and come back after 10-20 years

I got no money to travel like you. So atending AGM is useless and irrelevant and to me.

Apr 20 2025, 01:33 PM

Apr 20 2025, 01:33 PM

Quote

Quote

0.0879sec

0.0879sec

0.79

0.79

7 queries

7 queries

GZIP Disabled

GZIP Disabled