QUOTE(ChAOoz @ Apr 17 2020, 08:10 PM)

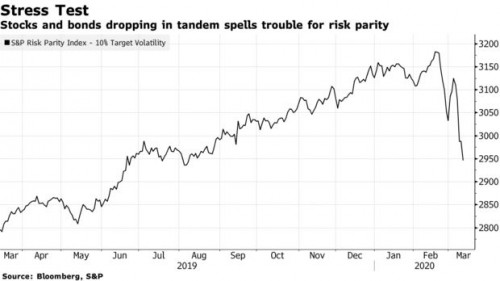

Long Term QE effect: Inflation on broad basket of item as value of money goes down.

Short Term QE effect: Inflating asset class, as this is where the money flow in the fastest

If we have learned something from last financial crisis is that free, cheap and easy money will always flow into equities first and subsequently other asset class. Last round of QE already benefited asset holder so much, if we din't take advantage of Global QE 2.0 we would be a fool.

If you look closely, equities has already become even more inflated. AAPL has gone back to their dec 19 highs as if the covid19 and china/US retail store shutdown never happened. So in value wise, AAPL has actually become more expensive. Their market cap remain at dec 19 level, but their profit definitely not comparable. Forward PE has definitely gone up by a fair margin.

But the bargain hunter within me cannot buy it even though I know helicopter money is inflating it to infinity and beyond. Oh well, lets hope market gets rational soon and we see a correction nearer to the true value. Or either QR out and people got shock. Fighting my FOMO to wait for either one to materialized.

That is definitely true especially if you see the data out of China today but there seems to be conflicting info.

Tesla had record orders in China during March and if one is to look at this site below it seems tech is still not really hit.

QUOTE

https://layoffs.fyi/tracker/

Even Samsung chip said they weren't really hit and yesterday Taiwan Semi seem quite bullish

QUOTE

The company said its latest results benefited from strong demand for both high-performance computing components, which are used by cloud-computing companies, and “the continued ramp of 5G smartphones.” For the second quarter, the company sees weaker mobile-product demand, balanced by continued deployment of 5G phones, and product launches in high-performance computing.

QUOTE(AVFAN @ Apr 17 2020, 08:25 PM)

but u c... that's the problem...

we know something is not right but it may not surface in the next 3, 5, 10 years.

what is going on is basically a postponement of some big problem into the future.

then again, people alive today aren't that interested in a time when they are r dead (or in a hospital

).

here, watch this - the 4th wave:

https://www.cnbc.com/video/2020/03/26/is-a-...sis-coming.htmlYeah

Things take time and one never knows the breaking point and can only be prudent and risk manage for it

Even in the video one can see with the ballooning debts that it took time to ultimately hit the economies

Enron's off balance sheet antics took a while before everyone realized how bad it was

This post has been edited by zacknistelrooy: Apr 17 2020, 09:27 PM

Feb 7 2020, 10:17 PM

Feb 7 2020, 10:17 PM

Quote

Quote

0.0397sec

0.0397sec

0.90

0.90

7 queries

7 queries

GZIP Disabled

GZIP Disabled