QUOTE(yok70 @ Apr 27 2020, 09:01 AM)

As the USO's oil futures policy keeps changing, it's becoming more and more difficult to valuate its value via its NAV's movement and premium ratio. The change seems to benefit "longer term investors", but USO is not suppose to be an instrument for long term investment.

I don't think even for long term investors it is suitable for now at least. It is still trading at 6% premium and as long as the extreme contango issue exists it will be quite difficult to hold its value and not to mention the doezens of retail investors holding it currently.

Ultimately you are better off with trading the equity of the big majors then this product

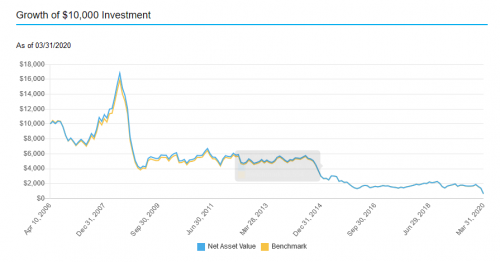

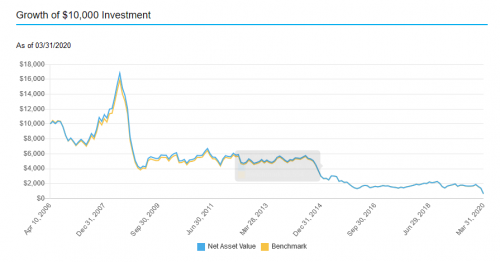

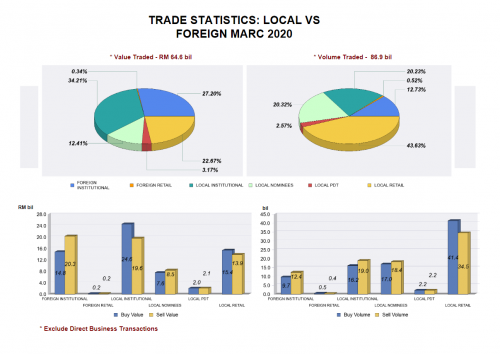

This chart is up to 31st March 2020

Did West Texas Intermediate collapse burn US$1 billion hole in Bank of China investors’ pockets?

Did West Texas Intermediate collapse burn US$1 billion hole in Bank of China investors’ pockets? QUOTE

Bank of China’s estimate for the carnage to retail investors from the collapse in a product linked to US crude oil futures surged 11-fold to more than 7 billion yuan (US$1 billion), as it consolidated reports from its nationwide network, according to people familiar with the matter.

The estimate of losses to customers across China increased from about 600 million yuan in the middle of last week, as more information was gathered from its more than 10,000 outlets, said the people, asking not to be identified as they were discussing a private matter. The number is not final and subject to further change as more branch data is examined, one of the people said.

QUOTE(FishIsSmart @ Apr 27 2020, 10:17 AM)

finding a good hong kong ETF to play. Listed in HK.

anybody knows well ?

eg.

Tracker Fund of Hong Kong

HKG: 2800

SPDR Gold Trust

HKG: 2840

Try looking here:

QUOTE

https://www.hkex.com.hk/Market-Data/Securities-Prices/Exchange-Traded-Products?sc_lang=en

This post has been edited by zacknistelrooy: Apr 27 2020, 05:49 PM

Apr 22 2020, 11:17 PM

Apr 22 2020, 11:17 PM

Quote

Quote

0.4426sec

0.4426sec

0.52

0.52

7 queries

7 queries

GZIP Disabled

GZIP Disabled