QUOTE(mapeyeo1 @ Jul 4 2019, 09:53 PM)

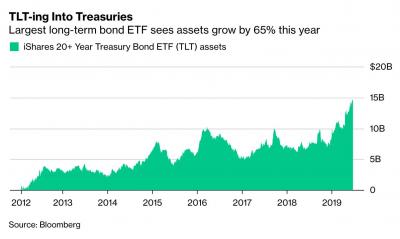

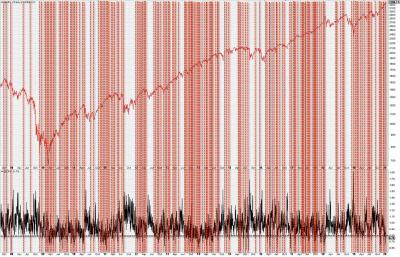

[Do note that fund mangers at least in the US have been paring their equity holdings and moving into bonds but if the US markets goes parabolic like in Jan 2018 then we are in for another top

Yup it is madness out there

Especially Europe even after so much easy money policies it is still lagging

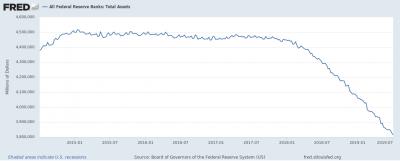

I read the book by Ray Dalio and it talks about deleveraging, which illustrates that quantitative easing will only help out to a certain extent and after that no effect can be seen.

Yeah, his hedge fund has been performing quite well.

He also has solid views on the economic and most of his views make sense but the issue like it as always been like the famous quote for investors "The market can remain irrational longer than you can remain solvent."

This blog may also interest you but it is a long read:

The Psychology of MoneyQUOTE(icemanfx @ Jul 4 2019, 10:01 PM)

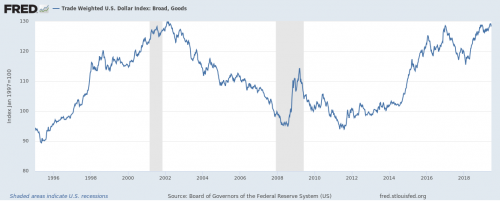

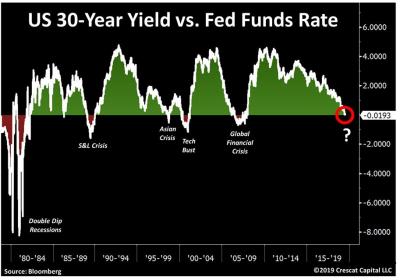

Every crisis is precede by a bubble, what is the bubble this time? u.s. corporate debts? china?

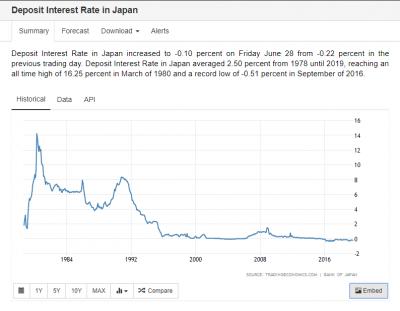

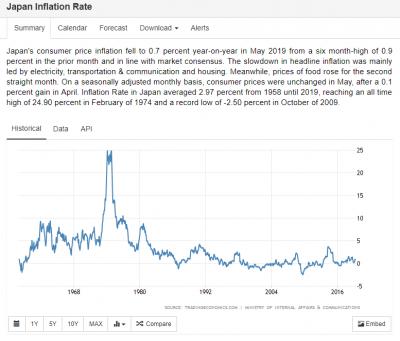

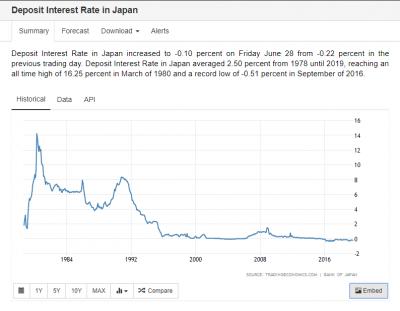

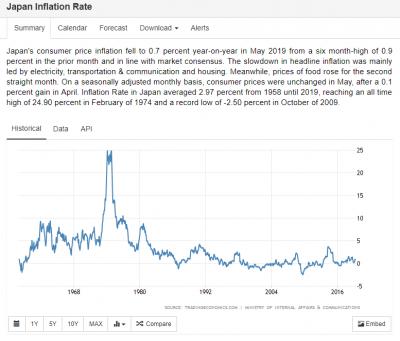

Easy money and low interest rate doesn't mean people will spend or invest e.g. japan. immediate market uncertainty is dt's twitter.

True but Japan isn't a great example

They have had multiple issues since the 90's (Lost decade) and they have not had much inflation for 30 years

If they founded the likes of Alibaba, JD and Tencent then they would probably be in a different place

Europe right now is heading into the same issue as Japan

QUOTE(oOoproz @ Jul 5 2019, 12:21 PM)

Great sharing, but don't forget DT is trying to add in new member to FED, if it happens, market will just follow his twitter too, by that time he can do whatever he wants with the market

Those two won't make a huge difference in the long term unless he manages to replace the FED chair

In the end the economy will dictate their moves no matter how much DT tries to think otherwise

Doves and HawksThis post has been edited by zacknistelrooy: Jul 5 2019, 07:41 PM

Jun 21 2019, 12:01 AM

Jun 21 2019, 12:01 AM

Quote

Quote

0.4705sec

0.4705sec

0.54

0.54

7 queries

7 queries

GZIP Disabled

GZIP Disabled