Outline ·

[ Standard ] ·

Linear+

OCBC 360 Savings Account - Up to 3.25% Interest !, Get higher interest on your savings acct

|

zenquix

|

Mar 20 2020, 04:01 PM Mar 20 2020, 04:01 PM

|

|

some of the more "VIPs" did hint they got something from RM's etc. Me? After a call from OCBC, I did not get a written reply for me to send to BNM despite of reminder emails.

|

|

|

|

|

|

zenquix

|

Apr 5 2020, 05:05 PM Apr 5 2020, 05:05 PM

|

|

QUOTE(epie @ Apr 5 2020, 04:25 PM) i guess we cannot open 360i account at normal ocbc branch is it? can. |

|

|

|

|

|

zenquix

|

Apr 30 2020, 03:28 PM Apr 30 2020, 03:28 PM

|

|

QUOTE(rocketm @ Apr 30 2020, 01:43 PM) Hi all, I have some question regarding having 2 ocbc saving accounts. My initial ocbc saving account is Islamic one. During mco, I open a conventional saving account via online. If I like to top up my wechat wallet in order to fulfill the RM500 spending then how ocbc will know which saving account to deduct the money since wechat is using the debt card number to transact. It will use the account current set to "Quick Cash" in the ATM card. if you did not change the tagging when you open the 2nd account, then it will be the first account. |

|

|

|

|

|

zenquix

|

Apr 30 2020, 04:47 PM Apr 30 2020, 04:47 PM

|

|

QUOTE(GrumpyNooby @ Apr 30 2020, 03:47 PM) How to configure this? Tie which account to Quick Cash for the ATM card. can only be done OTC unless they change/upgraded the system |

|

|

|

|

|

zenquix

|

May 2 2020, 08:56 AM May 2 2020, 08:56 AM

|

|

QUOTE(rocketm @ May 1 2020, 07:38 PM) What is Quick Cash actually means? What is the benefit? Any charges? After request to setup OTC, then we can choose which saving account to topup money from to our Wechat? you actually choose OTC for them to setup. cannot choose in app or outside when you use the debit card option |

|

|

|

|

|

zenquix

|

May 2 2020, 04:45 PM May 2 2020, 04:45 PM

|

|

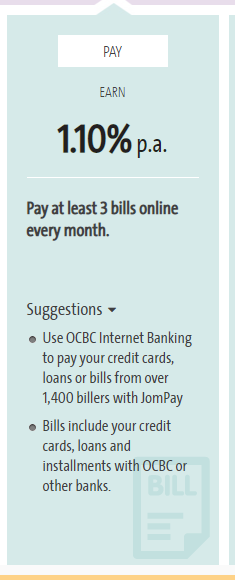

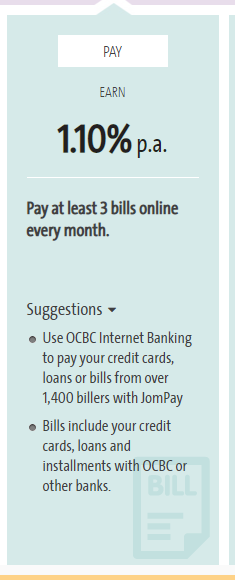

QUOTE(akafoz @ May 2 2020, 12:42 PM) pay to other bank credit card still ok right? yeah. (b) below QUOTE(wyh @ May 2 2020, 02:00 PM) A minimum of 3 Bill Payments must be made from your OCBC 360 Account within the calendar month to be eligible for the Pay Bonus Interest. This includes payment via standing instruction to your OCBC home loan facility and/or retail payment channel of OCBC Online Banking to: (a) your OCBC/OCBC Al-Amin home loan facility; or (b) any account with any bank or financing institution other than the Bank and OCBC Al-Amin Bank Berhad (Company No. 200801017151 / 818444-T); or © any participating billing organisations; or (d) payment by Interbank GIRO/Duitnow conducted through OCBC Online Banking, but excluding any payment by the Financial Process Exchange (FPX) platform. what did it used to say to signify payment of credit card allowed? man.. the trustworthiness of this bank is really going down until we need to start keeping previous versions of T&C.. their website still shows OK https://www.ocbc.com.my/personal-banking/ac.../360/index.html This post has been edited by zenquix: May 2 2020, 04:58 PM This post has been edited by zenquix: May 2 2020, 04:58 PM |

|

|

|

|

|

zenquix

|

May 2 2020, 09:46 PM May 2 2020, 09:46 PM

|

|

other bank credit card should be fine via

(b) any account with any bank or financing institution other than the Bank and OCBC Al-Amin Bank Berhad (Company No.

200801017151 / 818444-T); or

however the same line also means OCBC Credit Card may not be acceptable as a Bill Payment

|

|

|

|

|

|

zenquix

|

May 5 2020, 04:53 PM May 5 2020, 04:53 PM

|

|

QUOTE(GrumpyNooby @ May 5 2020, 03:34 PM) Since base interest is already 0.1%, they may slash the bonus interest. I'm seeing: 1. 3.1% 2. 2.95% QUOTE(Anson Wong 412 @ May 5 2020, 04:20 PM) I guess in total is 3.1%: Based Rate: 0.1% Deposit: 1.0% Pay: 1.0% Spend: 1.0%  it's a big 0.5% cut.. we would be lucky to get anything above eff 2.9% |

|

|

|

|

|

zenquix

|

May 5 2020, 05:00 PM May 5 2020, 05:00 PM

|

|

QUOTE(GrumpyNooby @ May 5 2020, 04:57 PM) Agreed with you that 0.5% cut is a big deal. Well, they need to balance for customers (or cash) retention too. yeah.. most need to remember board FD rates will likely hover around 2% now.. so all this "high yield" accounts will still boast a premium above FD |

|

|

|

|

|

zenquix

|

May 6 2020, 05:48 AM May 6 2020, 05:48 AM

|

|

QUOTE(cclim2011 @ May 5 2020, 07:24 PM) i am more concerned if they changed the rate on 31st May instead of now. 😅 They have already had a track record for doing this so I won't put in past them. The bright side is, if you have not already moved money out, the rate you will eventually get will still be higher than most FDs QUOTE(MGM @ May 5 2020, 09:29 PM) Sorry I should have said new car loan. because they already advertised "low" simple interest rates all this while to trap the masses. it is not BR based so they do not have to follow the OPR. And if they convinced you to sign, it is basically like FD for them, from you  |

|

|

|

|

|

zenquix

|

May 6 2020, 11:45 PM May 6 2020, 11:45 PM

|

|

we lack big noise to push the Feb case. This time they already covered their bases. Just suck it up or move to SC PSA like most have already done

|

|

|

|

|

|

zenquix

|

Jun 16 2020, 10:37 PM Jun 16 2020, 10:37 PM

|

|

for ocbc got report ppl pay on due date after 9:45pm get hit by interest and late payment fee...

|

|

|

|

|

|

zenquix

|

Jul 9 2020, 08:20 AM Jul 9 2020, 08:20 AM

|

|

QUOTE(nightpipper @ Jul 8 2020, 06:28 PM) 0.3% > 0.25% - OCBC really clawing back all the "bonus" QUOTE(rocketm @ Jul 9 2020, 12:05 AM) If I instruct the service provider to perform standing instruction and it is stated as Direct debit in my online account, may I know it is under spending or pay? If the SI is via the account number, then it is likely pay or might even be not eligible. Spending is through the debit / credit card. |

|

|

|

|

|

zenquix

|

Jul 14 2020, 01:31 AM Jul 14 2020, 01:31 AM

|

|

QUOTE(datolee32 @ Jul 14 2020, 12:07 AM) Just to confirm, in order to get maximum interest for RM 100k x 2 for both 360 account, i need to do: Fresh fund RM 500 into each account Pay 3 bills online instead of 6 bills Spend RM 500 on credit card instead of RM 1,000 Am I correct? no.. the credit card spend can only associate to one account. most tie the debit card fast cash account to the ocbc 360-i and spend RM500 on the debit card. bill payments must be from the account in question so 3 bills via ocbc360 and 3 bills via ocbc360i. there was a post that said you cannot repeat account numbers between this 6 bills ie. cannot pay the same bill with ocbc360 and ocbc360i |

|

|

|

|

|

zenquix

|

Jul 15 2020, 12:36 AM Jul 15 2020, 12:36 AM

|

|

QUOTE(datolee32 @ Jul 14 2020, 09:44 AM) I see, thanks for clear explanation, credit card spend can only associate to the one account. If i have 2 OCBC credit cards, also can be linked into one account only? no idea.. but i suspect so since you only have 1 credit limit (unlike local banks that give diff credit limit for conventional and islamic cards). have to ask others since i don't have experience in your situation  |

|

|

|

|

|

zenquix

|

Sep 14 2020, 01:48 AM Sep 14 2020, 01:48 AM

|

|

QUOTE(rocketm @ Sep 13 2020, 08:41 PM) yup and save the hassle to withdraw to saving and find another bank for better rate. The problem is the average daily balance in OCBC 360. I have FD mature today already in my OCBC 360, thinking whether 6 months at 2.45% pa, which is the same rate as OCBC 360 is worth or not FD locks the rate. OCBC360 rate change at little notice when OPR cut. Also recently found out OCBC Sg removed bonnus for credit card spend - can easily happen in Malaysia as well. |

|

|

|

|

|

zenquix

|

May 28 2021, 07:50 AM May 28 2021, 07:50 AM

|

|

QUOTE(LostAndFound @ May 27 2021, 06:49 AM) 18th May received RM50 'Cashback Campaign' to my OCBC 365 card. Anyone know what campaign this was? maybe |

|

|

|

|

|

zenquix

|

Jun 30 2022, 10:15 AM Jun 30 2022, 10:15 AM

|

|

QUOTE(MGM @ Jun 6 2022, 12:42 PM) CB CREDITED: 03/06/22 CashBack Campaign - 200 Anyone won more than 1x, cos can win max 18, once/week? i noticed a lot of repeated names though |

|

|

|

|

|

zenquix

|

Mar 31 2023, 06:38 PM Mar 31 2023, 06:38 PM

|

|

QUOTE(MGM @ Mar 31 2023, 05:13 PM) U r only getting more cb if spend btw 1500 to 2500,otherwise u will be getting less. So sad cos i used >20k/mth getting >rm200 cb. sweet spot looks like RM1286 for RM20.70 - 1.61% cashback rate. RM1287 - RM1499 spending get a big fat 0 - basically u need to increase your spending to past RM1500 for less effective cashback. |

|

|

|

|

Mar 20 2020, 04:01 PM

Mar 20 2020, 04:01 PM

Quote

Quote

0.0241sec

0.0241sec

0.60

0.60

7 queries

7 queries

GZIP Disabled

GZIP Disabled