QUOTE(mamamia @ Feb 7 2020, 06:57 PM)

Is it as easy to get the 4%?OCBC 360 Savings Account - Up to 3.25% Interest !, Get higher interest on your savings acct

OCBC 360 Savings Account - Up to 3.25% Interest !, Get higher interest on your savings acct

|

|

Feb 7 2020, 07:13 PM Feb 7 2020, 07:13 PM

Return to original view | Post

#41

|

All Stars

18,410 posts Joined: Oct 2010 |

|

|

|

|

|

|

Feb 7 2020, 08:43 PM Feb 7 2020, 08:43 PM

Return to original view | Post

#42

|

All Stars

18,410 posts Joined: Oct 2010 |

|

|

|

Feb 13 2020, 10:55 AM Feb 13 2020, 10:55 AM

Return to original view | Post

#43

|

All Stars

18,410 posts Joined: Oct 2010 |

|

|

|

Feb 13 2020, 11:03 AM Feb 13 2020, 11:03 AM

Return to original view | Post

#44

|

All Stars

18,410 posts Joined: Oct 2010 |

|

|

|

Apr 6 2020, 08:22 PM Apr 6 2020, 08:22 PM

Return to original view | IPv6 | Post

#45

|

All Stars

18,410 posts Joined: Oct 2010 |

The Maximum “Average Daily Account Balance” that qualify for bonus interests is RM100,000.00. Any additional balance will continue to earn the base rate.

So if my balance is 0 for 15days and 200k for 15 days in a 30day month then ADAB is 100k n this amount qualifies for the bonus interests? This post has been edited by MGM: Apr 6 2020, 08:28 PM |

|

|

Apr 6 2020, 08:40 PM Apr 6 2020, 08:40 PM

Return to original view | IPv6 | Post

#46

|

All Stars

18,410 posts Joined: Oct 2010 |

Is there any benefits using OCBC 360 debit card to reload to BP nad Boost?

|

|

|

|

|

|

Apr 23 2020, 04:11 PM Apr 23 2020, 04:11 PM

Return to original view | Post

#47

|

All Stars

18,410 posts Joined: Oct 2010 |

I am thinking of log into SSPN-i account to deposit via FPX from my OCBC360 account and max FPX/IBFT is rm30k/transaction.

Previously every time I do IBFT from Ocbc360, I am not allowed to exceed 10k even though I I have set my FPX & IBFT limits to 30k. Do I have to activate Ocbc One Token for bigger amount? |

|

|

May 2 2020, 11:11 AM May 2 2020, 11:11 AM

Return to original view | Post

#48

|

All Stars

18,410 posts Joined: Oct 2010 |

QUOTE(ryan18 @ May 2 2020, 10:22 AM) Reading the revised tnc seems that OCBC credit card payment not considered as bill payment anymore Very sneaky OCBC? How were u informed about this new t&c?https://www.ocbc.com.my/assets/pdf/Accounts...unt_TnC_ENG.pdf Luckily I did lots of transaction with ocbc360. |

|

|

May 5 2020, 06:03 PM May 5 2020, 06:03 PM

Return to original view | IPv6 | Post

#49

|

All Stars

18,410 posts Joined: Oct 2010 |

Seems like OPR reduction affects everything except car loan, why is that?

|

|

|

May 5 2020, 09:29 PM May 5 2020, 09:29 PM

Return to original view | Post

#50

|

All Stars

18,410 posts Joined: Oct 2010 |

|

|

|

May 6 2020, 04:53 PM May 6 2020, 04:53 PM

Return to original view | Post

#51

|

All Stars

18,410 posts Joined: Oct 2010 |

No surprise here, OCBC always so efficient, a drop of 0.5% OPR but OCBC360 drops 0.65%, well done.

Hope SCB PSA not as efficient. This post has been edited by MGM: May 6 2020, 04:54 PM |

|

|

May 8 2020, 05:46 PM May 8 2020, 05:46 PM

Return to original view | Post

#52

|

All Stars

18,410 posts Joined: Oct 2010 |

QUOTE(cucikaki @ May 8 2020, 05:03 PM) i have the same problem with foodpanda but with my RHB card, suppose to receive 10% online cashback but didnt. it's due to out of all my foodpanda online order, the one that didnt receive cashback is ending with SINGAPORE details instead of foodpanda kuala lumpur. Which RHB card gives 10% online cb? guess they process with a different payment gateway, hence, the exclusion, might be the same as yours - look for 'SG' word in the description. Did u save your RHB card in your foodpanda(FP) account, cos without otp it will clasified as offline? The MCC for FP is tricky. I used HL Mach card 16x last month, 1 under Dining, 2 under Retail, 13 under Online(without otp). |

|

|

May 8 2020, 06:12 PM May 8 2020, 06:12 PM

Return to original view | Post

#53

|

All Stars

18,410 posts Joined: Oct 2010 |

QUOTE(cucikaki @ May 8 2020, 05:55 PM) I have 3 FP order about rm100 in total. 2 is online, 1 is not considered online food. Thanks, the RHB CB card is probably the only card that gives cb for online dining/grocery delivery. Wonder if pickup order eligible or not?All three is from saved CC in the apps. Im using rhb cashback cc. Now the name i think maybe different, but it’s still inside their website To bad they replaced mine with the Reward card. |

|

|

|

|

|

May 19 2020, 09:05 PM May 19 2020, 09:05 PM

Return to original view | Post

#54

|

All Stars

18,410 posts Joined: Oct 2010 |

|

|

|

May 19 2020, 09:26 PM May 19 2020, 09:26 PM

Return to original view | Post

#55

|

All Stars

18,410 posts Joined: Oct 2010 |

|

|

|

May 27 2020, 01:03 PM May 27 2020, 01:03 PM

Return to original view | Post

#56

|

All Stars

18,410 posts Joined: Oct 2010 |

|

|

|

May 28 2020, 04:26 PM May 28 2020, 04:26 PM

Return to original view | IPv6 | Post

#57

|

All Stars

18,410 posts Joined: Oct 2010 |

QUOTE(1wildcat1 @ May 28 2020, 04:21 PM) Hi all, I think own OCBC CASA not count. Silly question, I’ve looked through the last 20 pages and gotten the following info, would like to double check if this is the best way to get max interest at the lowest cost: 1) base interest 0.05% 2) spend: BigPay/grab/boost RM500 3) pay: bank transfer to 3 different bank accounts (same bank is ok) - RM1 each x3 = RM3 4) deposit: RM500 fresh funds Could you guys please advice? Thanks so much. just opened the account today! QUOTE(GrumpyNooby @ May 28 2020, 04:23 PM) 3) pay: bank transfer to 3 different bank accounts (same bank is ok) - RM1 each x3 = RM3 To count as 3 transfers, a criteria, any amount.Why this one needs to pay RM 1? |

|

|

Jun 8 2020, 10:50 AM Jun 8 2020, 10:50 AM

Return to original view | IPv6 | Post

#58

|

All Stars

18,410 posts Joined: Oct 2010 |

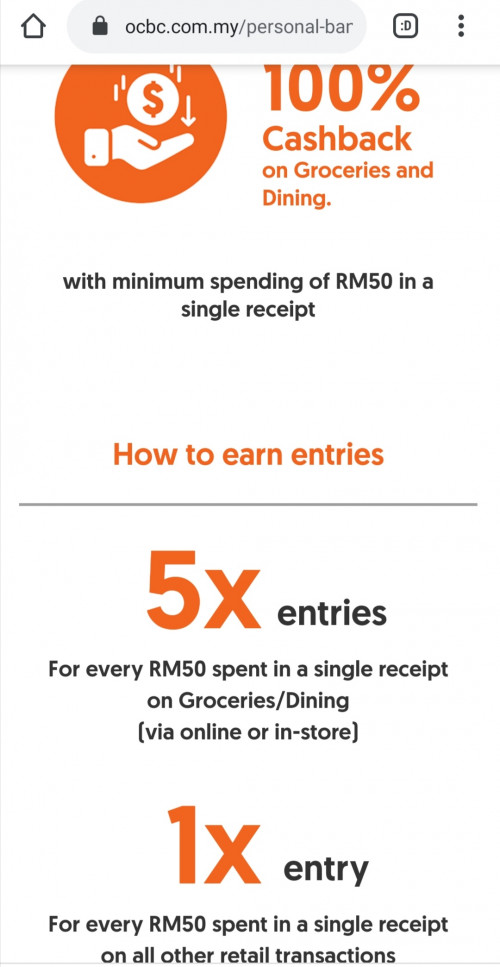

QUOTE(MGM @ Jun 8 2020, 07:28 AM) Currently ocbc got the following campaign. For d condition "For every RM50 spent in a single receipt on all other retail transactions", does it mean that if I reload rm1000 to Boost it is considered as 1 entry n not 20 entries?  QUOTE(rojakwhacker @ Jun 8 2020, 07:58 AM) 1)Transaction for online or in store for grocery and online or in store for dining only.= 5x 2)Transaction for all retail only = 1x 3)Every RM50 spent in a single receipt = spent any amount in one receipt, each RM50 in the any amount gets 1 entry(all retail other than online grocery and online dining) Example for online (grocery or dining) or in store (grocery or dining) : a) spent RM100 in one receipt, RM100 divide by RM50 multiply by 5x = 10 entries. b) spent Rm1000 in one receipt, Rm1000 / RM50 multiply by 5x = 100 entries. Example for all retail: a) spent RM100 in one receipt, RM100 divide by RM50 = 2 entries. b) spent Rm1000 in one receipt, Rm1000 / RM50 = 20 entries. QUOTE(MGM @ Jun 8 2020, 08:37 AM) I tot I read somewhere with similar t&c that should be the interpretation but CS said reload rm1000 to Boost in a single transaction considered 1 entry. Since there is no OCBC CC thread, I tumpang here, sorry if off topic. So what is your opinion? |

|

|

Jul 8 2020, 10:06 AM Jul 8 2020, 10:06 AM

Return to original view | Post

#59

|

All Stars

18,410 posts Joined: Oct 2010 |

|

|

|

Oct 12 2020, 03:52 PM Oct 12 2020, 03:52 PM

Return to original view | IPv6 | Post

#60

|

All Stars

18,410 posts Joined: Oct 2010 |

QUOTE(cucikaki @ Oct 12 2020, 12:27 PM) this stupid bank done it again. charge interest to my CC which i've paid in full before due date on 11 October 2020. For those "difficult" banks i always pay via their CASA. IBFT to CASA - - > CC. But i tot OCBC gives grace period.but the interest charged is dated 10 October 2020 - 1 day before the payment due date. I've called then they say will request for waiver and subject to approval. - hello it's not suppose to subject to approval as I've done nothing wrong. I wonder if people dont check their CC statement regularly, they might have earning so much from people. I've paid before 9.45pm on 11 October 2020, hence, there's no issue about cut off. in my internet banking also shown 11 October 2020 as payment. This post has been edited by MGM: Oct 12 2020, 03:53 PM |

| Change to: |  0.0959sec 0.0959sec

0.27 0.27

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 08:20 AM |