QUOTE(psiloveu @ Nov 2 2017, 03:36 PM)

HLB will remind customers about the "special rate expire at DDMMYYY".

Example, last month statement closed at 15 Oct 2017. The balance account which going to resume back to normal interest rate, there is a message to inform

"Special Rate will expire at 15 Nov 2017"

As long as u make full payment on 16 Nov 2017 morning......there is no interest charge to the BT account. If u make full payment on 15 Nov 2017......u need to pay early settlement penalty "RM70"

Plenty painful lar this HLB BT 0%Example, last month statement closed at 15 Oct 2017. The balance account which going to resume back to normal interest rate, there is a message to inform

"Special Rate will expire at 15 Nov 2017"

As long as u make full payment on 16 Nov 2017 morning......there is no interest charge to the BT account. If u make full payment on 15 Nov 2017......u need to pay early settlement penalty "RM70"

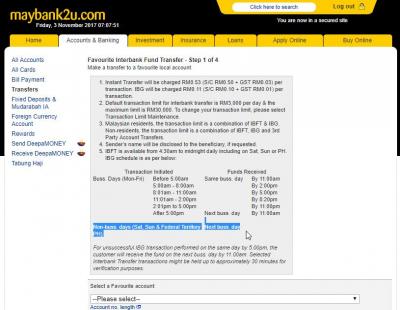

Mine ends on 12th Nov - alo SUNDAY leh

Instant Bank Transfer pun xjalan

They said use ATM cash deposit lor.. good gawd..

Nov 2 2017, 03:43 PM

Nov 2 2017, 03:43 PM

Quote

Quote

0.2570sec

0.2570sec

0.48

0.48

7 queries

7 queries

GZIP Disabled

GZIP Disabled