QUOTE(james2306 @ Feb 15 2025, 09:39 PM)

Just pay the min amount for 5 months.

B4 9th July pay the remaining for the 1st plan.

B4 21st July pay the remaining for the 2nd plan.

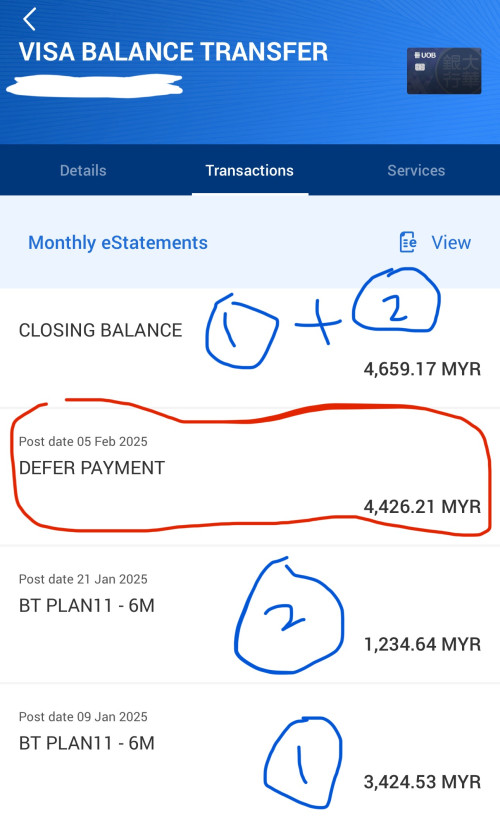

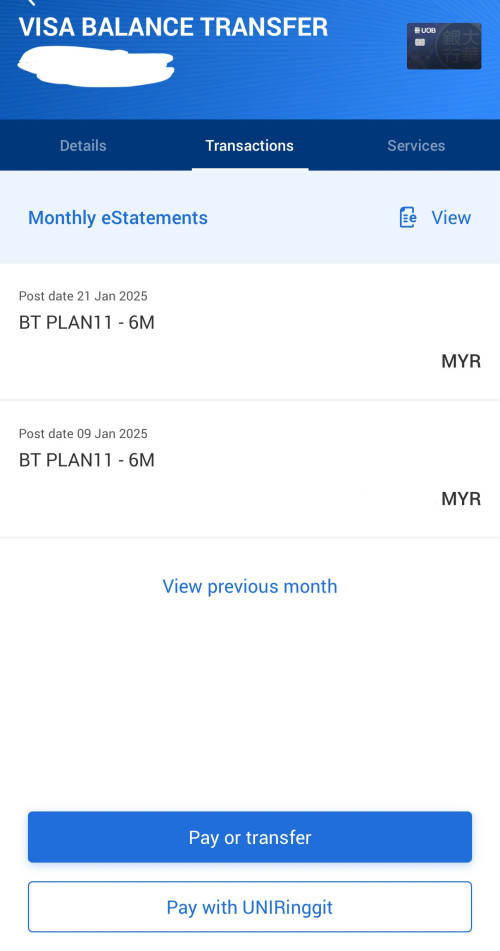

They lumpsum all your BT plans under this 1 acc, so like me got 3 to 5 running concurrently so it can get confusing. I keep an excel sheet to keep track.

For the amount you need to settle b4 9th and 21st July, you can either calculate yourself or call their BT hotline and they will give you the exact amount to pay to avoid charges.

If you want to calculate yourself. Let's say ur BT amt is 1000.

Feb due will be 1000×5% = 50

Mar due will be (1000-50)x5% = 47.50

Apr due will be (1000-50-47.50)x5% = 45.125

So on...

You get the picture...

From my experience in the past, If you call the normal hotline and ask about this, most of the time, these cs agents don't know or just tell you to pay as per statement.

The BT centre cs agents will give accurate information in regards to the BT.

Also I just make sure I pay off the remaining b4 the 6 month date to avoid any charges.. so far no extra charges...

Thanks a lot bro for the explanation. I also initially wanted to ask UOB CS. But like u said, I think they also likely dun know how to explain to me. Ur explanation is helpful.

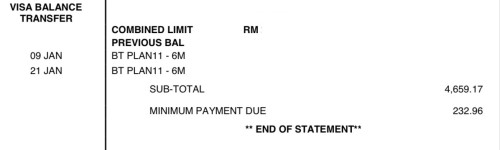

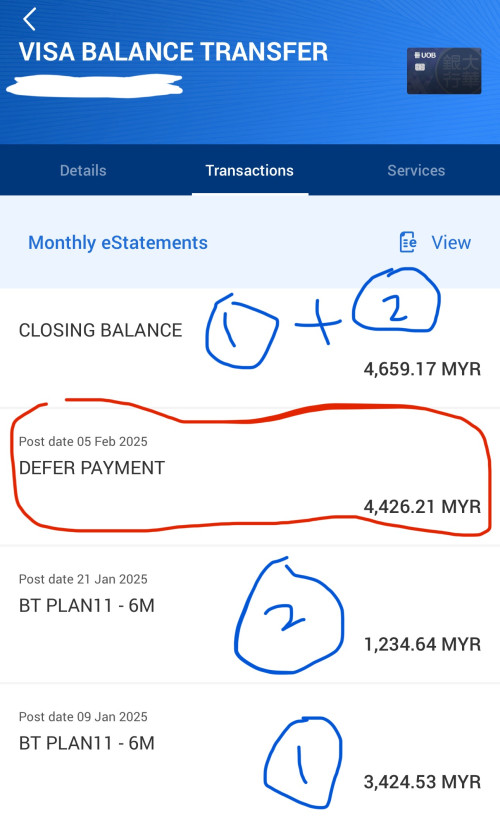

Besides, in the app transaction, I saw this line called defer payment which I dun know what is this and why there is this new figure.

And I count the total balance it is still the same as the total of the two BT I did.

Besides, just to check, while I am taking these two 0% BT, if I want to settle all outstanding before 6 months, can I do so? Any penalty for early settlement?

Apr 3 2018, 06:24 PM

Apr 3 2018, 06:24 PM

Quote

Quote

0.1149sec

0.1149sec

0.54

0.54

7 queries

7 queries

GZIP Disabled

GZIP Disabled